Contents

Summary

1. Introduction

1.2 Who is James Wynn?

1.3 Why This Trade (and Venue) Matters

2. Timeline: How the Trade Unfolded

2.1 19~20th May: Entering the 40x Arena

2.2 21~24th May: Booking Profits and Continuing To Flip With Size

2.3 24~26th May: From $1.27B Long to $1.03B Short

3. Hyperliquid… Hyper Liquid.

3.1 Perp Funding

3.2 Price Execution: Slippage Was Contained

3.3 Closing $1.25B in 47 Minutes

4. Final Word

Summary

In May 2025, pseudonymous trader James Wynn built one of the largest public perp positions in crypto history: a $1.27 billion BTC long on Hyperliquid using 40x leverage.

At its peak, Wynn’s position showed $40 million in unrealised gains; by the end of the month, his account value had fallen from $90 million to $5 million - a 94% drawdown in 8 days.

Wynn’s trade served as a live stress test for Hyperliquid: despite the tremendous size and leverage of his trade, the platform handled both price integrity and execution without slippage spirals or system failure.

1. Introduction

1.1 Who is James Wynn?

James Wynn is a pseudonymous crypto trader who gained recent notoriety for executing highly leveraged, high-risk trades, most visibly on the decentralised derivatives platform Hyperliquid. His activity has made him both a cult figure in crypto trading circles and a cautionary case study in the risks of public, outsized positioning.

Figure 1: James Wynn, May’s Crypto Main Character

Source: Twitter

Wynn first came to prominence in 2022–2023 after reportedly turning a $7,000 investment in the memecoin $PEPE into $25 million. He built a following by aggressively trading memecoins and broadcasting his positions on Twitter. His style is characterised by extreme leverage (~40x), rapid trade cycles, and a tendency to fuel or amplify market sentiment.

In May 2025, Wynn initiated a series of large leveraged Bitcoin long positions on Hyperliquid, quickly becoming Crypto Twitter’s “main character” as his notional size reached $1.269 billion (11,588 BTC) with 40x leverage. While at one point showing $39 million in unrealised gains, this trade ultimately contributed to over $100 million in total losses, culminating in the near-complete liquidation of his Hyperliquid account by the end of May.

The trades had a visible impact on the market as traders closely monitored Wynn’s large, transparent position whilst also bringing in a lot of attention to Hyperliquid around its ability to facilitate such a trade as well as speculation around what a potential liquidation might look like.

1.2 Why This Trade (and Venue) Matters

The scale of Wynn’s trade made it one of the largest ever publicly visible perp positions in crypto history. It was opened, adjusted, and liquidated entirely on-chain, in full view of market participants, without downtime, spread dislocation, or infrastructure failure. In this sense, the event became a live stress test of Hyperliquid’s architecture: can decentralised derivatives exchanges really match the performance and liquidity of centralised venues?

While Wynn did lose money (a staggering amount at that), what DIDN’T happen was equally instructive: there was no cascading failure, no platform exploit, no collateral haircut. The billion-dollar trade closed as smoothly as any routine execution would have, which is a truly remarkable feat for crypto exchanges in general, let alone a fully on-chain perps venue. In past cycles, entire platforms have buckled under far less.

From a behavioural angle, the episode also highlighted the reflexive dynamics of crypto trading: Wynn’s public entries and exits created visible price impact, and his liquidation became a widely anticipated event in its own right. This feedback loop of a hyper-visible, vocal trader on a transparent protocol, brought back a uniquely crypto phenomenon where a single account became market-moving not through size alone, but by becoming narrative.

2. Timeline: How the Trade Unfolded

2.1 19~20th May: Entering the 40x Arena

While he had built up 9-figure notional positions early in May, with a $137 million position on 03rd May, Wynn’s big positions really began on 19th May, when he built up a 5,521 BTC long at $101,750.51, using 40x leverage. With a notional size of $562 million and a liquidation level just 4.8% below entry, his account’s unrealised PnL jumped almost $20 million in one day.

By the same time the next day, he reduced his position by 3,709 BTC, a notional of $172 million. But a mere 4 hours later, Wynn was back buying, increasing his position to 7,764 BTC, a notional value of $800 million at an average entry of $103,083.66. Crypto Twitter took notice, with traders and on-chain analysts monitoring the position’s PnL in real time, kickstarting Wynn’s main character arc. Still, Wynn had not yet become a destabilising market factor. BTC’s price action remained calm, and the position, while aggressive, was not systemically large… yet.

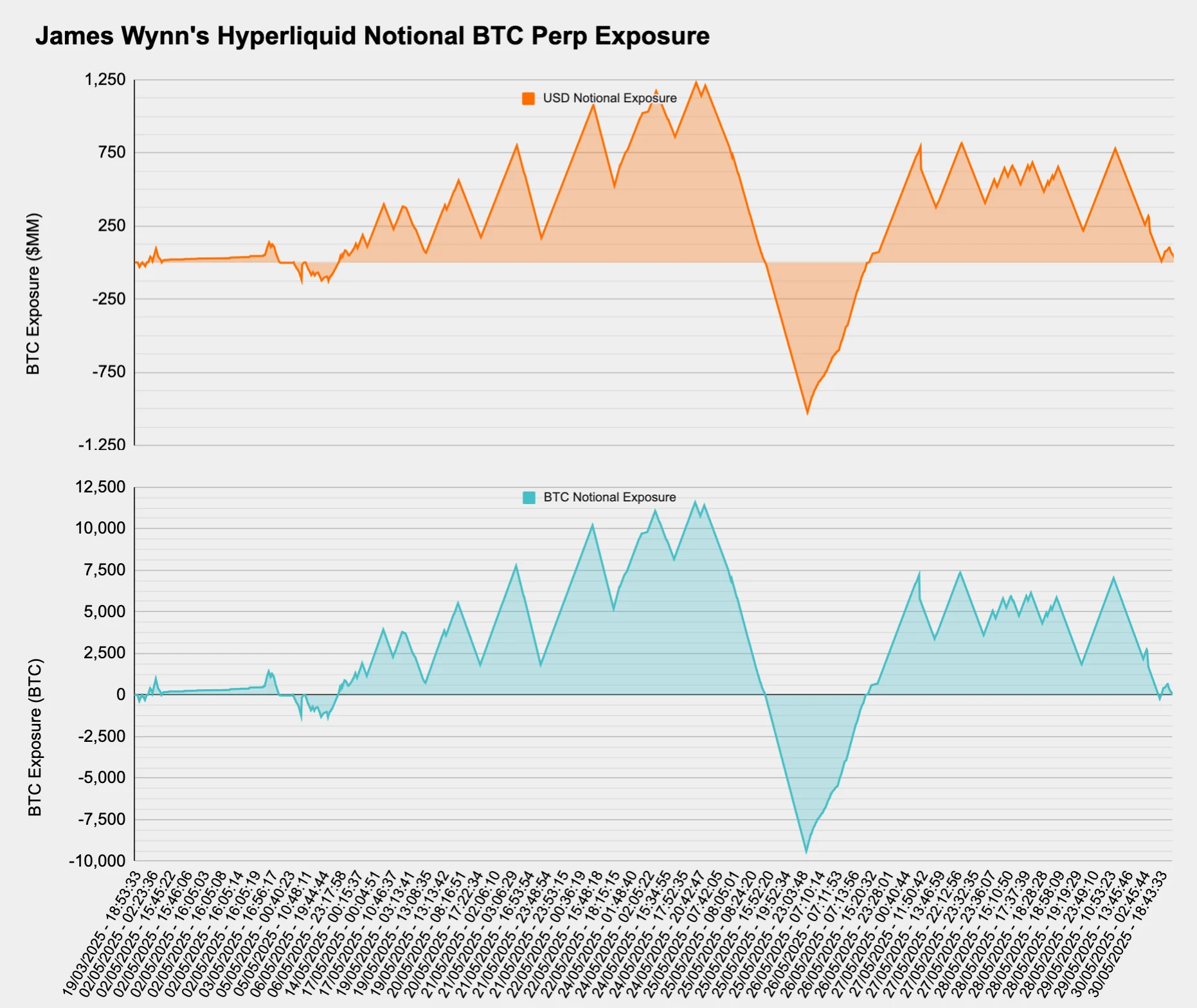

Figure 2: James Wynn’s Notional BTC Exposure on Hyperliquid

Source: Hyperliquid, Presto Research;

Note: Each x-axis step is 1 trade, hence the spacing does not reflect an accurate temporal visualisation.

2.2 21~24th May: Booking Profits and Continuing To Flip With Size

This time, Wynn managed to hold his position for a little over 12 hours, with BTC gaining 1.68% (or 39.67% if you’re leveraged 40x), before scaling back down: he sold 5,944 BTC, reducing his long exposure from $800 million to $167 million. But just like in the previous day, he didn’t wait too long before bidding again. 3 hours 10 minutes and 44 seconds after reducing his position to $167 million, Wynn was back buying. After a 7 hour manual TWAP, Wynn’s BTC exposure increased to 10,200 at an average price of $105,713.17. Astute readers may have noticed but this was the first time Wynn’s notional hit $1 billion ($ 1.078B to be exact).

At this point, Wynn’s unrealised PnL was over $40 million higher than it was 3~4 days ago before he started this frantic trading, and he had become a genuine narrative drive in crypto. Monitoring accounts like Lookonchain flagged that Wynn’s position had the potential to influence market behaviour, not simply as a large trade, but as a reflexive input into sentiment and positioning.

And perhaps in typical James Wynn fashion, 12 hours later on the 22nd, Wynn cut 5,188 BTC to a notional of $524 million, before again turning on the buying machine 3 hours after his last sell trade. Over the next 29 hours, Wynn bought 5,882 BTC in 73 clips with an average size of $8.88 million. His new notional was long $1.172 billion at an average price of $105,870.43. From the 23rd May to the 24th, Wynn’s unrealised perp PnL went from $81,247,815 to $38,233,844: 52.94% down and a paper loss of over $43 million.

2.3 24~26th May: From $1.27B Long to $1.03B Short

After holding his long for 12 hours, Wynn was back selling, but this time “only” 312 BTC, with a new notional of $860 million. But 10 minutes later (technically 9 minutes and 41 seconds later), at 17:08 UTC+9 on the 24th, he entered his final bidding frenzy to build his largest position yet. 37 trades, average clip size of $10,009,012.35, over a span of 1 hour and 22 minutes: Wynn was now long 11,588 BTC at an average price of $106,144.07. In the 2 hours 11 minutes and 34 seconds that he held this monster trade, using Coinbase’s BTCUSD as the mark price, Wynn’s position reached a notional value of $1,269,092,034.64.

But yes, the position lasted no more than a little longer than 2 hours. Wynn spent the next few hours reducing then adding to his position, before ultimately executing 107 sell trades with an average size of $11.49 million to completely flatten out a $1.21 billion position (not $1.27 since he reduced some and added back a bit) in 47 minutes.

However, the tale doesn’t end there. 7 hours and 34 minutes later, Wynn was back but this time, to go short… in size. Over the next 8 hours, he executed 72 short positions at an average size of $13.98 million and a notional of -$1.026 billion. Long $1.269 billion to short $1.026 billion in a little over 15 hours.

And 7 hours later, after BTC rose 0.73% (equivalent of 39.29% at 40x leverage), he seemingly had enough and started closing his position. By 07:15 26th May GMT+9, Wynn had closed his short position entirely (he started trading again 8 hours and 4 minutes later but this report will stop the coverage here). His unrealised PnL snap on the 27th May showed a value of $17,130,692: a further 55.19% lower than three days prior. What’s incredible is that he did all of this without once being liquidated.

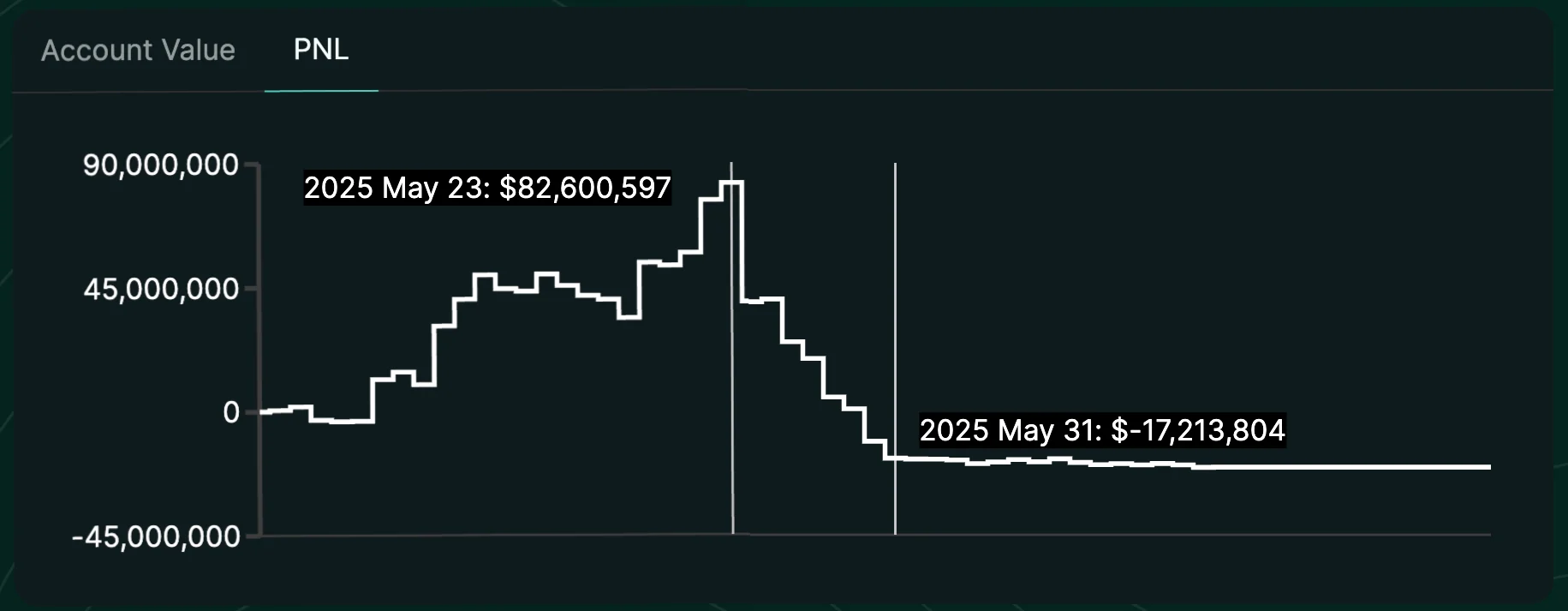

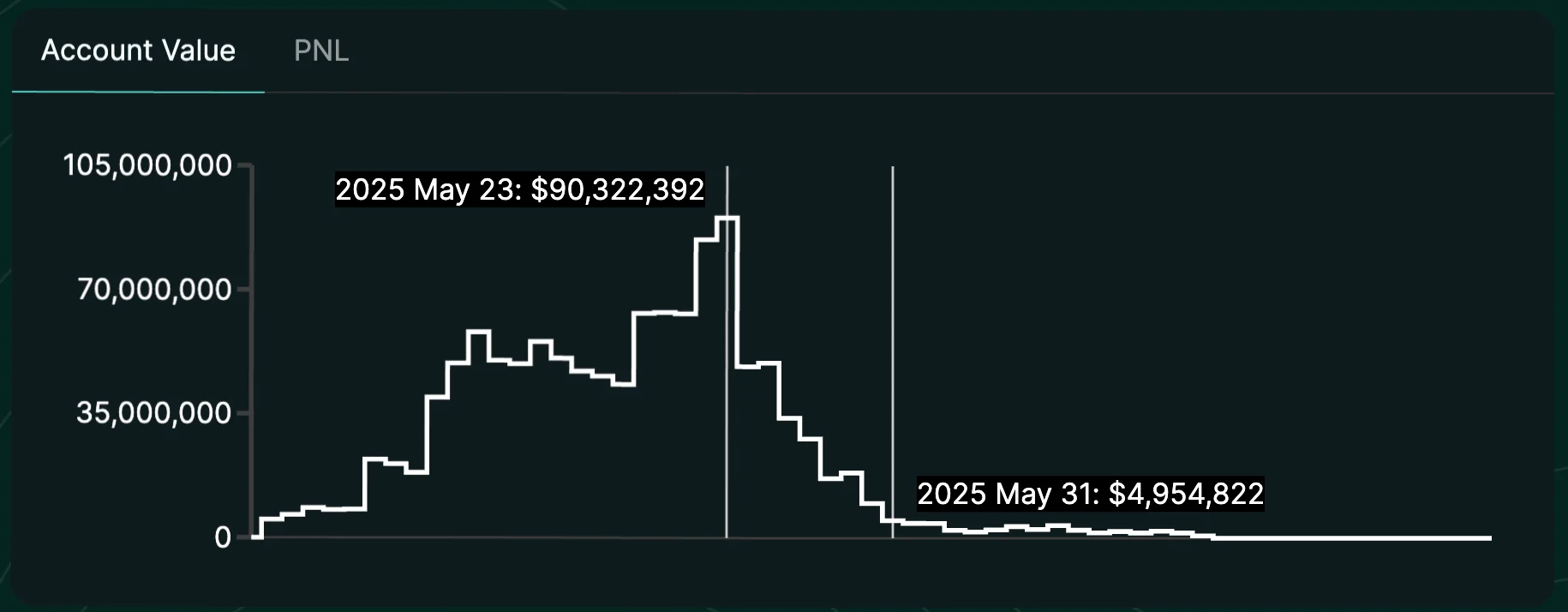

However, as his exposure visualisation in Figure 2 shows, he continued to trade after this, albeit never reaching the same whale positions he once held. His trading in the last week of the month was less than glamorous, and Wynn finally experienced a few long liquidations. Figure 3 shows just how much money he lost from his flipping: the top chart shows his Hyperliquid PnL while the bottom shows his Hyperliquid account value. With an account value of $90.32 million when he first opened his billion dollar long, by the end of the month he had traded that down to just under $5 million… -94% in 8 days.

Figure 3: Wynn Continued To Trade Away Generational Wealth

Source: Hyperliquid

3. Hyperliquid… Hyper Liquid.

When James Wynn scaled into a $1.27 billion BTC long at 40x leverage, many expected some part of the system to break. In fact, Crypto Twitter was filled with liquidity and scenario analysis and various predictions of how the ugly things could get for the platform given a gigantic long with high leverage. Historically, this kind of size, especially when transparently broadcasted, triggers something: liquidation level hunting, crazy slippages, liquidation spirals, or outright venue failure. Instead… none of that happened.

Hyperliquid absorbed the flow. The platform matched, cleared, and eventually unwound the position without downtime, visible dislocation, or notable spread dysfunction. In less than 60 minutes, Wynn fully exited the 10 figure position in 8 figure clips, all on-chain, without any collapse in pricing integrity.

This section dissects three key areas - perp funding dynamics, fill quality, and exit mechanics - to assess how “real” HL’s liquidity really was during one of the largest visible perp trades in crypto history.

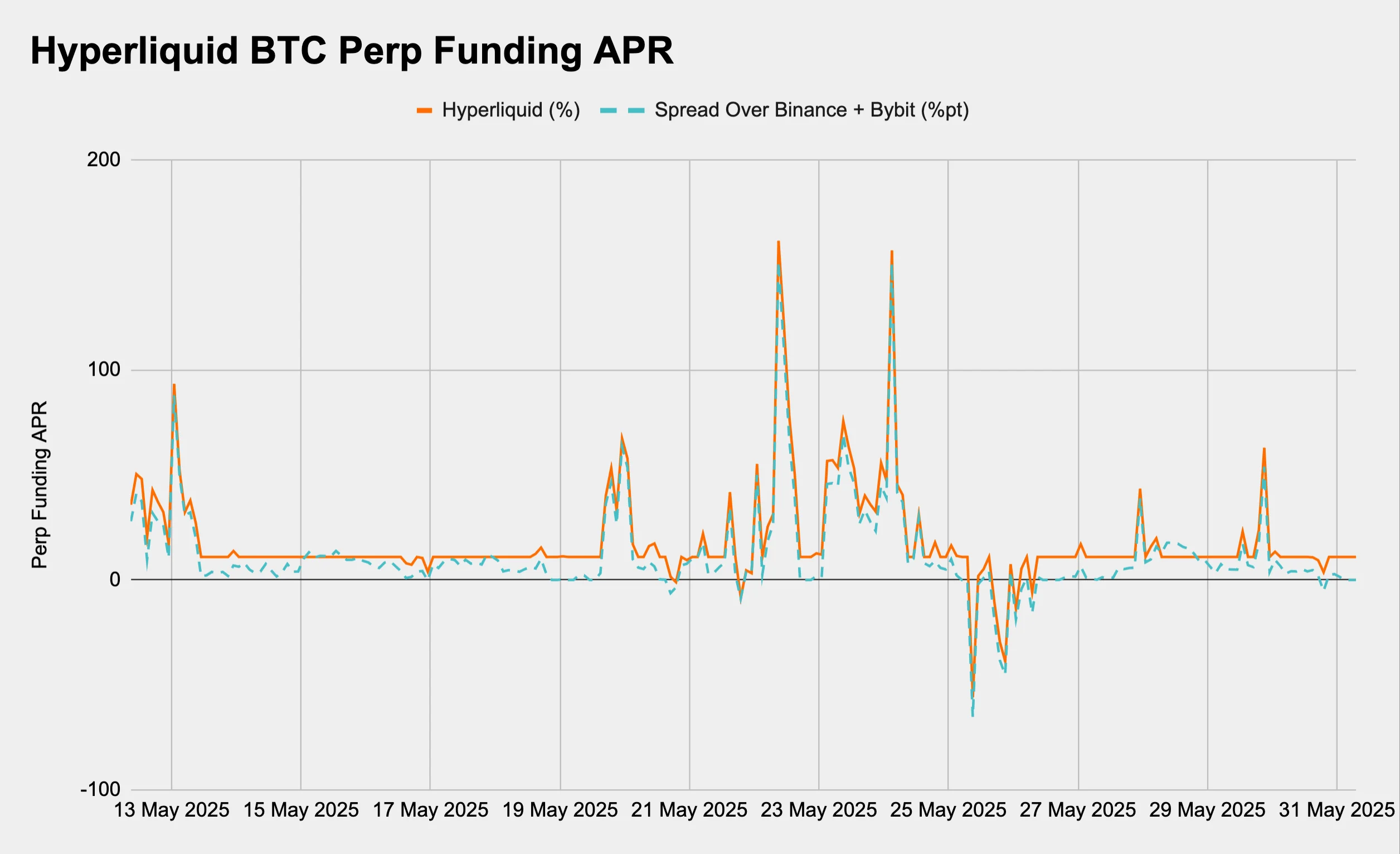

3.1 Perp Funding

If there was one place where the strain of Wynn’s trade did show, it was in the perp funding rate (see Crypto Derivatives Series I: Futures for a primer on how funding rates work). As the long built toward peak size, and stayed live through multiple re-entries, Hyperliquid’s BTC perp funding rate surged, reaching annualised levels north of 160% APR on the 22nd of May (Figure 4). These were not brief spikes but rather, prolonged structural shifts in funding, reflecting how aggressively the long side of the book was being paid for.

Figure 4: Hyperliquid’s Perp Funding Was Notably High

Source: Laevitas, Presto Research

What makes this more interesting is the comparison. As shown in Figure 4, the spread between Hyperliquid and major CEXs’ perp funding rates (the analysis takes the average of Binance and Bybit’s most liquid BTC perp products, the BTCUSDT-Perp) widened significantly during key periods, at times hitting over 150 percentage points. Hyperliquid’s average spread over Binance and Bybit, between the 22nd and 24th May was 35.56 percentage points, while the average delta between the 14th and 18th of May, before Wynn started building out his large longs, was 6.86%. This divergence tells us two things:

Hyperliquid’s market skew was real and persistent: longs were in demand, and shorts weren’t stepping in fast enough to balance the book.

The venue allowed natural price signals to clear the imbalance, rather than force artificial constraints on the rate.

Instead of freezing or throttling the funding, HL let it run and in doing so, revealed just how reflexive Wynn’s activity had become. The system worked as perpetual futures were designed to: longs were punished, shorts were incentivised, and the clearing mechanism remained functional.

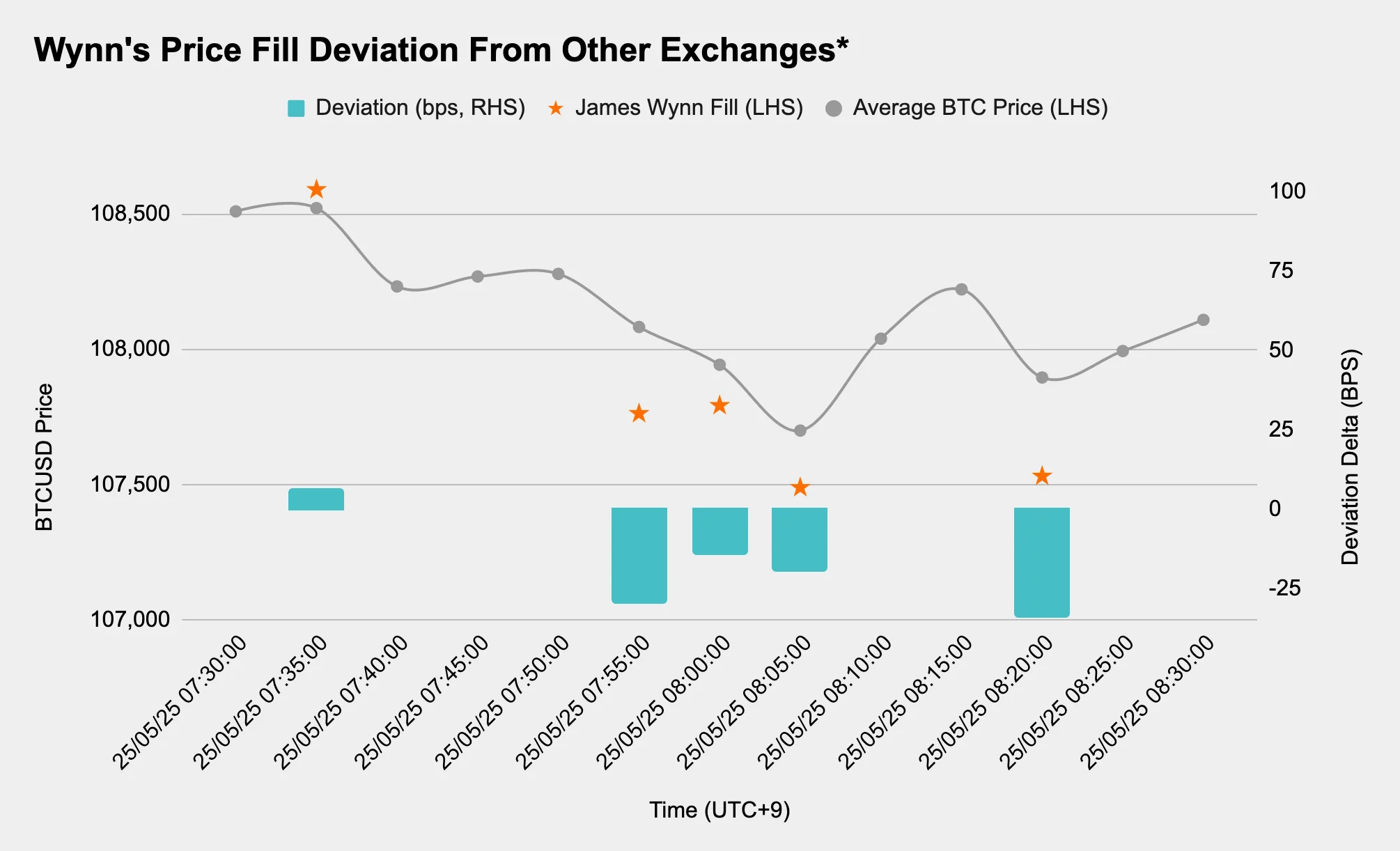

3.2 Price Execution: Slippage Was Contained

Despite the size and frequency of Wynn’s entries almost all in 8 figure clips, his fills remained surprisingly tight relative to the broader market. Between the 19th and 26th of May, throughout the duration covered in §2, Wynn’s average single trade size was $10,906,791.14.

Figure 5 plots Wynn’s actual execution prices while reducing his $1.27 billion position to zero, benchmarked against the average BTC price across major venues. Because 1-second-level pricing data from other exchanges wasn’t available, the comparison uses the closing price of the most recent 5-minute candle, but only includes Wynn’s fills that occurred within seconds of that timestamp. This conservative filtering ensures the slippage shown, measured in basis points, reflects genuine near-synchronous price comparisons, rather than artefacts of asynchronous data.

Figure 5: Wynn’s Slippage Was Business As Usual

Source: Laevitas, Presto Research;

* This takes the average of the most liquid BTC CEX instruments: BINANCE:BTCUSDTP, BINANCE:BTCUSDT, BYBIT:BTCUSDT.P, BYBIT:BTCUSDT, and COINBASE:BTCUSD

Over the course of 25th May when he closed his largest position, most fills came in within 30bps of the spot composite, even during moments of elevated funding and directional flow, and the largest deviation was 33.81bps.

For a trade that totaled over $1.27 billion in notional, that level of pricing discipline is remarkable. To put the 33.81bps into context, here are the fees CEX traders face: Coinbase’s taker fees start at 60bps, while Binance and Bybit both start at 10bps.

This was a quiet but powerful signal that Hyperliquid’s matching engine was deep enough to handle directional pressure without caving and that venue participants weren’t reflexively pulling liquidity when a known whale started clicking size. Not bad for a DEX.

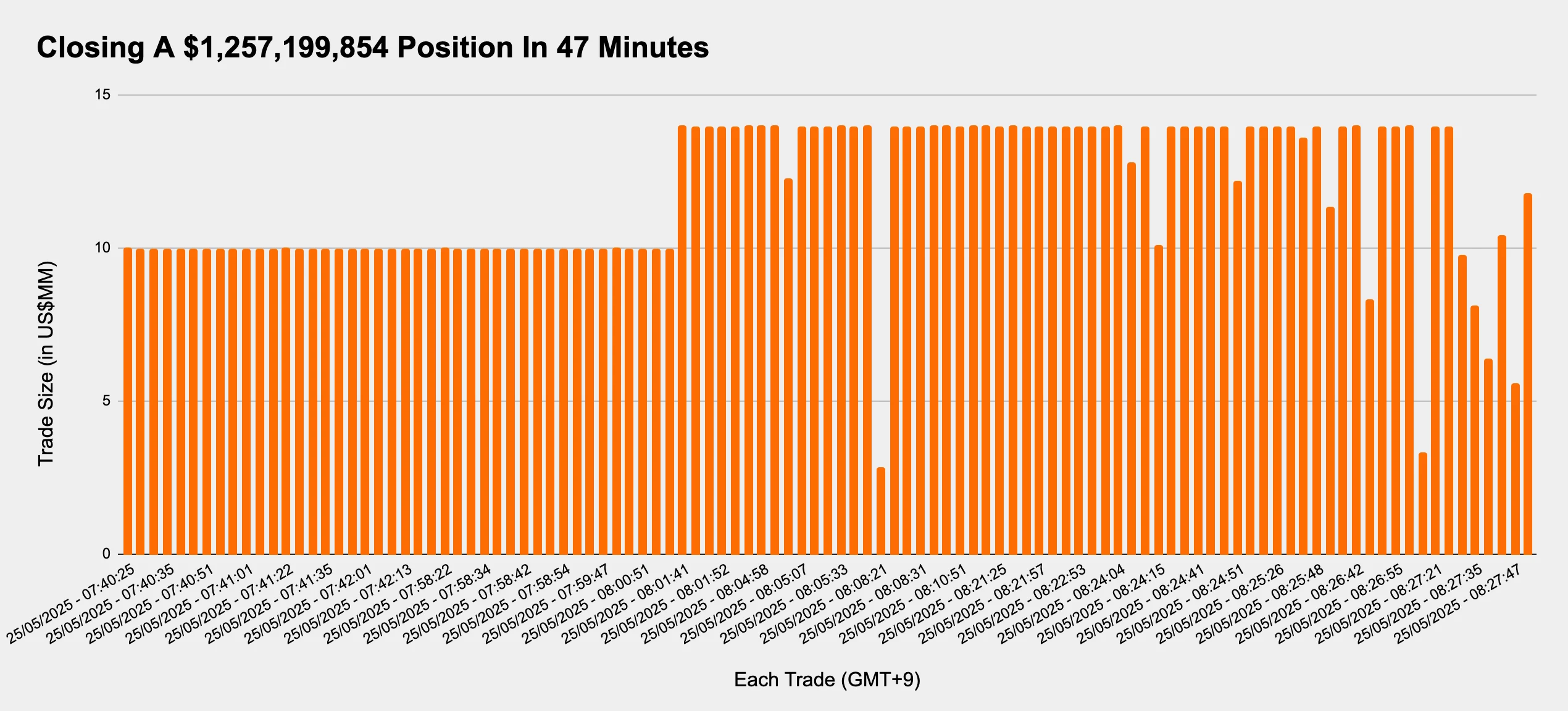

3.3 Closing $1.25B in 47 Minutes

As covered in §2, Wynn exited his $1.2+ billion BTC long position, 11,407 BTC in a span of 47 minutes. It wasn’t a single market order, but each trade was large. Executed in 107 trades, with an average clip size of $11.49 million, the unwind showed minimal (perhaps even zero) visible signs of slippage spirals, order book fatigue, or platform disruption.

Figure 6: Each of Wynn’s Orders Were Consistently Large

Source: Hyperliquid, Presto Research;

Note: Each x-axis step is 1 trade, hence the spacing does not reflect an accurate temporal visualisation.

Figure 6 shows each of these trades in sequence. The size remained consistent throughout, with no telltale signs of the venue widening spreads or throttling activity, even as the market watched it happen in real time. The liquidity seemed to be omnipresent.

In past cycles, trades of this size, especially from a known wallet, on-chain, and under leverage, would have triggered some form of failure for a variety of reasons. Bid walls would vanish. Matching engines would freeze. Index prices would gap, and cascading liquidations would follow. Bad actors would come in to exploit the whale account’s liquidation levels. On Hyperliquid, none of that occurred.

It was a $1.27 billion exit, executed like a routine rebalance.

4. Final Word

James Wynn’s $1.27 billion BTC long made history not only because it was one of the largest directional perp trades the crypto market has ever seen, but it was also one of the most transparently monitored. Few times in crypto history do all participants come together to monitor on-chain positions and balances like they did during this episode. The position was built live, traded in the open, and dissected in real time by an audience of thousands. In the end, Wynn lost over $85 million. But the trade also proved something deeper about the state of crypto infrastructure.

Despite extreme leverage, reflexive positioning, and massive size, the system didn’t break. Hyperliquid didn’t lag, gap, or crash. There were no reorgs, no bailout mechanics, and no forced socialised losses. Instead, a DEX handled two billion-dollar trades with as much composure as any major CEX might, and definitely with more transparency.

What was an unfortunate blow-up for Wynn was a perhaps much-needed validation for DEXs in general, and a win for Hyperliquid.