Summary

1. The Problem: Fragmentation Is DeFi’s Execution Tax

1.1. What fragmentation looks like

1.1. How fragmentation taxes users

1.1. Why aggregation matters especially in crypto

2. Enter Ranger: Aggregation as a Trading Primitive

2.1. Introduction to Ranger Finance

2.2. What Ranger actually aggregates

2.3. Core product pillars

3. Execution at the Aggregation Layer

3.1. How aggregation actually works

3.2. SOR architecture (operator-level view)

3.3. Why this matters for “traders of size”

4. Ranger’s Strategic Positioning

5. Final Word

Summary

DeFi execution remains taxed by fragmentation, with liquidity split across venues and chains driving slippage, failure rates, and MEV leakage.

Ranger Finance’s crosschain Smart Order Router consolidates depth from Solana’s routing stack, and relays, enabling lower-cost, MEV-resilient execution that scales with trade size.

Based on reported volume growth from December 2024 to September 2025, meta-aggregation appears to be gaining traction among size-sensitive traders, though longer-term adoption patterns remain uncertain.

1. The Problem: Fragmentation Is DeFi’s Execution Tax

DeFi execution is still taxed by fragmentation: liquidity is split across L1s/L2s, venues, and routing layers, which widens slippage bands, raises failure rates, and leaks value to MEV. Aggregation is the corrective primitive.

After Ethereum’s Dencun, base L1 gas dropped materially, shifting the “execution tax” mix toward slippage, latency and failed transaction externalities, while Solana’s throughput boom has coincided with bot-driven failure rates and evolving MEV dynamics. This makes smart routing and quote competition more valuable than simply lowering gas.

Ranger Finance positions itself as a meta-aggregator on Solana that pulls quotes from DEXs, other aggregators, RFQ relays, and hybrid venues to minimise slippage and venue fees while hardening execution against MEV. The product angle is “aggregation as a trading primitive,” not just a UI.

1.1. What fragmentation looks like

Fragmentation manifests itself through both venue and chain sprawl. Liquidity is distributed across many AMMs, RFQ relays, and app-chains. During stress, prices diverge more on thinner venues, creating real execution gaps that single-venue swaps cannot close.

Routing layers add another split. On Solana alone, a meaningful share of flow routes via aggregators and private AMMs inside those aggregators, so “best venue” is a moving target across multiple routers, not just pools.

1.2. How fragmentation taxes users

Slippage and price impact.

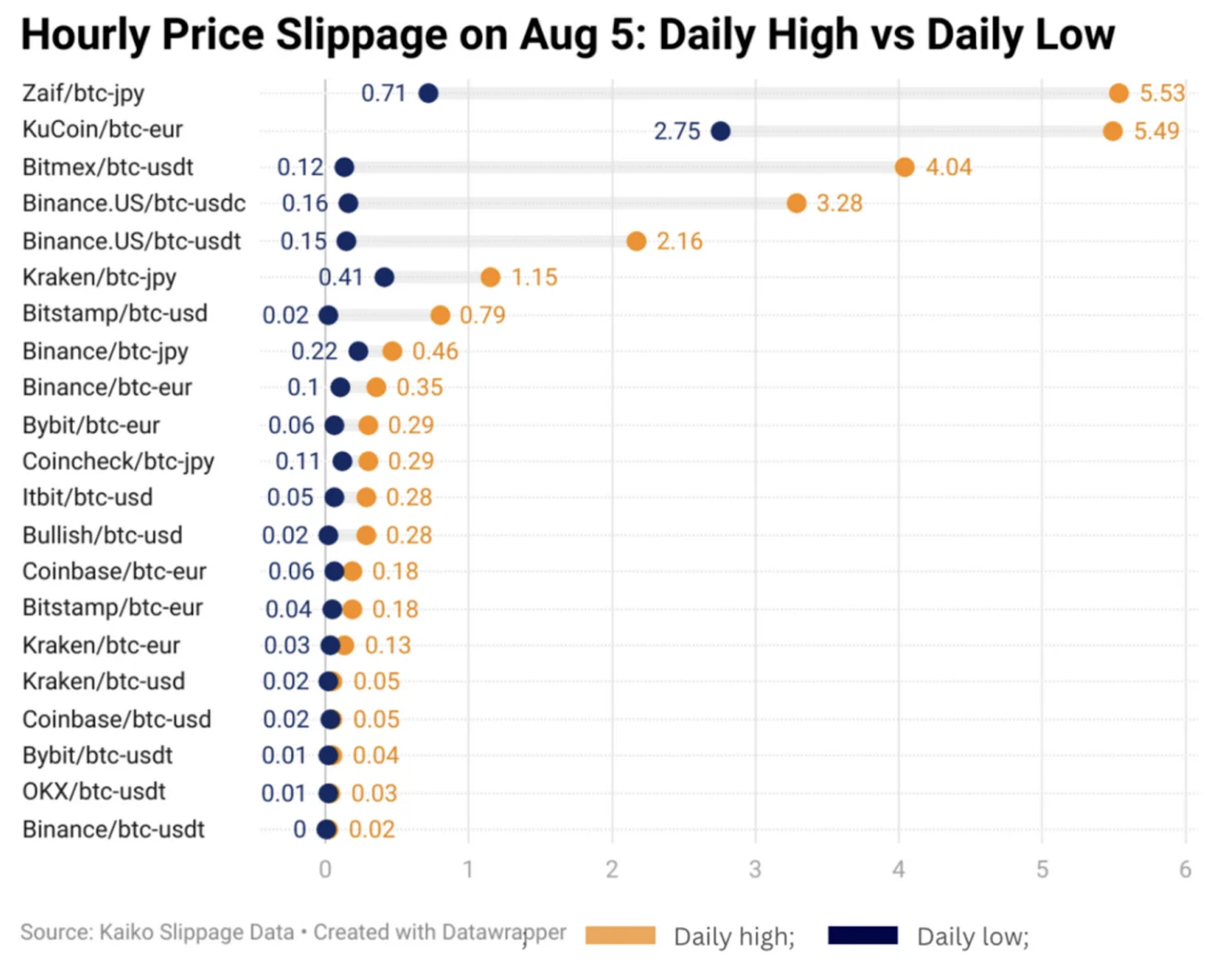

When liquidity is scattered across venues, expected impact rises unless order flow is actively split and routed. Figure 1, which shows Kaiko data on cross-venue divergence during the 05 Aug 2025 sell-off, shows how costly this gets: picking the wrong venue at the wrong time can add basis points to full percentage points of slippage. For example, BTC-JPY on Zaif saw the steepest dislocation, KuCoin’s BTC-EUR pair lost over 5%, and even normally liquid stablecoin-quoted pairs (e.g. BitMEX and Binance US) recorded multi-basis-point slippage. Within exchanges, depth differences across pairs (Coinbase BTC-EUR vs. BTC-USD) produced extreme volatility and widening execution gaps.

Figure 1: Hourly slippage of BTC pairs across CEXs

Source: Kaiko Research

Latency and MEV

Execution ordering is an ever-present cost. Solana’s public mempool shutdown cut sandwiching for a period, but activity quickly adapted, reinforcing the need for private flow and enforcement. On EVM chains, MEV-aware routing is now explicitly built into leading APIs, acknowledging that latency-sensitive routing is part of the execution stack.

Failed transactions and wasted gas

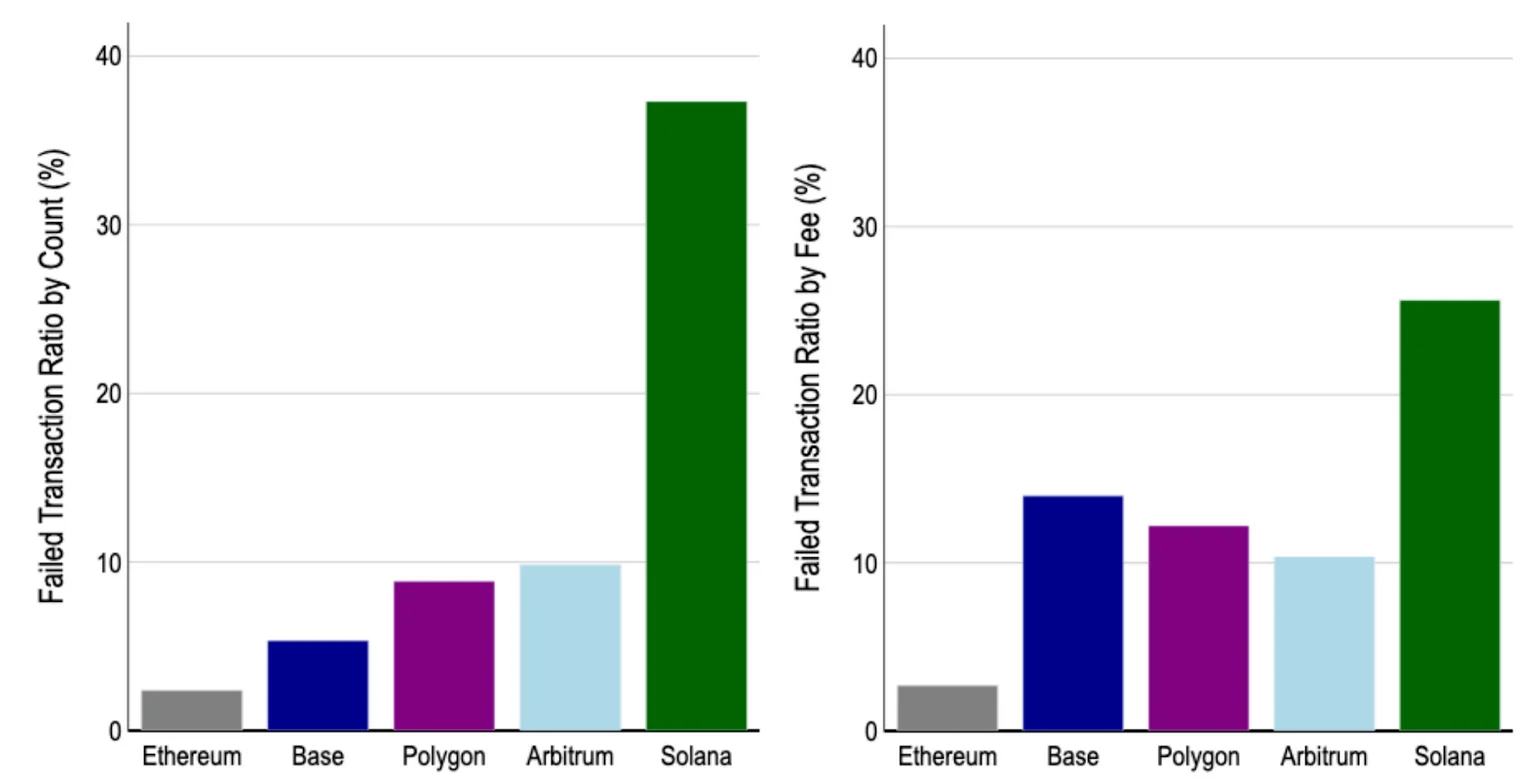

On Solana, Coinbase Institutional reported that more than a quarter of fee spend in 3Q24 was on failed transactions, down from a peak of 55% in March but still a striking indicator of value lost without robust routing and back-off logic (Figure 2).

Figure 2: Solanaʼs proportion of failed transaction spending is higher than other blockchains

Source: Coinbase Institutional

Operational drag

For derivatives, fragmentation extends beyond spot execution. Managing positions across multiple venues compounds margin fragmentation, funding slippage, and operational risk, adding another layer of hidden execution tax.

1.3. Why aggregation matters especially in crypto

No single NBBO (National Best Bid and Offer)

Unlike equities, crypto has no consolidated tape or protected quote. Prices and fees vary not only across venues but also across routing layers, which means execution quality depends as much on the search process as on raw liquidity. On-chain traders often talk about how base fees have compressed, making routing precision now the dominant driver of cost or alpha.

Visibility and ordering risk

Onchain transactions are transparent and orderable by third parties. That makes retail-sized single-venue swaps predictable and exploitable. Aggregators can defend flow with MEV-aware routing, private RFQ rails, and split execution, coordinating tactics that individual users or UIs cannot.

Multi-market plumbing

Crypto execution spans spot, perps, and RFQ venues, each with distinct funding curves, maker rebates, fee structures, and queueing rules. Aggregators are uniquely positioned to arbitrage these micro-differences in real time, capturing incremental edge across markets.

Beyond first-generation DEX aggregators

Established aggregators like Jupiter have proven effectiveness for standard spot trading, with advantages including battle-tested infrastructure, extensive venue relationships, and simplified user experience. Ranger's meta-aggregation approach targets a different segment: users requiring cross-venue optimization who are willing to accept additional complexity for potential execution improvements.

How Ranger frames this problem

Ranger attempts to reduce execution costs through meta-aggregation, though effectiveness varies by trade size and market conditions.: it requests and scores quotes from for spot & Drift, Jup, Flash & Hyperliquid for perps, then routes in a single transaction with MEV-resilient options. The fee schedule is transparent, stacked on top of any venue fees: 1 bp perps, 5 bps spot market, 0 bps spot limits. This lets the product “buy” better prices with competition across routers, not just pools. Unlike earlier perp “aggregators” such as Rage Trade or Mux, which aggregated liquidity sources without handling routing, Ranger executes the full transaction path end-to-end.

2. Enter Ranger: Aggregation as a Trading Primitive

2.1. Introduction to Ranger Finance

Ranger Finance positions itself as Solana’s meta-execution layer. The product sits above DEXs, aggregators, RFQ rails, and intent layers, normalising that flow across perps, spot, and emerging spot-margin. The aim is clear: concentrate fragmented liquidity, compress slippage, and make smart routing the default. As of September 2025, Ranger reports more than $1bn in cumulative volume and frames its interface as a “command centre” for trading and data rather than a venue-specific front end.

Ranger Spot aggregates quotes across Solana routing layers and custom sources - including Jupiter, DFlow, Kamino, OKX, and Pyth - returning a single best quote with venue fees and expected impact baked in.

Check out Presto Research’s Q&A as part of the Builder Spotlight series with Ranger’s co-founder Coby: Coby, Ranger Finance: TradFi background, competitive cheerleading, and unifying DeFi.

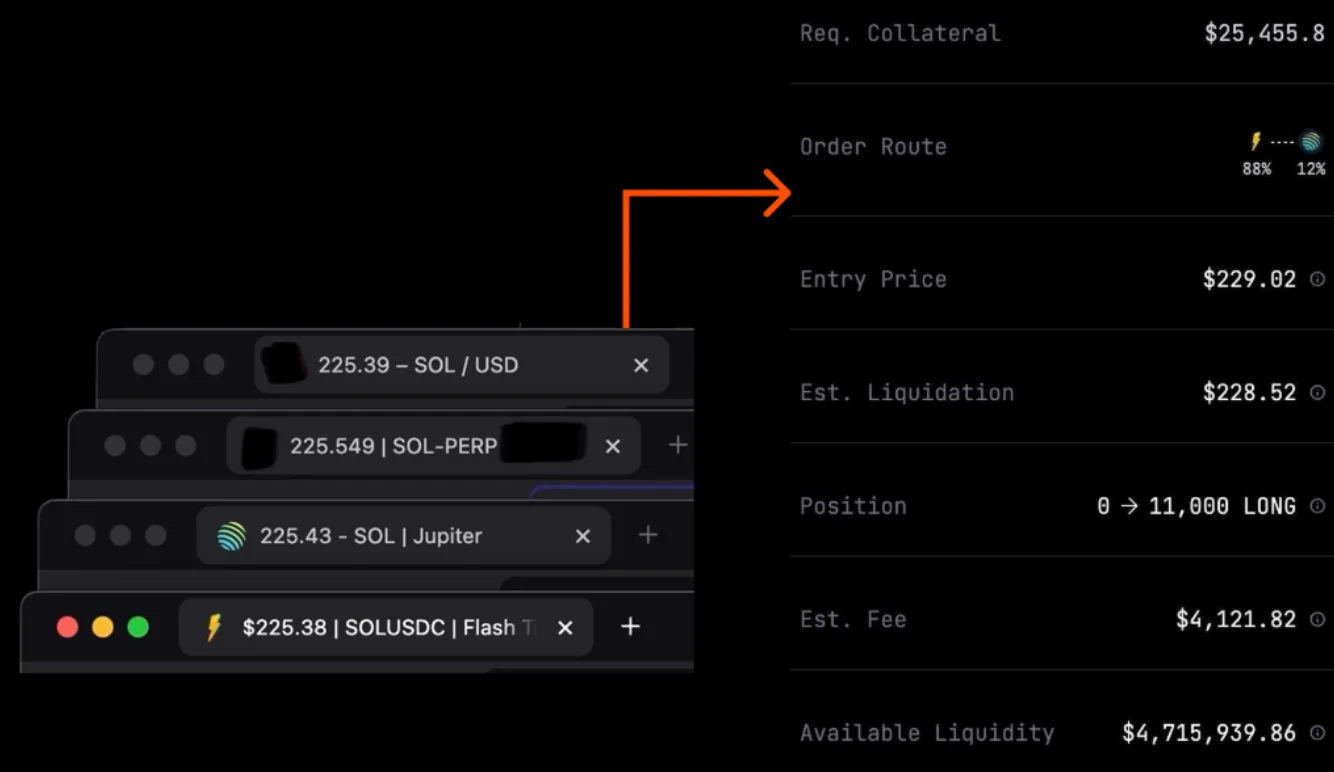

Figure 3: Ranger’s perp trading interface

Source: Ranger Finance

2.2. What Ranger actually aggregates

Ranger’s scope extends beyond DEX pools. It sources from other aggregators and RFQ relays, functioning more like a broker-level execution layer than a simple front end. On perps, it routes across integrated venues such as Drift and a Hyperliquid, covering majors and long-tail markets. Notes cite 61 supported Drift markets and cross-chain connectivity via Privy and Relay Finance for Hyperliquid. On spot, the meta-aggregator pulls from Jupiter, DFlow, OKX, Kamino, and Pyth, adding MEV protection and support for tokenised equities like AAPLx and NVDAx. Partnerships such as Velo extend into cross-border liquidity.

This creates a venue-agnostic execution path capable of splitting orders and combining partial fills when depth is thin. At submit, Ranger requests quotes in parallel, scores them on price, slippage, venue fee, and estimated time to fill, then executes the optimal route. Larger tickets are composed across routes to minimise impact. MEV-resilient routing is standard on spot.

2.3. Core product pillars

Aggregated Liquidity: Ranger integrates liquidity crosschain, on both Solana and Hyperliquid (with Lighter.xyz also on the roadmap), ensuring traders access the best available rates with minimal slippage. By pooling depth from multiple venues, the platform enables large orders to clear without heavily moving the market, improving effective execution for size-sensitive flow.

Smart Order Router (SOR): The SOR is Ranger’s execution engine. Queries connect venues every 200-500ms depending on market volatility, applying weighted scoring algorithm: 40% price improvement, 30% estimated slippage, 20% total fees, 10% historical fill reliability over trailing 7-day period. For larger tickets, it can split orders across venues, stitching fills into a single transaction to preserve depth and minimise impact (Figure 4):

How it works:

Order placement: Every trade triggers the SOR to analyse order size and prevailing market conditions.

Liquidity scan: The system evaluates depth, fees, and route reliability across integrated venues.

Execution strategy: Orders are split or sequenced where needed, ensuring optimal fill quality.

Execution and monitoring: Trades are routed in real time, with built-in failover to backup paths if conditions change.

Confirmation: Results are consolidated into a unified trade update and position view.

Technical components:

Price Aggregator: Normalises quotes across venues.

Risk Engine: Models slippage and penalises unreliable paths.

Optimisation Engine: Designs and executes the routing strategy, including split-fills.

Trader benefits:

Better pricing and lower costs through venue competition.

Reduced slippage and faster fills, even in volatile conditions.

Higher reliability via redundant routing and failover mechanisms.

Data Tools: Ranger provides real-time analytics including liquidation data, open interest, and funding rates. These datasets give traders market context and strategy inputs directly within the interface, reducing reliance on third-party dashboards. Access to live and historical analytics supports faster decision-making and better risk management.

Multi-Asset Ecosystem: Ranger aims to unify spot, and perps within a single platform. This expansion builds on the core aggregation layer, offering traders seamless access across asset classes while maintaining consolidated execution and reporting.

Figure 4: Ranger's technical approach: Multi-venue routing system

Source: Ranger Finance

3. Execution at the Aggregation Layer

Ranger is not a venue-specific UI; it is an execution layer that aggregates perpetuals and spot routes, normalises quotes and fees, and composes fills across sources. On perps, Ranger launched in December 2024 as Solana’s first perps aggregator, starting with Drift, Flash, and Jupiter, and later expanding into Hyperliquid. The same Smart Order Router (SOR) now powers spot meta-aggregation across Jupiter, DFlow, OKX, Kamino, and Pyth.

3.1. How aggregation actually works

On perps, aggregation unifies fragmented order books by requesting executable prices at submit, scoring each path on price, slippage, fees, and reliability/ETA, then executing a single on-chain transaction that can contain split fills. For cross-venue routes like Hyperliquid, collateral transfers are abstracted through Privy and Relay Finance where needed. A consolidated position view and funding display remove UI friction while preserving venue-level transparency.

On spot, Ranger’s meta-aggregator sits above Jupiter and peers (DFlow, OKX, Kamino, Pyth), returning a single best quote with MEV-resilient options. The parallel design highlights why aggregation matters more in perps: fragmentation is deeper, with order book structure, fees, and queueing mechanics diverging sharply across venues.

3.2. SOR architecture (operator-level view)

Ranger’s SOR operates through three cooperating parts:

Price aggregator: normalises quotes across venues and relays, enforcing apples-to-apples comparisons on fees and lot sizes.

Risk engine: estimates slippage using exponential decay model of historical impact data, applies 0.5-2.0x penalty multiplier for venues with >5% fill failure rate in previous 24 hours.

Optimisation engine: selects the optimal route and composes fills across venues when a single book lacks sufficient depth.

3.3. Why this matters for “traders of size”

For traders, the binding constraint is market impact. A single Solana perps venue may show tight spreads but offer limited top-of-book depth. Aggregation extends effective liquidity, reduces the need to manually split orders, and provides redundancy when a venue degrades. Ranger’s design makes competition happen at submit, not in the trader’s head.

Reported outcomes include six-figure cumulative fee savings and execution at scale (>$1bn in volume once spot and perps aggregation were both live). These are supporting context, not substitutes for the head-to-head tests presented later in the report.

Aggregation benefits typically emerge when:

Trade size exceeds $15,000 (where routing costs <0.05% of trade value)

Market volatility >25% daily (where venue price divergence exceeds routing latency costs)

Trading long-tail assets with <$5M daily volume (where liquidity fragmentation is severe)

During stress periods when individual venues experience >10% of normal liquidity"

Aggregation may provide limited benefit when:

Trade size <$5,000 (where routing overhead approaches or exceeds slippage savings)

Trading major pairs (SOL/USDC) during stable conditions (where venues converge quickly)

Network congestion causes routing delays >500ms (where timing costs exceed execution benefits)

When individual venues offer incentive programs that exceed aggregation benefits

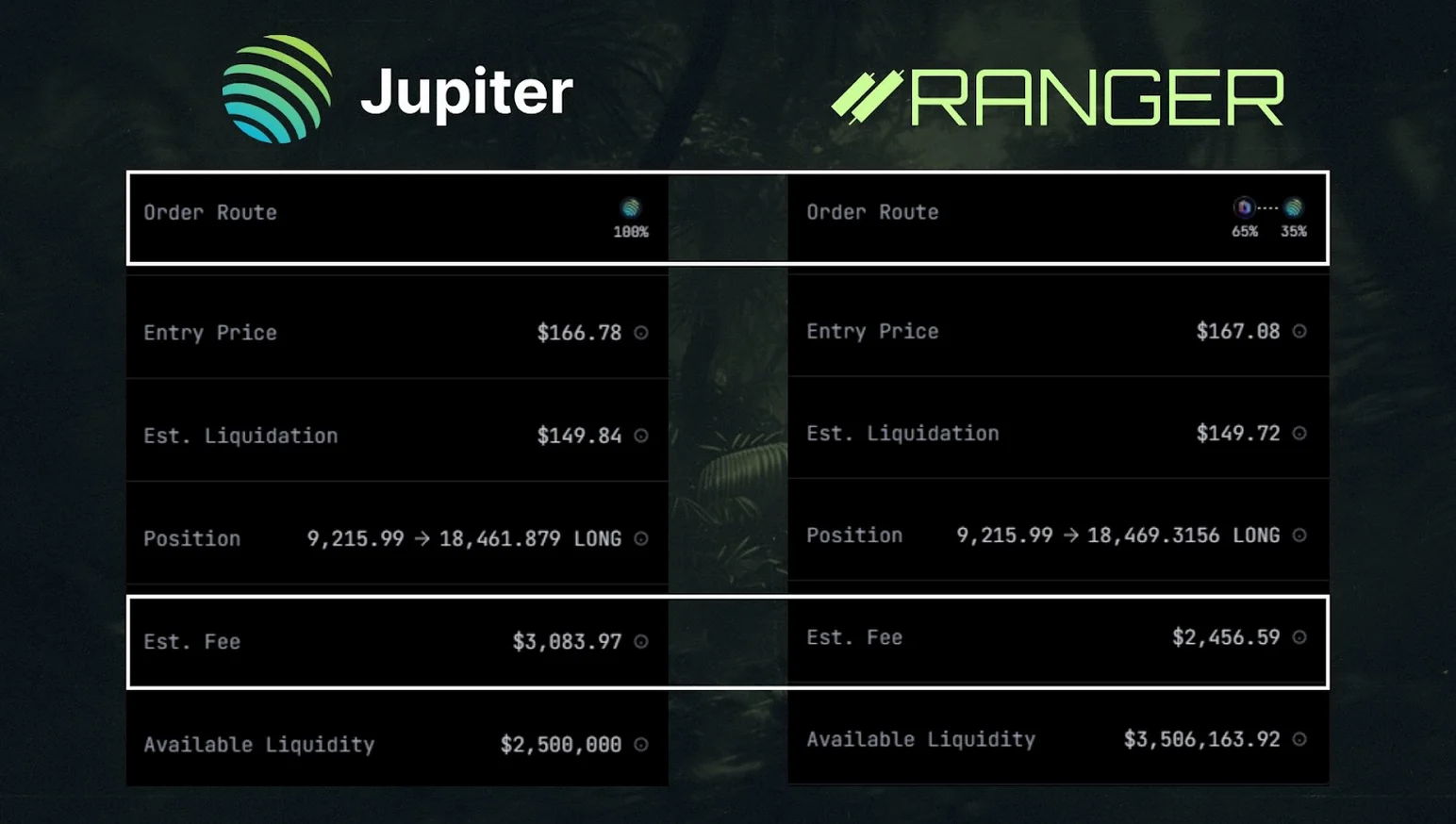

Figure 5: Ranger’s benefits are clear for those trading size

Source: Twitter @nzrnrdn

4. Ranger’s Strategic Positioning

Ranger’s thesis is that DeFi execution consolidates at the aggregation layer. Rather than competing as another venue, it abstracts venues into a broker-like surface where depth, routing, and collateral are normalised and where venues must compete for flow at submit.

Market traction

As of September 2025, Ranger has cleared more than $1bn in cumulative trading volume, with growth being fuelled by a points season distributing 500k weekly, referral fee-sharing, and creator-led campaigns under Operation X. The July rollout of its DEX aggregator pushed weekly volumes to roughly $150m by August.

Strategic wedge

Perp aggregation was the natural entry point: Solana’s perps liquidity is fragmented, and traders of size hit queue and impact walls on single books. By stitching fills across Drift and a Hyperliquid beta, Ranger raises effective depth and abstracts cross-chain execution through Privy and Relay Finance. This wedge differentiated the product early and gave it credibility with heavy users.

Ecosystem build

Ranger’s integrations extend from Drift (61 supported markets) and Hyperliquid to Solana’s routing stack (Jupiter, DFlow, OKX, Kamino, Pyth), with additional reach via Velo for cross-border liquidity, xStocksFi for tokenised equities and pre-IPOs, Privy for wallet infrastructure, Relay Finance for bridging, and Elfa for enriched data. Seed financing of $1.9m in 2024 from crypto and quant investors underwrites this expansion.

Competitive slot

With more than 20 perps DEXs competing for flow, venue-picking is a decaying strategy. The aggregator that arbitrages price, fees, and reliability across venues is the one positioned to capture the traders who care most about execution quality. That is the segment Ranger is targeting.

Forward roadmap

The company is signalling a Ranger app, Cross-margin system and APIs, alongside deeper Hyperliquid integration for cross-chain perps. Each extension reinforces Ranger’s aggregation-first model rather than pulling into unrelated products.

5. Final Word

For certain trade sizes and market conditions, aggregation approaches may improve execution quality. Fragmentation creates real costs in slippage, latency, failed transactions, and operational drag: those costs scale with trade size. Ranger Finance’s model is to make liquidity sources compete, abstract complexity into a single surface, and position aggregation itself as the trading primitive. For traders executing positions above $10,000 in fragmented markets, aggregation approaches appear to offer measurable execution improvements, though long-term sustainability depends on continued market structure evolution.