Summary

Bittensor (TAO) is a decentralized network that rewards useful AI work—such as inference, training, and validation—through a crypto-native incentive system. With no VC funding, pre-mine, or team allocation, TAO is fairly distributed and powers a permissionless ecosystem of AI subnets. In February 2025, the network introduced Dynamic TAO (dTAO)—an emission framework that allocates TAO to subnets based on the market demand for their native alpha tokens.

TAO is executing the “Bitcoin playbook” for decentralized AI: a clean supply model, strong staking economics, and growing institutional adoption. With the launch of Dynamic TAO (dTAO), the network now operates as a live prediction market for AI performance, where every subnet issues its own alpha token. TAO is emerging as both infrastructure and monetary primitive for the next major crypto narrative—AI.

TAO’s long-term value depends on subnets delivering real AI utility, a challenging goal amid speculative activity and technical complexity. The tokenomics of dTAO are still evolving, with concerns around alpha token dilution and emission splits between root and subnet stakers. Until more stability and proven use cases emerge, TAO remains an early-stage experiment with high potential and meaningful uncertainty.

1. Introduction

Bittensor (TAO) is emerging as the foundational asset of decentralized artificial intelligence—a network designed not just to secure data, but to produce intelligence itself. By combining blockchain’s incentive structure with open-source machine learning, Bittensor enables anyone to contribute AI compute and earn rewards for valuable outputs. Unlike traditional AI development, which is often siloed within large corporations or academic labs, Bittensor creates a permissionless marketplace where inference, training, and validation are decentralized and economically aligned.

The network’s launch was uniquely fair, like Bitcoin: no venture capital, no premine, and no team allocation. Every TAO in circulation has been earned on-chain. This clean distribution model is paired with an economic engine—known as Dynamic TAO (dTAO)—which governs how emissions flow to productive AI subnets. Introduced on February 13, 2025, dTAO marked a turning point in Bittensor’s architecture, turning TAO into both the economic and governance backbone of a growing ecosystem of AI modules.

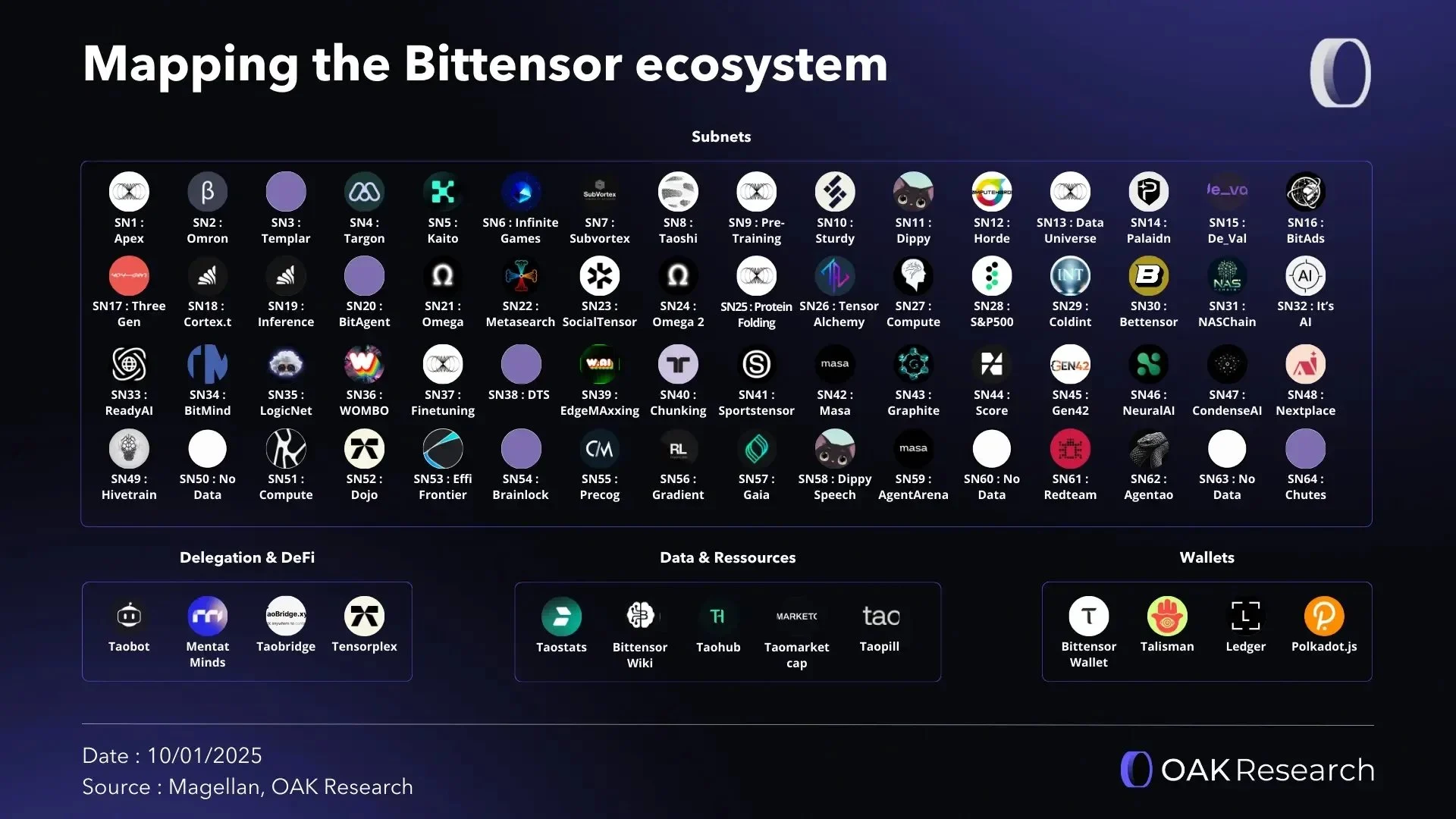

Today, Bittensor is more than just an experiment. With over 110 active subnets, rising institutional involvement, and hundreds of millions in value locked across its speculative and productive layers, TAO is becoming a credible asset for those betting on decentralized intelligence.

2. Overview

Bittensor is an open-source protocol that allows anyone to contribute, validate, and monetize machine learning models on a decentralized network. Participants earn TAO—the native token—by providing valuable outputs or infrastructure. The protocol operates as a hybrid between a decentralized data marketplace, a blockchain, and a peer-reviewed AI network.

2.1. Key facts and figures as of June 2025

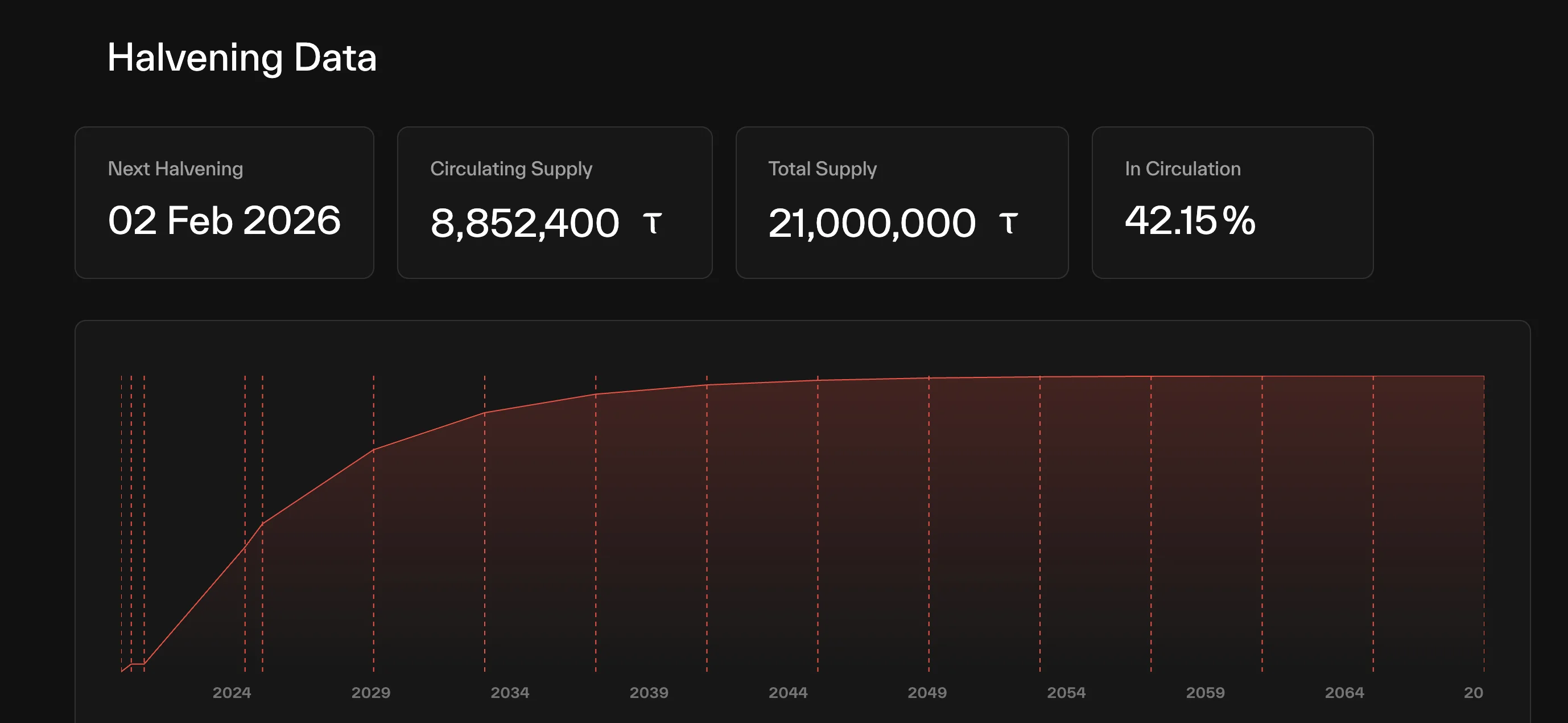

Genesis block: March 2021

Block time: ~12 seconds

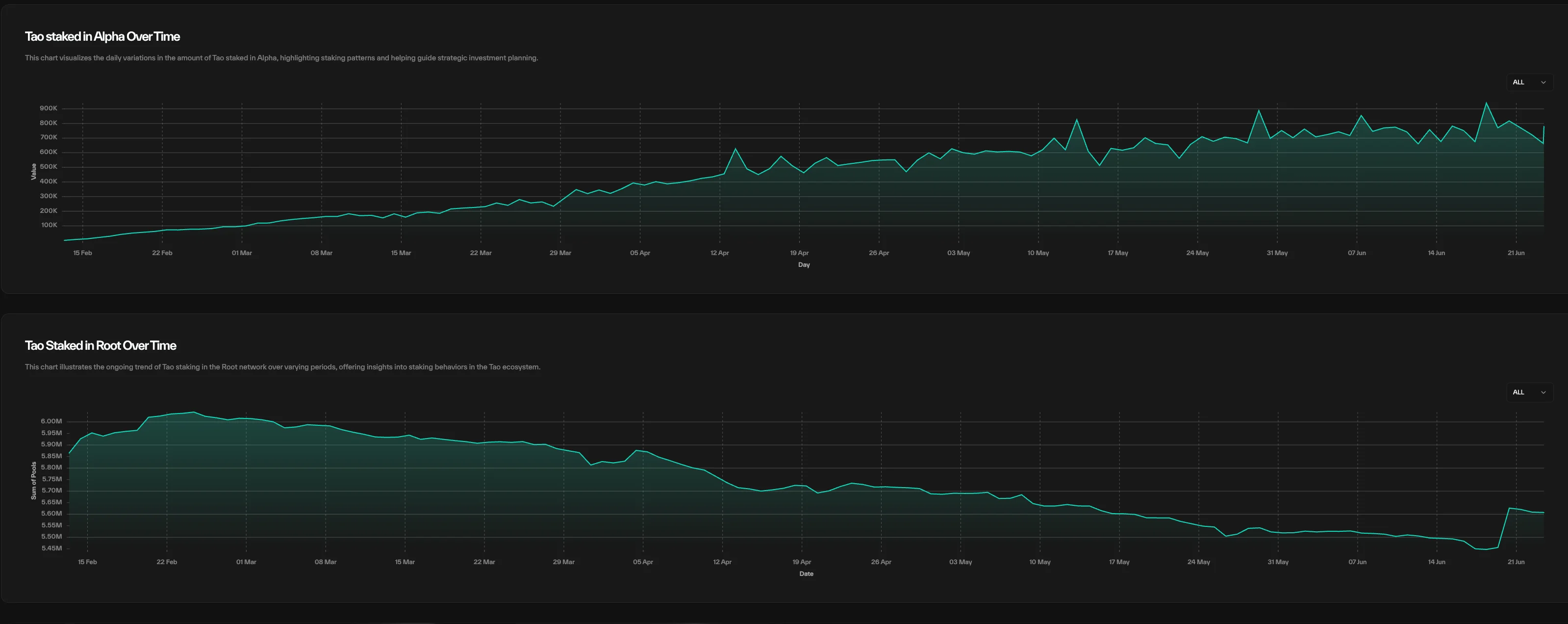

Halving schedule: Every ~4 years (210,000 blocks)

Current emission: 1TAO per block

# of subnets: 125 (65 in Jan 2025)

Figure 1-1: Halvening data of TAO (1)

Source: Taostats

Figure 1-2: Halvening data of TAO (2)

Source: Taostats

2.2. Tokenomics

Dynamic TAO was introduced and deployed to mainnet on February 13, 2025, after over a year of R&D and testing. dTAO is the backbone of Bittensor's incentive mechanism, enabling a market-based allocation of daily emissions to the most valuable subnets.

Under dTAO, each subnet has its own alpha token, which is minted when users stake TAO into that subnet’s reserve pool. This is not traditional staking with a yield—it’s more akin to a bonding curve mechanism. Users swap TAO for alpha tokens, and the token price increases as more TAO is deposited.

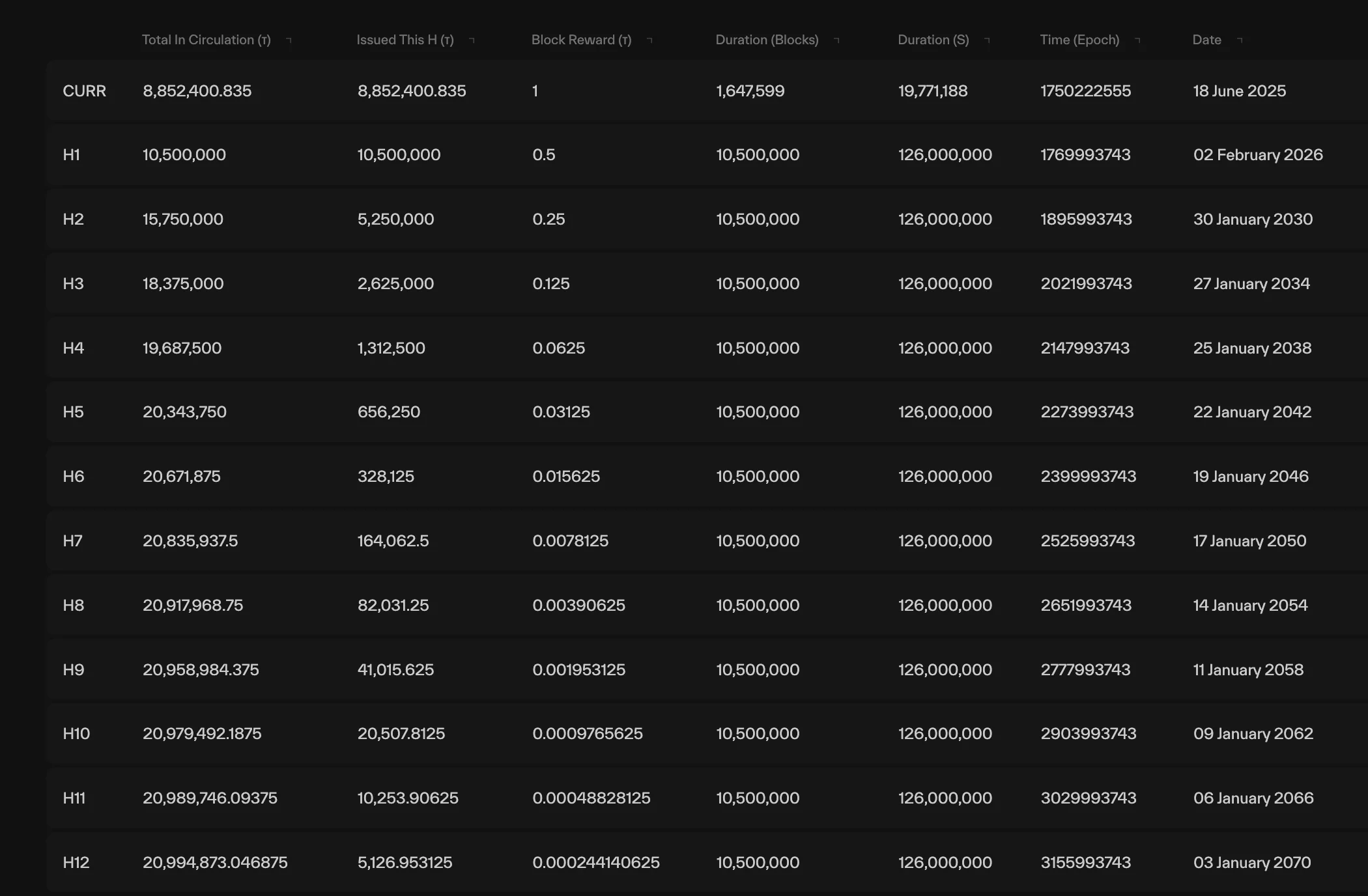

Daily TAO emissions follow this process:

Each block emits 1 TAO, though this emission rate is subject to halving over time.

The allocation across subnets is based on the relative price of each subnet’s alpha token (i.e., subnets with more demand for alpha receive more emissions).

A portion of emissions goes to Subnet 0 (roots) for shared network security (Root proportion).

In addition to TAO, each subnet mints its own alpha tokens:

The number of alpha tokens minted is capped at 2x the TAO emissions for that block.

These are split (configurable per subnet, but typically):

~50% added to the reserve to maintain price ratios

~50% distributed to miners, validators, and subnet operators using the same 41/41/18 breakdown

Figure 2: Flow chart of emission quantities

Source: dtao Whitepaper

3. Thesis

3.1. AI Bitcoin?

Bittensor introduces a new paradigm for crypto networks: emissions tied directly to useful machine learning work. Unlike Bitcoin, where block rewards go to miners securing the network through arbitrary computation, TAO is issued to nodes that produce valuable AI outputs—such as answering prompts, training models, or validating results. The protocol evaluates the quality of each contribution, and TAO is allocated accordingly.

In this way, Bittensor is arguably the first “proof-of-intelligence” network: every newly minted TAO reflects real, measurable AI activity. This is not just philosophically interesting—it creates a strong alignment between token supply growth and network utility.

This feedback loop isn’t theoretical. TAO now powers over 110 active subnets, with use cases ranging from LLM inference to image generation and deepfake detection. Each subnet contributes real AI capacity to the network, driving TAO’s role as both economic incentive and infrastructure asset.

3.2. No VC and also No Team?

TAO’s supply model is clean, simple, and unusually fair by crypto standards. There were no venture capital allocations, no team reserves, and no pre-mine. Every TAO in existence has been earned through network participation—either by mining, validating, or staking. This “fair launch” architecture mirrors Bitcoin and gives TAO a kind of structural credibility that’s increasingly rare in the space.

The supply is capped at 21 million. As of mid-June 2025, about 8.8 million TAO have been issued, putting it roughly 42% through its emission lifecycle. The current block reward is 1 TAO per 12 seconds, or around 7,200 TAO per day—translating to an annualized inflation rate of ~30%. But that rate will drop sharply with the first halving scheduled for December 2025, cutting emissions in half.

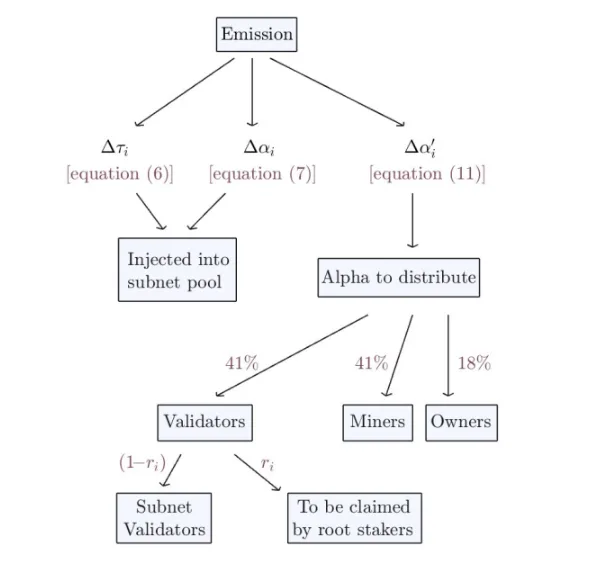

Importantly, TAO’s circulating supply available for trading - the float- is tight. Over 72% of the circulating supply is currently staked back into the network, leaving relatively little available for trading or speculation. As staking demand grows—both from yield-seeking retail users and institutional validators—the free supply of TAO continues to shrink.

Figure 3: TAO staked in Alpha & Root

Source: Taostats

3.3. TAO MicroStrategy?

Bittensor is no longer a niche experiment—it’s becoming a magnet for serious institutional capital, reminiscent of the early Bitcoin balance sheet era.

In late 2024, Digital Currency Group (DCG) launched Yuma, a dedicated Bittensor subsidiary focused on incubating subnets, operating validators, and providing infrastructure for on-chain AI development. DCG reportedly holds over 500,000 TAO—more than 2.4% of total supply, worth approximately $175–200 million as of mid-2025. Other large holders include Polychain Capital (~$200M) and dao5, which operates the third-largest validator and holds around $50 million in TAO. Yuma currently incubates several key subnets: Subnet 10, Subnet 6, Subnet 44, Subnet 42, Subnet 58, Subnet 59, Subnet 61, Subnet 55, Subnet 60, Subnet 70, Subnet 96, Subnet 72, and Subnet 54.

In parallel, the custodial and regulatory rails are snapping into place. BitGo added TAO support in early 2025 and now offers qualified custody and institutional staking. Grayscale launched a Reg D TAO Trust in August 2024, which now comprises nearly one-third of its Decentralized AI Fund. Coinbase Institutional and Kraken are also integrating TAO across spot, custody, and staking services, building the same financial infrastructure that enabled institutional flows into Bitcoin and Ethereum.

Public companies are now following suit. In June 2025, Oblong (Nasdaq: OBLG) announced a $7.5M TAO purchase, alongside plans to run validators, develop subnet tooling, and participate in governance. The firm explicitly framed this as a strategic bet on decentralized AI infrastructure, calling Bittensor “the third major crypto epoch” after Bitcoin and Ethereum.

In just two years, Bittensor has attracted more than $350 million in traceable institutional investment, integrated with blue-chip service providers, and spun up a live, incentive-aligned network. It’s executing the “Bitcoin playbook” at an accelerated pace—and the next wave of capital is already watching.

3.4. Infra Getting Started

As institutional capital flows in, the infrastructure around TAO is finally taking shape. Today, even seasoned crypto users find it challenging to navigate the Bittensor ecosystem. From wallet setup to staking mechanics, onboarding is unintuitive and fragmented. But that’s beginning to change.

New platforms are emerging to make Bittensor more accessible. TaoFi, for example, allows users to purchase subnet tokens directly with SOL or ETH—bypassing the current multi-step process of acquiring TAO, transferring it to a native wallet, selecting a subnet, and manually staking. Similarly, TaoFu serves as a launchpad and tokenization platform for subnets, enabling subnet operators to issue Subnet Seeds (SNS)—tradable tokens backed by future alpha token emissions. These tools lower the barrier to entry and provide clearer on-ramps for both retail and institutional participants.

More importantly, this early infrastructure suggests that Bittensor is not just another AI app—it’s evolving into a full-fledged base layer for decentralized AI economies. Just as Ethereum required MetaMask and Uniswap to unlock its potential, Bittensor’s next chapter will be defined by the maturity of its tooling. And we’re only at the beginning.

3.5. AI Pump.fun?

While institutions are laying the foundation for Bittensor’s legitimacy, it’s retail activity that’s fueling its momentum—thanks to the rollout of Dynamic TAO (dTAO) in February 2025.

Before dTAO, the only way to bet on the Bittensor ecosystem was through TAO itself—a high-market-cap asset with relatively limited upside for short-term traders. But with dTAO, Bittensor introduced a way to bet on the next breakout within the network. Every subnet now issues its own alpha token, which users receive by staking TAO into that subnet’s reserve pool. These alpha tokens can be freely traded, farmed, or held—effectively turning each subnet into its own high-beta, early-stage asset.

It’s a model that perfectly mirrors the speculative instincts of the crypto-native investor. Subnet tokens are small, volatile, and narrative-driven—much like memecoins, but tied to real AI infrastructure and compute economics. dTAO has essentially turned Bittensor into a live, on-chain prediction market for AI adoption, where traders can front-run what they believe will be the most valuable AI use cases or models.

We’ve already seen how this dynamic can play out elsewhere: VIRTUAL, the token behind Virtual Protocol, has gained traction as a medium of exchange for purchasing AI agents—showing how deeply crypto users respond to tradeable assets tied to emerging AI behavior. Bittensor takes a similar approach: instead of one token tied to one project, it hosts dozens of subnets competing in an open market, with emissions and visibility flowing to the winners.

Since dTAO’s launch, alpha token market cap has surged from ~$4 million in February to over $200 million by June. Top subnets like Subnet 13 (Chutes) now exceed $100M market cap. Crucially, all of this growth loops back into TAO demand—because minting any alpha token requires TAO, and subnet participation is open to anyone willing to stake it.

Every new subnet, every trading pair, every farmable yield opportunity contributes to the economic flywheel around TAO. Traders speculating on subnets are, by design, increasing the network’s security, usage, and relevance. It’s a system where the same behaviors that drive memecoin mania now fund real AI infrastructure.

Figure 4: Bittensor Subnets

Source: OAK Research

4. Valuation

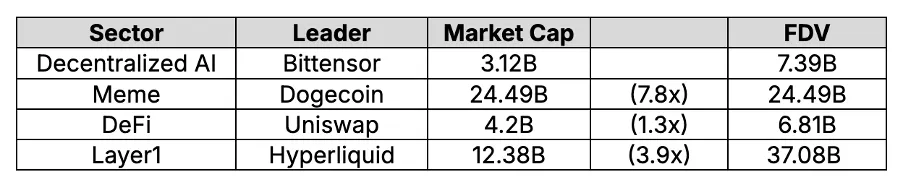

As noted in our MPLX and KAIA pieces, valuing crypto assets in absolute terms is inherently difficult. These networks don’t produce traditional cash flows, and their value depends as much on narrative dominance and network effects as on any discounted model. But in crypto, context matters—and relative valuation often tells the more important story.

The convergence of AI and crypto is not just a passing narrative; it’s arguably the defining investment theme of this cycle. Bittensor (TAO) sits at the center of that convergence. As markets rotate into long-term, high-conviction narratives, TAO is uniquely positioned to benefit from two of the most structurally explosive technologies of our time: open-source AI and decentralized infrastructure.

With a ~$3.2 billion market cap and ~$7.4 billion FDV, TAO may seem fully priced. But compared to incumbents in other categories, it remains materially undervalued:

Figure 5: Comparison with other sector leaders

*The reason Hyperliquid was chosen as a Layer 1 is because it serves as a purpose-specific Layer 1, unlike other general-purpose Layer 1s. This makes it comparable to Bittensor, which is also an AI-focused Layer 1.

Source: Presto Research

Moreover, with the launch of dTAO, Bittensor is increasingly becoming a dominant AI layer. Unlike typical AI application projects, it is evolving into something closer to a Layer 1—one that serves as the foundational infrastructure for AI-native economies. This shift demands a new lens for valuation.

Despite powering over 110 subnets, facilitating a live economy of alpha tokens, and offering the only emissions model tied to real-world AI throughput, TAO trades at a fraction of ecosystem leaders. More importantly, it has none of the typical overhangs: no VC unlocks, no team dump risk, no foundation wallet.

Staking participation remains above 72%, and the first halving is approaching in December 2025—both of which reduce effective float and increase structural pressure to reprice. If AI x crypto is the next dominant vertical, then TAO is the base asset of that vertical—and the market has yet to price it as such.

5. Risks & Considerations

5.1. Subnet Utility Dependency

The most fundamental risk to TAO’s long-term value lies in its dependency on subnets producing genuinely useful AI outputs. Without meaningful utility emerging from the subnet ecosystem, TAO risks becoming a speculative asset untethered from real-world value creation. Building performant, open-source AI models is technically demanding—and Web3-native developers may struggle to meet the benchmarks set by centralized AI providers like OpenAI or Anthropic. If subnets fail to demonstrate differentiated utility or attract meaningful adoption, TAO’s narrative as the “AI Bitcoin” may begin to erode.

5.2. High Inflation and Dilution Risk

Bittensor is still in its early emissions phase, and the current issuance rate—approximately 7,200 TAO per day—creates significant dilution pressure, especially for passive holders. The upcoming halving in December 2025 will reduce this rate to 3,600 TAO daily, but until then, inflation remains a headwind. Staking mitigates this risk, but only for those actively participating. For non-stakers, the inflation rate can feel punitive, and the system effectively forces participation in order to preserve relative token value.

5.3. dTAO Is Still an Experiment

Dynamic TAO (dTAO) represents a novel approach to decentralized emissions, tying TAO distribution to the relative price of subnet-specific alpha tokens. While this creates an organic market for AI performance, it also introduces volatility and unpredictability. The system implicitly assumes that higher alpha token prices reflect higher subnet utility—a logic that was challenged during the SN28 “LOL-subnet” incident, where emissions were farmed via a non-productive meme coin subnet. Although the network responded and adapted, the risk of future gaming or speculative exploits remains. Like many first-of-its-kind mechanisms, dTAO’s long-term success will depend on how well the system can self-correct and evolve.

In addition, there is an ongoing debate over the distribution of TAO emissions between Roots (Subnet 0) and the individual subnets. As subnet alpha tokens face persistent dilution and poor price performance, some community members have proposed redirecting a portion of the emissions currently allocated to root stakers toward subnet stakers instead. This reflects a broader uncertainty around dTAO’s economic design, especially given that it has only been live for about 120 days. The system remains in a highly experimental phase—and its tokenomics may continue to evolve in response to market pressures and governance decisions.

6. Conclusion

Bittensor isn’t just a crypto project—it’s the beginning of a new incentive structure for AI. By tying token emissions to productive machine learning work, TAO redefines what it means to “mine” value on-chain. Its fair launch, active subnet ecosystem, and growing institutional support position it not as an AI-themed token, but as the monetary base for a permissionless AI economy.

As artificial intelligence and crypto converge, most projects will chase narratives. TAO is building the infrastructure those narratives will run on. With real usage, provable utility, and a supply curve that gets tighter over time, it has the potential to become the BTC of decentralized AI—the asset people stake, benchmark, and build around.

Disclaimer: Presto has not received any grants, funding, or financial incentives from Bittensor or its affiliated entities. The views expressed in this report are based on independent research and analysis conducted by the author. This report is not intended as investment advice and does not represent the official position of Bittensor or any related parties. All opinions are our own and reflect our current views as of the date of publication.