Contents

(1) Macro Backdrop

(2) Crypto Market Moves

(3) Crypto Fund Performance

(4) Positioning and Flows

(5) Takeaways

1. Macro Backdrop

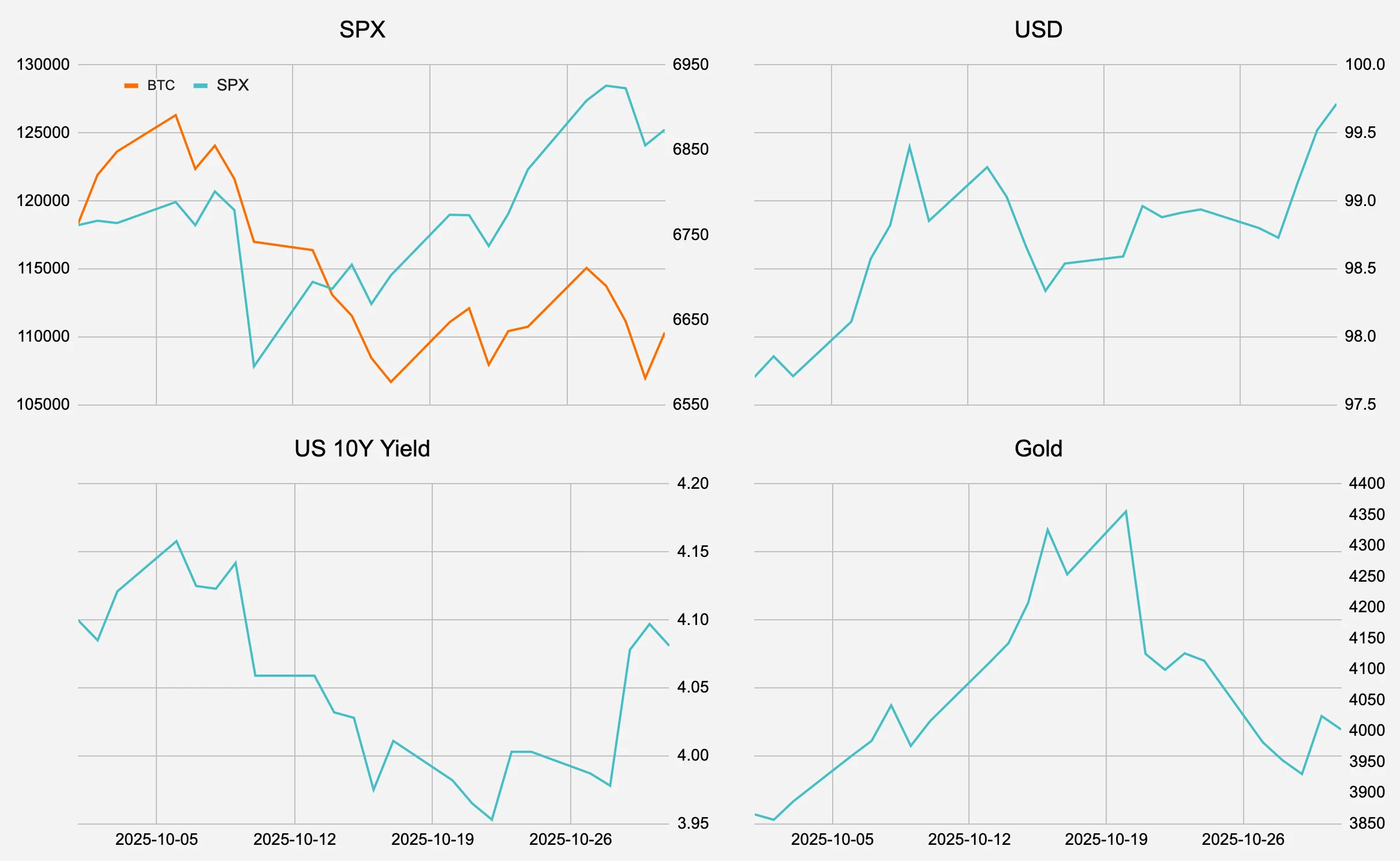

Markets opened October under pressure as the US government shut down on the first day of the month, its first closure since 2019. The impasse lasted the entire month, halting data releases and injecting volatility into rates and equities. Treasury yields swung with each hint of progress, while the dollar and gold stayed firm on safe-haven demand. Global politics added fuel: Macron’s cabinet reshuffle, turmoil in Japan’s LDP leadership, China’s rare-earth export curbs, and renewed US tariff threats all weighed on sentiment.

Through the month, the Federal Reserve maintained a dovish tone despite the lack of fresh data, culminating in a widely expected 25 bp rate cut on 29 October. The decision drew dissent from both hawks and doves but at the time reinforced the easing trajectory into year-end. Risk appetite improved into the final week as Trump and Xi agreed to a one-year tariff truce, export controls were relaxed, and equities closed at record highs.

Figure 1: October price action

Source: Presto Research

2. Crypto Market Moves

Crypto began the month on strong footing. Bitcoin surged to a fresh all-time-high above $126k and Ethereum bounced above $4,700, buoyed by macro debasement themes and record gold prices. CME announced plans to transition its crypto futures and options to 24/7 trading in 2026, reinforcing institutional confidence.

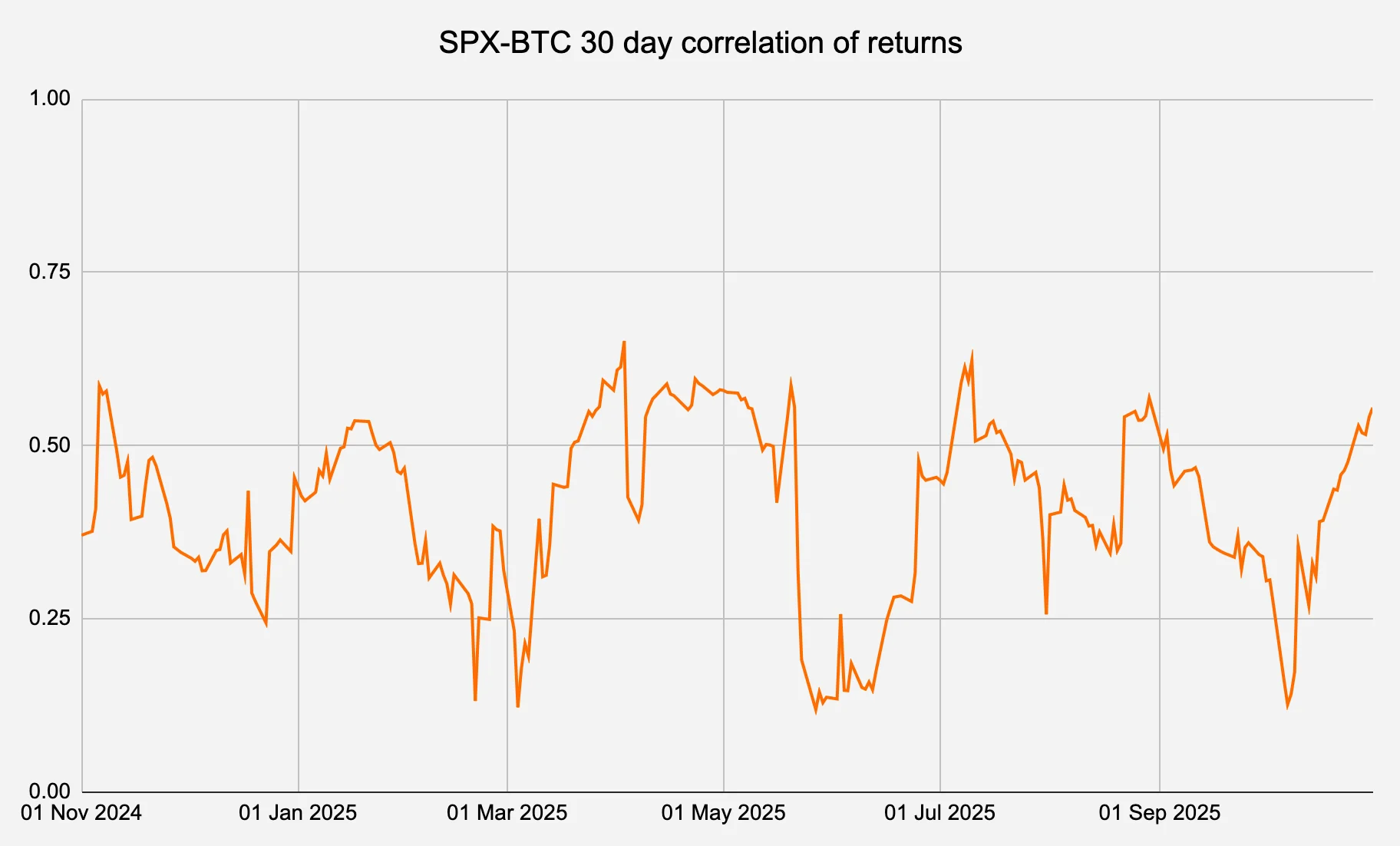

Momentum reversed sharply mid-month as “10/10” - the largest leverage flush on record - triggered a historic liquidation wave across exchanges, momentarily pushing altcoin prices to multi-year lows. Despite the shock, market activity remained brisk. BTC December basis held steady between 6~8% annualised, funding stayed positive, and implied vols ranged from the low 30s to mid-40s as traders repositioned.

Figure 2: Correlations increased in October

Source: Presto Research

Flows reflected rapid tactical rotation. Early in the month, upside positioning dominated in BTC call spreads and large ETH call blocks before traders shifted as defensive flow dominated the tape following the crash. A record $957 million ETH block trade (211k ETH) underscored persistent institutional activity.

Late-month sentiment turned constructive as the Bitwise Solana Staking ETF (BSOL) began trading, while SEC Chair Atkins reaffirmed digital assets as a regulatory priority and the CFTC advanced its tokenised collateral framework. By month-end, BTC consolidated near $110k and ETH around $4k, both stabilising after the rate cut and liquidation reset. Structural tone improved: volatility normalised, leverage reset, and positioning appeared cleaner heading into November amid dovish central banks and a steadier macro backdrop.

3. Crypto Fund Performance

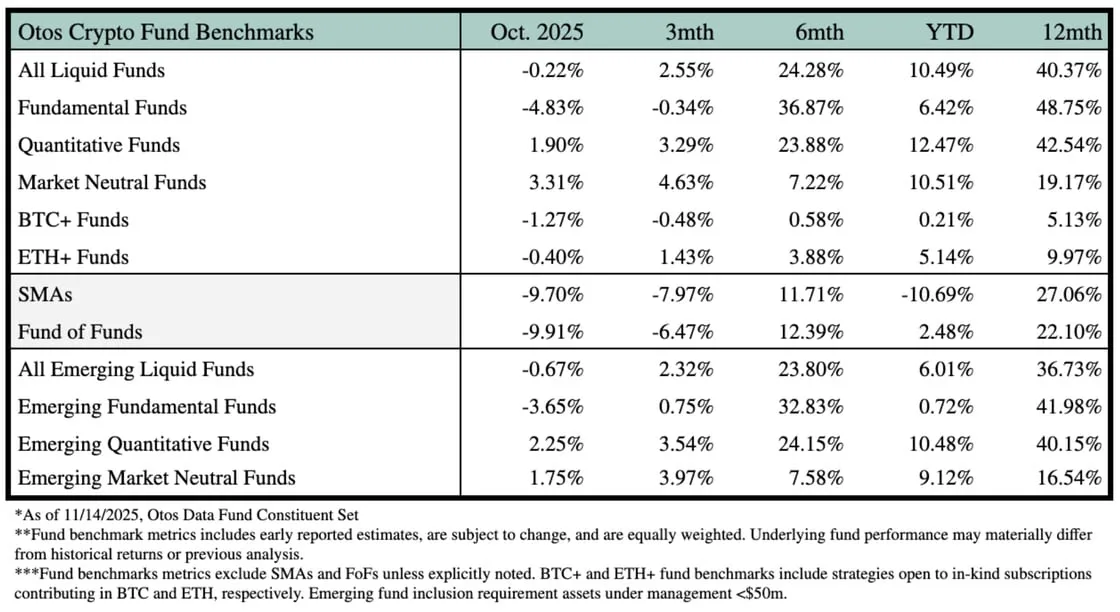

Figure 3: Market Neutral funds led in October

Source: Otos Data

October was a challenging month for crypto hedge funds, marking the first average and median negative benchmark returns since March 2025. According to Otos Data, All Liquid Funds fell –0.22%, as volatility spikes and deleveraging events pressured performance. Fundamental Funds posted the weakest returns at –4.83%, reflecting their higher beta to the mid-month selloff. Quantitative Funds rose +1.90%, and Market Neutral Funds gained +3.31%, showing resilience amid turbulence.

All Liquid: -0.22%, YTD +10.49%.

Fundamentals: -4.83%, YTD +6.42%.

Quantitative: +1.90%, YTD +12.47%.

Market Neutral: +3.31%, YTD +10.51%.

BTC+/ETH+: -1.27%, -0.40% respectively, YTD +0.21%, +5.14%.

SMAs returned -9.70%, while Fund of Funds delivered a -9.91%, dragging down its YTD performance to +2.48%. Among smaller managers (<$50mm AUM), Emerging Quantitative led the way with +2.25% (+10.48% YTD).

4. Positioning and Flows

October’s volatility revealed key structural cracks across fund strategies. While most managers avoided catastrophic losses, the assumption that market-neutral strategies would remain insulated from macro turbulence was tested. Several neutral funds posted low- to mid-single-digit drawdowns as stress emerged in funding spreads, basis trades, and multi-venue arbitrage. The month’s “10/10” liquidation event forced a reassessment of how liquidity fragmentation interacts with leverage and signal reliability.

Performance dispersion offered a clear map of adaptive strategy design. Systematic and factor-driven strategies generally occupied the left tail, struggling to adjust to real-time liquidity fractures, while discretionary and fundamental funds clustered around flat to modestly positive results, highlighting the edge of human discretion in volatile conditions.

Historically, broad liquid fund drawdowns - in 2018’s ICO collapse and 2022’s deleveraging cycle - showed minimal dispersion as all strategies fell together. October 2025 stands apart: losses were not systematic but segmented, differentiated by structure and liquidity sensitivity. This indicates a regime shift rather than a systemic crisis, defined by higher volatility, narrower liquidity channels, and elevated differentiation between managers.

5. Takeaways

October marked a transitional month for both macro and crypto markets. The US shutdown, leverage purge, and tariff truce produced short but intense waves of volatility that tested conviction and market structure. Yet crypto’s rebound into month-end and selective fund outperformance highlight increasing institutional maturity and risk adaptation.

Dispersion was the defining feature: wide, instructive, and revealing. The strongest managers capitalised on chaos, turning volatility into opportunity. Others faced the limits of systematic design in fragmented liquidity. Heading into November, cleaner positioning, dovish policy, and renewed ETF momentum set the stage for recalibration rather than recovery: a regime shift that may define the final stretch of 2025.