Summary

Japan’s centralised FSA + JVCEA framework allows disclosure-based pivots rather than permission-based approvals, enabling Metaplanet to operate as a listed, pure-play BTC treasury in ways not possible in the US.

Japanese regulation permits serial stock allotments and short-tenor bonds, allowing Metaplanet to run an ATM-style fundraising conveyor to accumulate 18,888 BTC in under 18 months. The model is openly dilutive but sustainable as long as BTC per-share metrics remain positive.

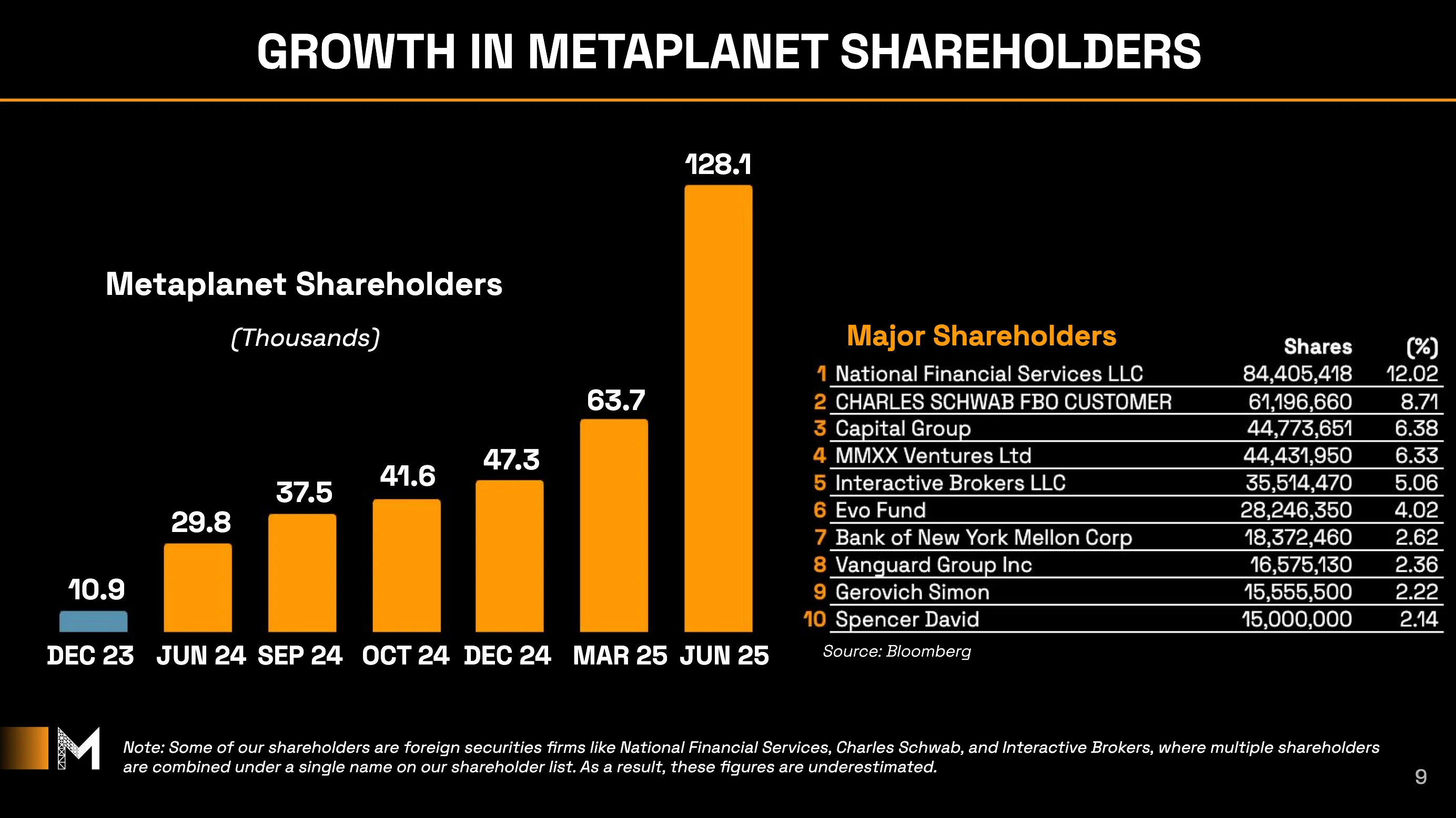

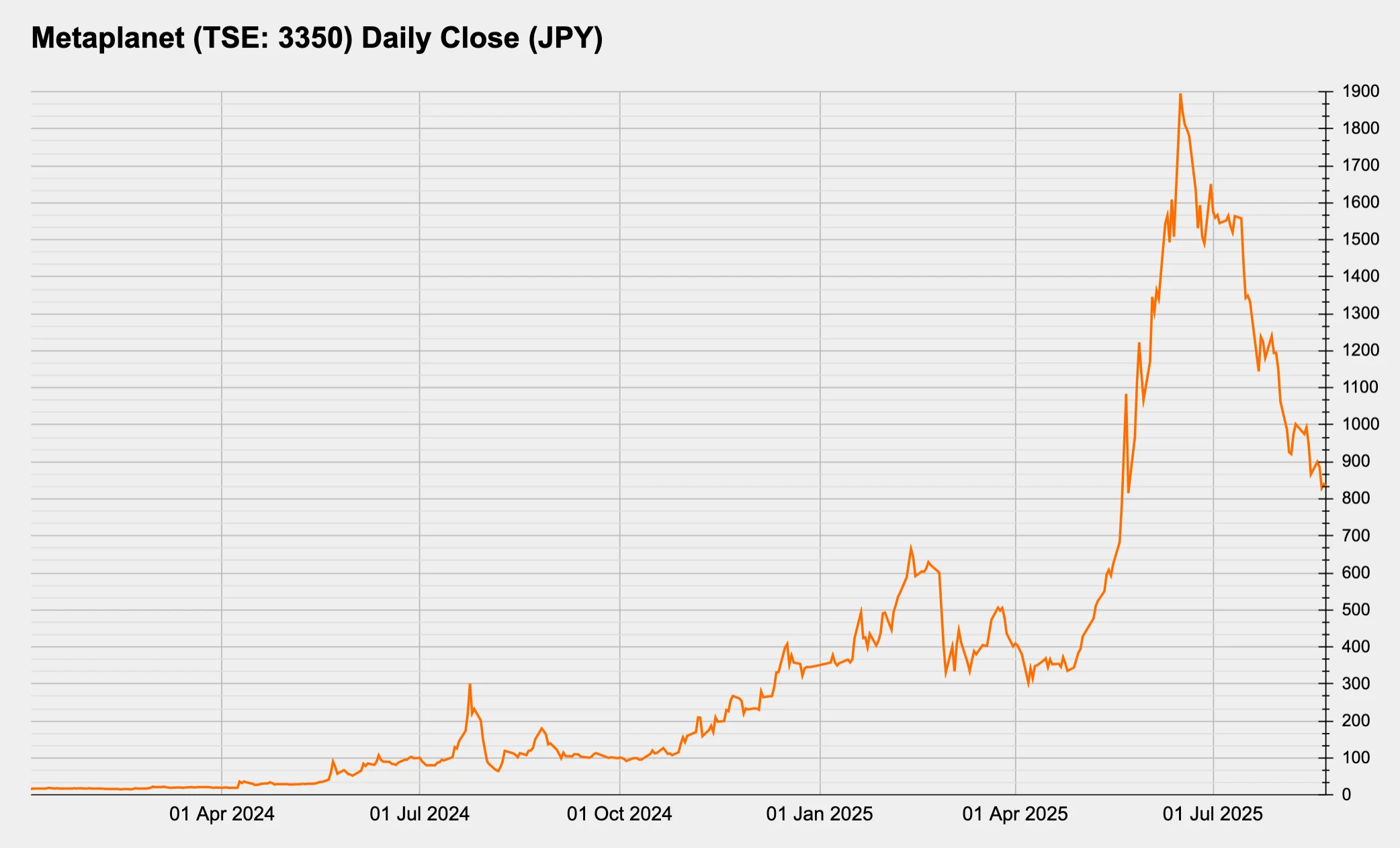

NISA’s tax-free equity accounts and retail enthusiasm have fuelled explosive shareholder growth (over 1,075% since Metaplanet’s first BTC purchase), making Metaplanet both one of Japan’s most bought NISA stocks as well as a high-beta BTC trading proxy.

1. Introduction

1.1. The SEC’s Vision

Metaplanet Inc. (TSE: 3350; OTCQX: MTPLF) is a Tokyo-listed company that has repositioned itself as Japan’s first pure-play Bitcoin treasury vehicle. Once a small-cap hospitality operator under the name Red Planet Japan, the firm, under the leadership of Representative Director and President Simon Gerovich, abandoned its struggling hotel business in 2024 and rebranded to Metaplanet, with Bitcoin formally added to its Articles of Incorporation as a core business.

The company’s stated mission involves increasing its BTC yield via growing its holdings through “disciplined management and intelligent leverage” (Figure 1). Its treasury model is straightforward: raise funds through equity, equity-linked instruments, and zero-coupon bonds, and deploy the proceeds directly into Bitcoin. Its first announcement of BTC purchases, shown below in Figure 1, came on 08th April 2024 and makes for an extremely interesting read on the motivations behind the decision (full link to the statement). As of 18th August 2025, Metaplanet holds 18,888 BTC valued at over ¥284.097bn (~US$1.96bn at 145 USDJPY) , making it the seventh-largest corporate holder globally and the largest in Asia.

Figure 1: Metaplanet’s first ‘Notice Regarding the Purchase of Bitcoin’

Source: Metaplanet website [link]

Metaplanet operates through three segments. The first and dominant segment is Bitcoin treasury operations, where performance is tracked by proprietary metrics such as BTC Yield (Bitcoin per share growth after dilution - more on this in Presto Research’s Twitter article). The second is media and education, anchored by its exclusive licence for Bitcoin Magazine Japan, used to promote adoption and investor awareness. The third is hospitality: the company owns one property in Tokyo, slated for relaunch as The Bitcoin Hotel in 2026.

Governance and branding have been strengthened by the addition of independent directors and international advisors, including Mark Yusko and David Bailey, alongside symbolic figures such as Eric Trump. The company maintains a lean headcount of around 20~30 employees, but leverages its public listing, high-profile partnerships, and retail-heavy shareholder base to amplify its market presence.

In short, Metaplanet is neither a traditional operating business nor a passive investment fund. It is a hybrid structure: a publicly listed Bitcoin vault with ancillary businesses that reinforce its narrative and distribution reach.

Figure 2: Metaplanet’s Company Manifesto and Bitcoin Mission

Source: Metaplanet website

2. Corporate Structure & Evolution

2.1. Founding and Legacy Business

Metaplanet’s, or perhaps more accurately Tokyo Stock Exchange ticker 3350’s, corporate lineage is unusually complex, reflecting two decades of reinventions and pivots, starting as a CD and vinyl production firm in 1999 to eventually becoming the innovational BTC treasury company today. In a May 2025 interview, Gerovich summarised his journey at Metaplanet:

I’ve been associated with the company now for the past 10 years. We originally acquired the company when I was running a hotel business: we realised when we entered Japan that in order to get financing from Japanese banks, to be taken seriously by potential investors, to be a public company would be very useful and so we acquired a majority stake in a company at that time and then we rebranded it to become Red Planet Japan which was our pan-Asian budget hotel platform.

COVID-19 was terminal for the hotel business model. Revenues collapsed, assets were sold, and in May 2024, a month after Metaplanet’s first notice regarding its inaugural purchases of BTC, the hotel subsidiary Red Planet Hotels Japan filed for bankruptcy, leaving the listed parent to retrench around a single Tokyo property. That property is now under redevelopment as The Bitcoin Hotel, scheduled to open in 2026 with Bitcoin-themed programming, effectively repurposing the only physical remnant of the hospitality era into a brand asset for the new treasury strategy.

2.2 Ownership, Governance, and Shareholder Shifts

The decisive change came on 17 September 2022, when EVO Fund (Cayman), through its Delaware vehicle, completed a tender offer for 70.5% of Red Planet Japan. EVO had already provided bridge loans during the COVID downturn, functioning as a sponsor-style backer. Red Planet Holdings exited, and EVO became the new parent.

From February 2023, the company rebranded as Metaplanet Inc., reshaping subsidiaries and adding entities like Wen Tokyo for hospitality and Metamarket for e-commerce before simplifying again around Bitcoin. EVO’s dominance later diluted as the firm issued waves of equity and stock acquisition rights, but the fund remains the cornerstone counterparty in financing programmes. Disclosures emphasise related-party oversight, with auditors flagging EVO’s dual role as both bondholder and warrant subscriber.

Since then, as Metaplanet entered its BTC journey and the popularity of the revised NISA grew in Japan, the company has seen an explosion in its shareholder base, an increase of over 1,075% from December 2023 to June 2025 (before BTC purchases until latest) with a rising recognition and popularity amongst millennials and Gen Z.

Figure 3: Metaplanet’s shareholder count has exploded recently

Source: Metaplanet’s Q2 2025 Earnings Presentation [link]

2.3 Pivot Into a Bitcoin Treasury Vehicle

As explored in §1.1, the formal pivot began in April 2024, when the board adopted a “Bitcoin first, Bitcoin only” treasury mandate, explicitly citing yen weakness and Japan’s long-term negative real rates. By December 2024, Bitcoin Treasury operations were recorded as a standalone business segment.

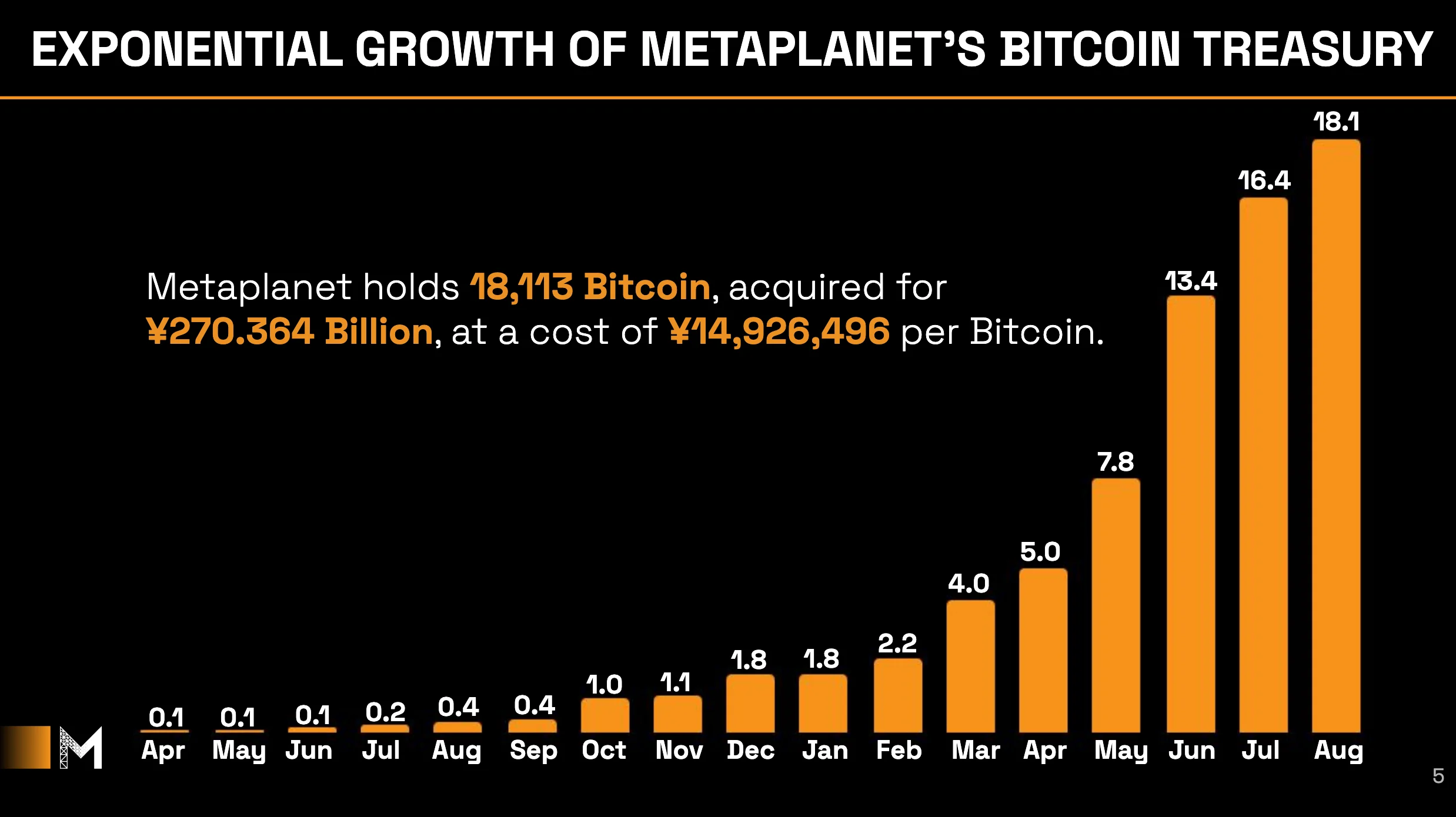

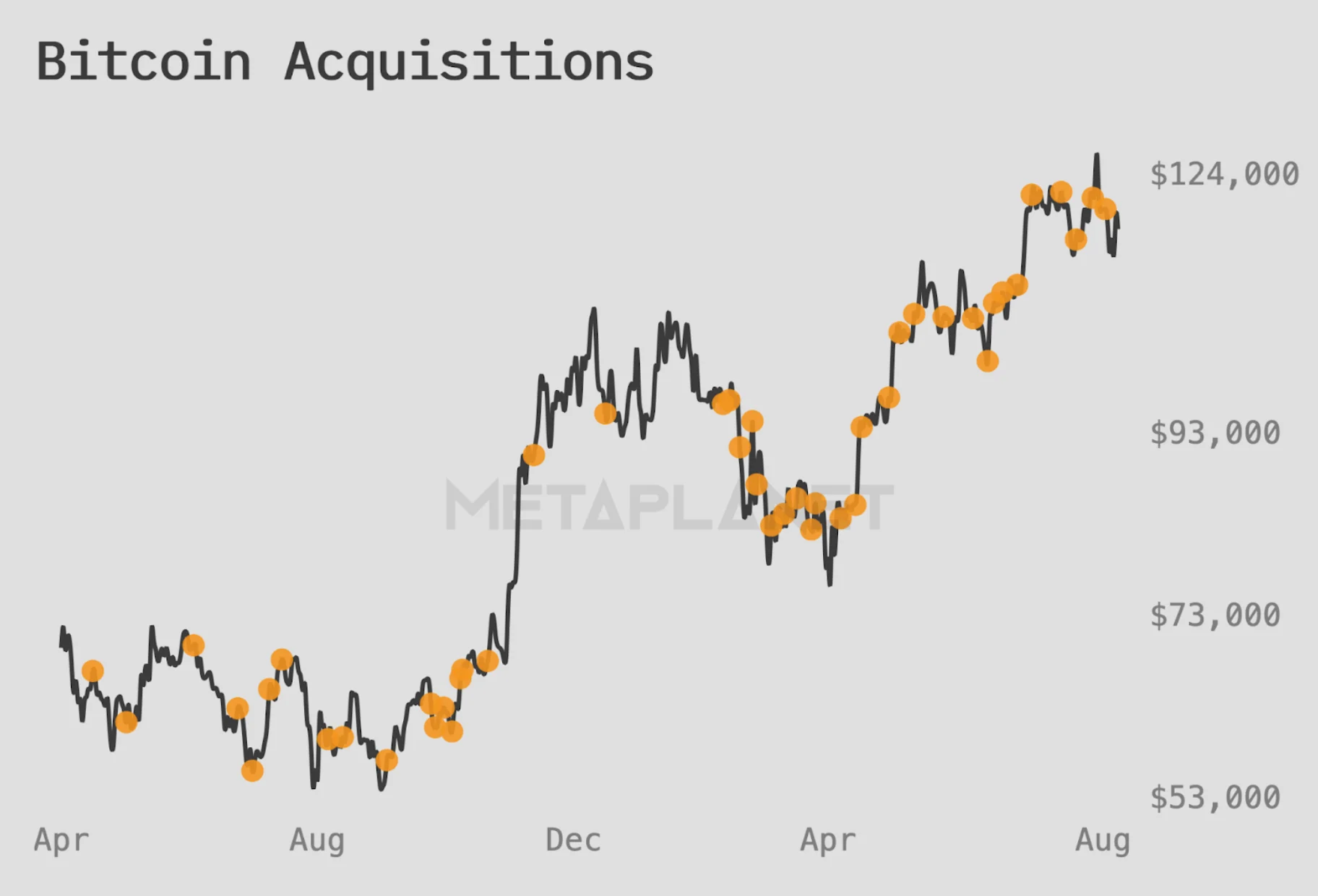

Financing mechanics define this evolution. Metaplanet pioneered the use of moving-strike equity warrants issued in series to EVO, coupled with zero-coupon unsecured bonds that provided bridge funding for immediate BTC purchases. Warrants were exercised into equity, cash was deployed into Bitcoin, and bond liabilities were redeemed in rapid cycles. This conveyor belt allowed the company to front-load purchases and report steady growth in holdings as seen in Figure 4.

Figure 4: Metaplanet’s BTC treasury growth rate has been exponential

Source: Metaplanet’s Q2 2025 Earnings Presentation [link]; As of 13th August 2025

The model is openly dilutive, but the firm tracks success via proprietary KPIs such as BTC Yield (percentage growth in Bitcoin per share, net of dilution), and has consistently achieved a positive quarterly yield. To stabilise operations, a “Bitcoin-Income” sleeve sells cash-secured put options, which complements Metaplanet’s capital efficiency goals as a non-dilutive strategy for equity holders, allowing the company to generate a yield on its BTC holdings and/or accumulate BTC at favourable prices.

Targets are explicitly aggressive: 30,000 BTC by end-2025, 100,000 by end-2026, and 210,000 (1% of total supply) by 2027. To support this scale, Metaplanet incorporated a U.S. subsidiary in Miami, Metaplanet Treasury Corp., designed to raise up to $5bn and enable round-the-clock execution across deeper capital markets.

The transformation has been extraordinary: in less than 18 months, the firm moved from a bankrupt hotel operator to one of the world’s largest listed Bitcoin treasuries. Its structure is now that of a financial holding company whose primary assets are Bitcoin and whose ancillary activities of a single hotel, media licences, and merchandising, serve as brand multipliers rather than profit engines. EVO Fund’s financing framework and Japan’s permissive disclosure-driven regulatory system were the catalysts.

3. Strategy & Treasury

3.1 Current Bitcoin Holdings and Philosophy

From its first purchase of 97.5819 BTC in April 2024, the company has now scaled to 18,888 BTC by 18th Aug 2025, with the BTC holdings value growing from ¥1bn ($6.5mm) to now over ¥313.979bn or ($2.2bn), or a 31,298% increase in JPY (33,746% increase in USD; uses 22nd Aug 2025 BTC prices for the current value). Filings show consistent BTC purchases throughout the volatility of the past year.

Figures 1 and 2 represent the company’s philosophy: Metaplanet explicitly frames BTC as superior reserve capital against yen depreciation, negative rates, and Japan’s high debt burden. All available financing is recycled into Bitcoin, with no allocation to altcoins or fiat instruments. Success is measured not by earnings per share but by proprietary metrics such as BTC Yield and BTC Gain, which track per-share Bitcoin accretion after dilution. Gerovich consistently discusses in interviews that the traditional finance approaches of thinking about company valuations do not apply to BTC treasury companies - by providing consistently positive BTC yields, he has been able to signal to investors that dilution can be accretive rather than destructive.

3.2. Execution (Acquisition, Custody, Funding)

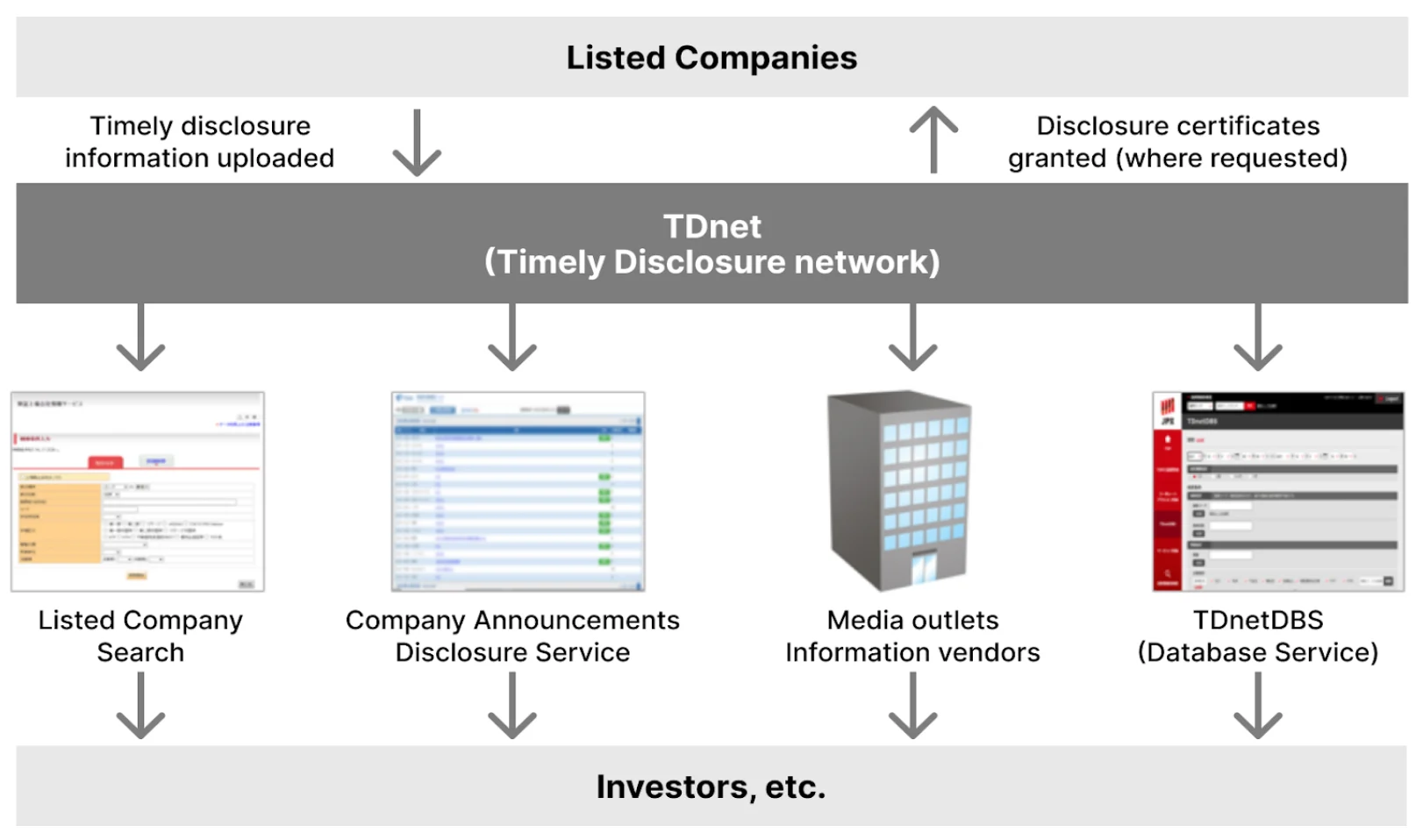

Acquisition cadence: The company executes BTC purchases through licensed Japanese exchanges and custodians, disclosing each tranche via TDnet. The rhythm is deliberately frequent. Rather than timing markets, Metaplanet accumulates continuously, often multiple times per month, creating a DCA-like treasury curve at institutional scale

Custody: Holdings are secured under Japan’s stringent custody rules, which require ~95% cold storage, segregation of client assets, and like-kind hot wallet coverage. By aligning with JVCEA standards, Metaplanet can demonstrate to regulators, auditors, and investors that reserves are held to bank-grade specifications. Custody is central to legitimacy; unlike some peers, Metaplanet has never pledged BTC as collateral, insulating it from forced-liquidation risk.

Funding mechanics: The financing loop blends moving-strike equity warrants and short-dated zero-coupon bonds, both anchored by EVO Fund. Bonds provide immediate capital for Bitcoin purchases, which is then backfilled by warrant exercises. This conveyor structure allows the company to front-load acquisitions and settle liabilities with subsequent equity inflows. Equity issuance is intentionally dilutive, but investors tolerate it as long as BTC per share continues to increase. Auditor reports emphasise related-party vigilance around EVO’s role, yet the structure has proven effective for rapid accumulation.

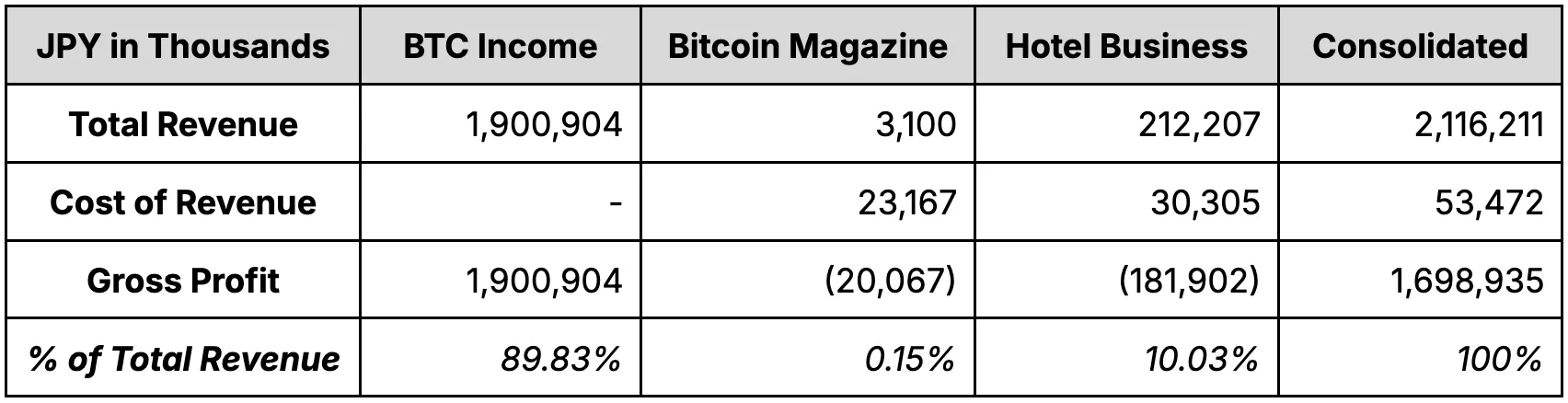

Income programme: To reduce reliance on constant issuance, Metaplanet sells cash-secured put options on BTC. In H1 FY2025, this generated ¥1.9bn profit ($12.8mm at 148 USDJPY), providing operating income without touching cold storage. Management positions this as ballast for opex and a complementary yield engine.

3.3 Comparison with Strategy and Global Peers

Metaplanet’s model is often likened to Strategy, but the two diverge sharply in structure and execution.

Operating base: Strategy retains software revenues of ~$500mm annually which is critical in avoiding investment-company classification in the US. On the other hand, Metaplanet has no meaningful operating business; its revenues are negligible outside the Bitcoin income sleeve (Figure 5). In Japan, this is permissible, while in the US it would risk reclassification under the Investment Company Act.

Figure 5: Select view of Metaplanet’s 1H 2025 financial results

Source: Metaplanet, Presto Research

Financing style: Strategy raised multi-billion-dollar convertibles in discrete tranches during 2020–21 and later used an at-the-market equity programme. Metaplanet instead runs a rolling issuance system, executing dozens of small warrant and bond tranches through EVO Fund. The Japanese framework allowed this ATM-like process without prior shareholder votes. The result is more dilution but no long-term debt service burden.

Leverage: Strategy’s leverage today is primarily long-dated unsecured convertible notes that carry coupon and maturity obligations. Metaplanet uses temporary leverage that is rapidly converted to equity, avoiding interest expense or margin calls. Risk is shifted to equity holders immediately rather than deferred to bondholders.

Disclosure Standard: Strategy faces SEC scrutiny on disclosures and non-GAAP metrics, while Metaplanet freely publishes KPIs such as BTC Yield and BTC per share in official filings. Japan’s disclosure-led system tolerates this innovation, whereas US regulators have historically objected to non-standard crypto metrics.

Market context: Metaplanet trades at far higher premiums to NAV than Strategy. In mid-2025, the stock implied a BTC price above $500k, more than five times spot. This valuation gap is likely due to a few factors such as (1) its scarcity on the TSE, where no spot ETF exists, versus the US where ETFs, miners, and exchanges dilute the premium effect; (2) Japanese retail enthusiasm, reinforced by NISA tax advantages; and (3) its unique position in Asia as no other listed vehicle offers such concentrated BTC exposure under a national regulator that explicitly permits it.

Strategy pioneered the idea of using public equity to accumulate BTC. Metaplanet industrialised it under Japanese conditions, using iterative financing, regulatory flexibility, and a retail-heavy investor base to push the strategy further than would have been tolerated in US markets.

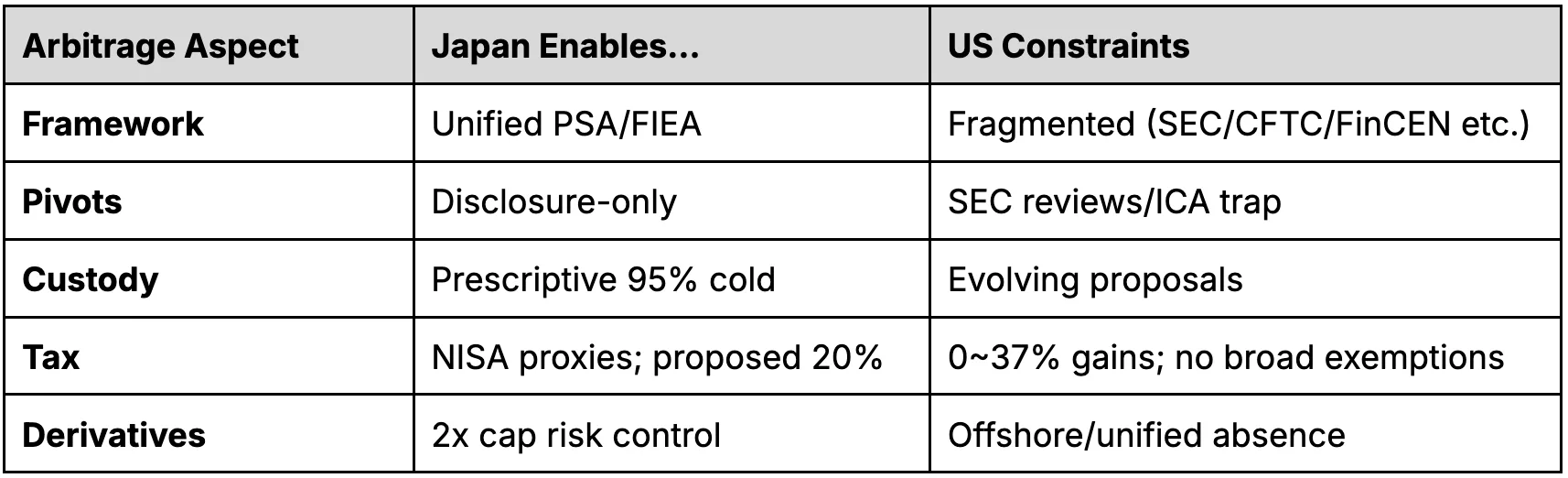

4. Regulatory Arbitrage: What Japan Enables That the US Can’t

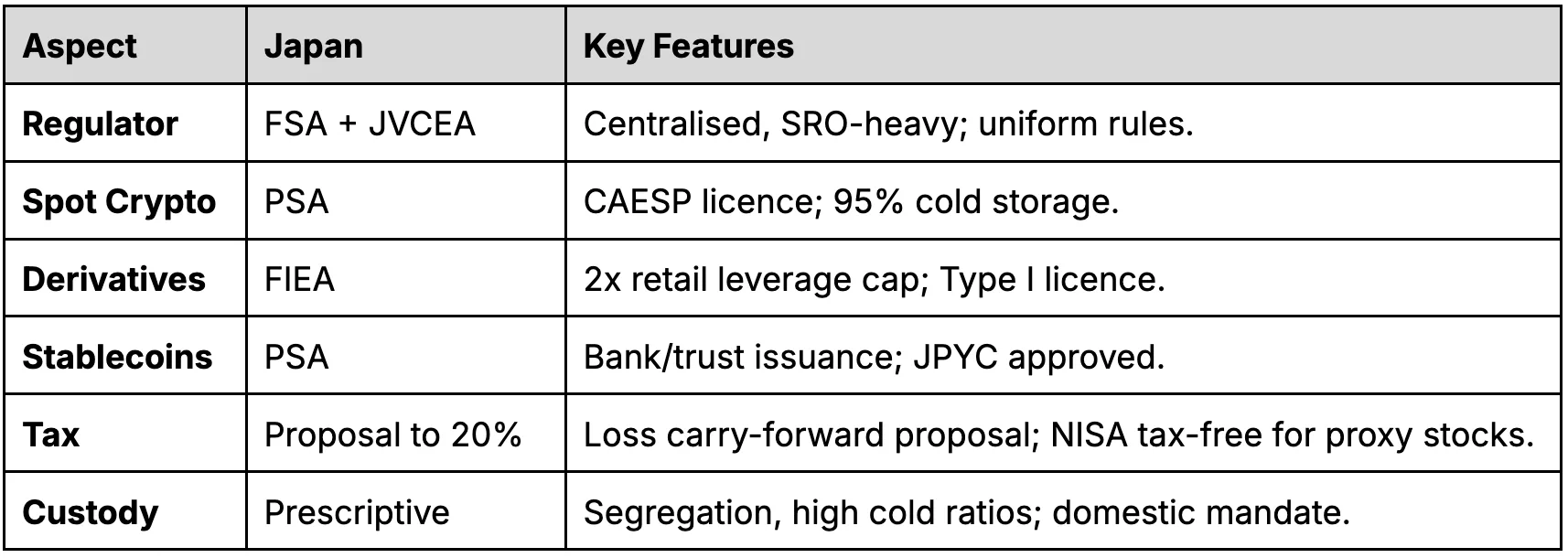

Japan offers one of the clearest and most permissive regimes for listed companies engaging with crypto. The Financial Services Agency (FSA) sits at the centre, supervising both the Payment Services Act (PSA) for spot crypto and stablecoins, and the Financial Instruments and Exchange Act (FIEA) for anything security-like. Beneath it, the Japan Virtual and Crypto Assets Exchange Association (JVCEA) acts as a recognised self-regulatory organisation (SRO) that writes detailed playbooks on custody, listings, leverage caps, advertising, and conduct. This single-architecture design removes the ambiguity seen in the United States, where the SEC, CFTC, FinCEN, and state regulators often deliver overlapping or conflicting guidance.

Critically, Japan runs a disclosure-driven rather than permission-based system for listed issuers. A corporate pivot to a Bitcoin treasury strategy runs through board approval and disclosure on TDnet, not pre-clearance of the business model. Metaplanet has exemplified this since April 2024, with a steady cadence of purchase notices, financing notices, and KPI updates like BTC Yield and BTC per share. The Tokyo Stock Exchange permitted the company to amend its Articles to explicitly reference Bitcoin treasury operations, signalling procedural tolerance for a pure crypto balance sheet.

Capital-raising mechanics are also unusually pragmatic. Boards can execute third-party allotments and serial stock acquisition rights quickly with disclosures. Metaplanet used this flexibility to construct an ATM-like fundraising conveyor, pairing serial warrant tranches with short-tenor, zero-coupon bonds. The bonds front-loaded BTC purchases, later converted into equity as warrants were exercised. Such continuous micro-tranche funding would be far harder under US rules, where shareholder-approval thresholds on >20% discounted issuance and heavier pre-clearance norms slow the process.

Finally, investor protection standards are tight where they matter. Japan mandates client-asset segregation, high cold-wallet ratios near 95%, prescriptive hot-wallet coverage, and full Travel Rule implementation. These bank-grade standards give institutional-level optics for auditors and investors, while leaving space for corporate treasuries to use licensed exchanges as execution rails. Accounting is also clearer: the Accounting Standards Board of Japan’s PITF No. 38 (2018) set out J-GAAP treatment years ahead of the US move to fair value through profit and loss in 2025, reducing accounting landmines for crypto-heavy balance sheets.

The result is a jurisdiction that allows a listed issuer to function as a high-velocity Bitcoin vault, financed in public markets at speed, while operating within strict custody and AML rules. Metaplanet is the first to industrialise this arbitrage under Japanese conditions.

Figure 6: Japan’s current framework around crypto-assets

Source: Presto Research

4.1 Japan’s FSA Rules and Accounting Treatment

Japan runs a single national architecture that splits the perimeter cleanly between the PSA for spot crypto and stablecoins and the FIEA for anything security-like, including crypto derivatives. The FSA sits at the apex, with the JVCEA as an FSA-recognised self-regulatory organisation that writes prescriptive rulebooks on listings, custody, cold-wallet ratios, advertising, and conduct.

For corporates, the process is unusually straightforward: board approval → TDnet filings → execution and custody routed through licensed CAESPs → period-end fair-value accounting. The fact that the TSE allowed Metaplanet to rewrite its Articles of Incorporation to include Bitcoin treasury operations underscores this procedural clarity.

Figure 7: How TDnet works

Source: Japan Exchange Group website

Accounting has long been clearer in Japan compared with the US and other jurisdictions. J-GAAP rules enabled fair-value presentation and allowed treasury income sleeves such as cash-secured put writing without reclassifying issuers as funds. This clarity removed the uncertainty that plagued US corporates before the 2025 FASB shift.

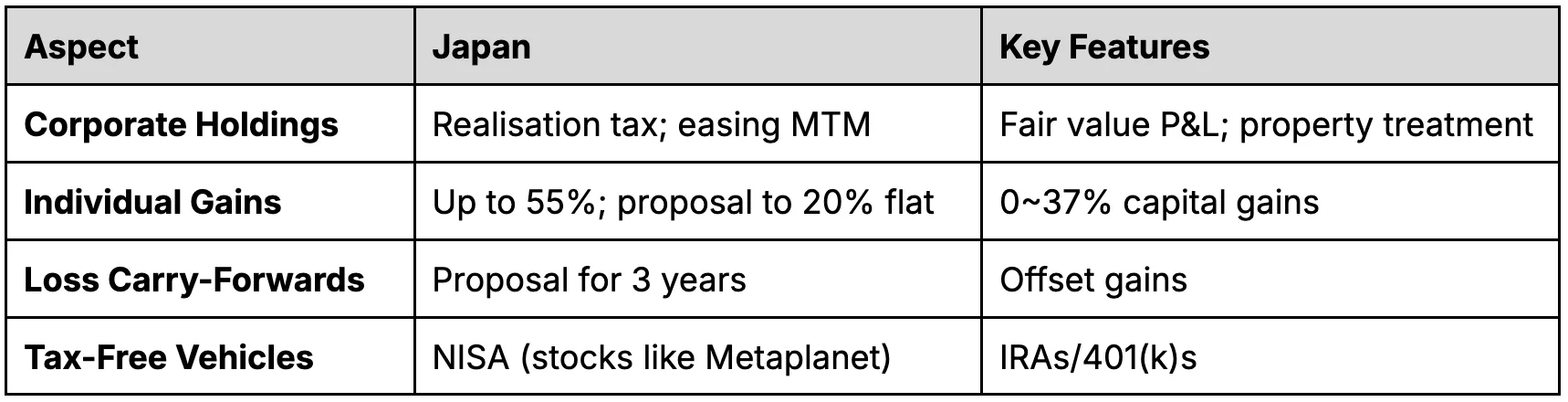

4.2 Tax and Disclosure Advantages vs the US

Japan’s arbitrage for investors is tax and distribution. New NISA provides a zero-tax wrapper for listed equities. A TSE-listed BTC proxy such as Metaplanet can therefore be held tax-free inside NISA, while direct crypto gains are still taxed as miscellaneous income up to 55%. Crucially, the NISA expansion in 2024 transformed it into a mainstream retail driver, accelerating flows into listed equities like Metaplanet over direct spot holdings.

Figure 8: Japan and the US, tax comparison

Source: Presto Research

Disclosures are lighter-touch and faster in Japan. The TDnet system is disclosure-driven, requiring only timely board resolutions and notices rather than prior approvals. This has enabled Metaplanet to publish BTC-specific KPIs such as BTC Yield and BTC per share in official filings—innovations that would draw SEC scrutiny in the US.

Japan has also codified stablecoin rules under the PSA, requiring bank or trust issuance and licensed intermediaries, which ensures predictable JPY rails for treasury operations compared with the fragmented US approach.

4.3 Why the Same Playbook Can’t Be Run in the US

There are factors that act as obstacles for US companies to follow the Metaplanet playbook in the US.

Investment Company Act risk: US issuers risk classification as investment companies if their assets are predominantly “investment securities.” Japan has no equivalent trap for issuers holding only BTC.

Pre‑clearance by process rather than by statute: apan’s board-resolution model allows near-instant pivots, whereas in the US pre-clearance and SEC comment cycles slow adoption.

Capital‑raising structure and velocity: Japan’s framework allows serial third-party allotments and warrant issuances executed rapidly, creating an ATM-like conveyor. US exchange rules cap dilutive issuances and force shareholder votes, blocking continuous micro-tranche funding.

Custody and derivatives: Japan mandates prescriptive 95% cold-storage and a 2x retail leverage cap under FIEA. The US has no uniform custody rules and a fragmented regulatory patchwork.

ETF competition and scarcity: In the US, large spot BTC ETFs compete away equity premiums. Japan has no live spot ETF, allowing scarcity premiums to persist in Metaplanet’s stock.

Figure 9: Summary of US constraints to the Japan playbook

Source: Presto Research

4.4 Policy and Regulatory Risks

The Japanese landscape creates real arbitrage but not a free pass. Treasury companies like Metaplanet inherit risks from the strict system they operate under.

Custody discipline and CAESP dependency: While prescriptive custody creates institutional-grade optics, treasury companies remain dependent on licensed CAESPs, meaning any supervisory tightening directly affects them.

Derivatives leverage cap: The 2x cap restricts the contribution of income strategies such as option selling, forcing greater reliance on equity issuance in flat or bearish markets.

Equity‑financing scrutiny: JFrequent serial warrants and bonds invite auditor and investor scrutiny, especially when cornerstone investors act as both underwriters and subscribers.

Tax reform timing: Delays in Japan’s proposed 20% flat regime leave NISA as the core retail tailwind. If reforms succeed, direct crypto adoption could broaden and compress equity premiums.

Cross‑border execution risk: Expansion into US execution subsidiaries exposes Metaplanet to the fragmented US regime, narrowing the arbitrage even if its home listing remains in Tokyo.

Japan’s single‑map regime, prescriptive custody, disclosure‑led pivots, and tax‑distribution asymmetries create a structural edge that enables a listed company to operate as a high‑velocity Bitcoin vault financed in public markets. The US now matches fair‑value accounting but retains an Investment Company Act overhang, SEC comment friction, ETF competition, and fragmented supervisory rails. Metaplanet exists at scale because the Japanese combination of clarity, flexibility, and enforcement is rare.

5. Financials & Valuation

5.1 P&L, Balance Sheet, and Cash Flow

The pivot has transformed Metaplanet’s financial profile. In H1 FY2025 (Jan~Jun), the company reported ¥2,116mm revenue, up more than 11x year-on-year, with operating income of ¥1,409mm versus a loss the prior year. Almost 90% of revenue came from Bitcoin Income Generation, mainly cash-secured put premiums, with hotels contributing less than 10%. Net income reached ¥6,059mm, driven by unrealised Bitcoin valuation gains booked under Japanese GAAP, offset by deferred tax liabilities of ¥4,489mm.

The balance sheet is dominated by Bitcoin. As of 30th June 2025, total assets stood at ¥238.2bn, of which ¥208.0bn (87%) was Bitcoin at fair value. Net assets were ¥201.0bn, supported by heavy capital raises (capital stock +¥88.7bn; surplus +¥89.0bn). Liabilities were ¥37.2bn, largely short-term zero-coupon bonds to EVO Fund. Importantly, these are unsecured corporate bonds rather than collateralised loans, meaning no liquidation triggers if BTC prices fall.

Cash flow underscores the financing loop. H1 2025 operating cash flow was positive at ¥1,411mm, but dwarfed by investing outflows of ¥196.1bn from Bitcoin purchases. Financing inflows of ¥196.1bn (bond issuance ¥96.4bn, warrant and share proceeds ¥176.8bn) backfilled these purchases.

Figure 10: Metaplanet’s BTC purchases visualised

Source: Metaplanet; Last data as of 22nd Aug 2025

5.2 Bitcoin Cost Basis and Sensitivity to BTC Price

Metaplanet discloses its Bitcoin acquisitions weekly. By 18th August 2025, holdings reached 18,888 BTC, with an average purchase price of ¥15,041,118 ($101,629) per BTC. Given the aspirational targets explored in §2, the cadence has been relentless particularly in 2025.

Given the concentration of BTC on its balance sheet, combined with the aggressive acquisition strategy, one would expect Metaplanet’s price sensitivity to be high. At spot BTC ~$115k and USDJPY ~147.5, NAV/share is ~¥447 gross and ~¥423 net of debt, compared with a share price around ¥835. A 50% drawdown to $57.5k cuts NAV/share to ~¥224 gross, ~¥200 net, implying 50% equity erosion. A 90% collapse to $11.5k would leave equity negative, at ~¥21/share net of debt. No collateralised debt means no margin call, but refinancing the ¥17.25bn bond maturing Dec 2025 (19th ordinary bond) could become problematic in a downturn.

Assumptions: holdings 18,888 BTC, USDJPY 147.5, basic shares 717.11m, debt ¥17.25bn, spot BTC ~$115.1k.

Calculation: ΔNAV = Holdings × ΔPrice × ¥/USD rate. Risks amplified by deferred taxes on

Figure 11: Metaplanet stock price since 01Jan24

Source: TradingView, Presto Research; Last data as of 22nd Aug 2025

5.3 Valuation Approaches: NAV vs Market Premium

Valuing Metaplanet requires treating it simultaneously as a closed-end Bitcoin fund, a high-beta equity proxy, and a financial engineering platform. Each lens gives different signals.

NAV Baseline

On a simple net asset value basis, Metaplanet’s ~18,888 BTC holdings (Aug 2025) equate to ~¥321bn gross NAV, or ~¥303bn net of debt. Per share, this is ~¥447 gross, ~¥423 net. The stock trades near ¥835, which implies an 87–97% premium. This premium is well above most closed-end fund norms, where NAV multiples cluster between 0.8x and 1.2x.

Viewed strictly through this baseline, the equity looks expensive. However, Japan’s lack of spot ETFs, plus favourable tax treatment for equities versus crypto, provides justification for a structurally higher premium. Investors effectively pay for access and for the regulatory arbitrage.

Relative Multiples and Peer Comparisons

Compared with Strategy (MSTR), the closest analogue, the multiple divergence is stark. MSTR trades around 1.4x NAV, while Metaplanet has ranged from 2x to 5x NAV in 2025. At peak mania, the stock implied a Bitcoin price of ~$596k. Relative to miners like Marathon and Riot, Metaplanet offers cleaner exposure with less operational risk, but without mining upside. Against Galaxy Digital or Coinbase, its valuation is simpler but more concentrated.

When viewed as “Japan’s Strategy,” the market is pricing a scarcity premium: the only listed pure BTC treasury in Asia, accessible through NISA, and compliant with FSA rules. This scarcity multiple is hard to replicate domestically.

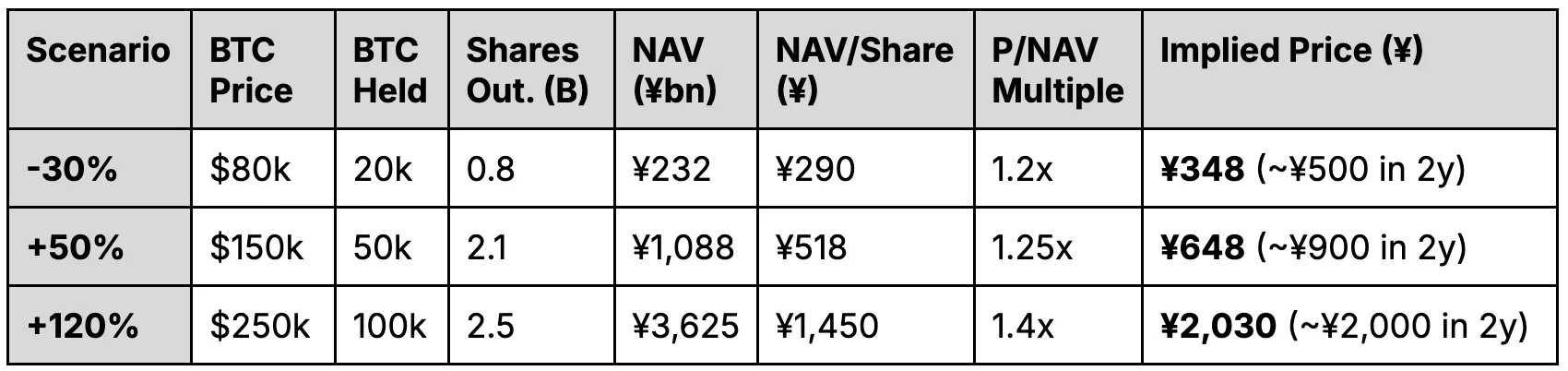

Scenario and Sensitivity Models

A simple scenario model can be created as follows (Figure 12)

Base case: BTC reaches $150k by 2027, with Metaplanet reaching ~50k BTC holdings and NAV/share of ~¥518. At a 1.25x NAV multiple, this implies ¥648 per share, again showing the premium the stock is currently trading at.

Bull case: BTC $250k, 100k BTC held, delivers NAV/share ~¥1,450, which at a 1.4× premium yields ¥2,030.

Bear case: BTC $80k, 20k BTC held, implies ¥290 NAV/share and a much lower ¥348 implied price.

Figure 12: Simple 2y scenario model

Source: Presto Research

Assumptions: USDJPY 145, shares outstanding projection includes the effect of converting preferred shares into common equity, NAV excludes any debt, assumes any debt financed assets are included in BTC held.

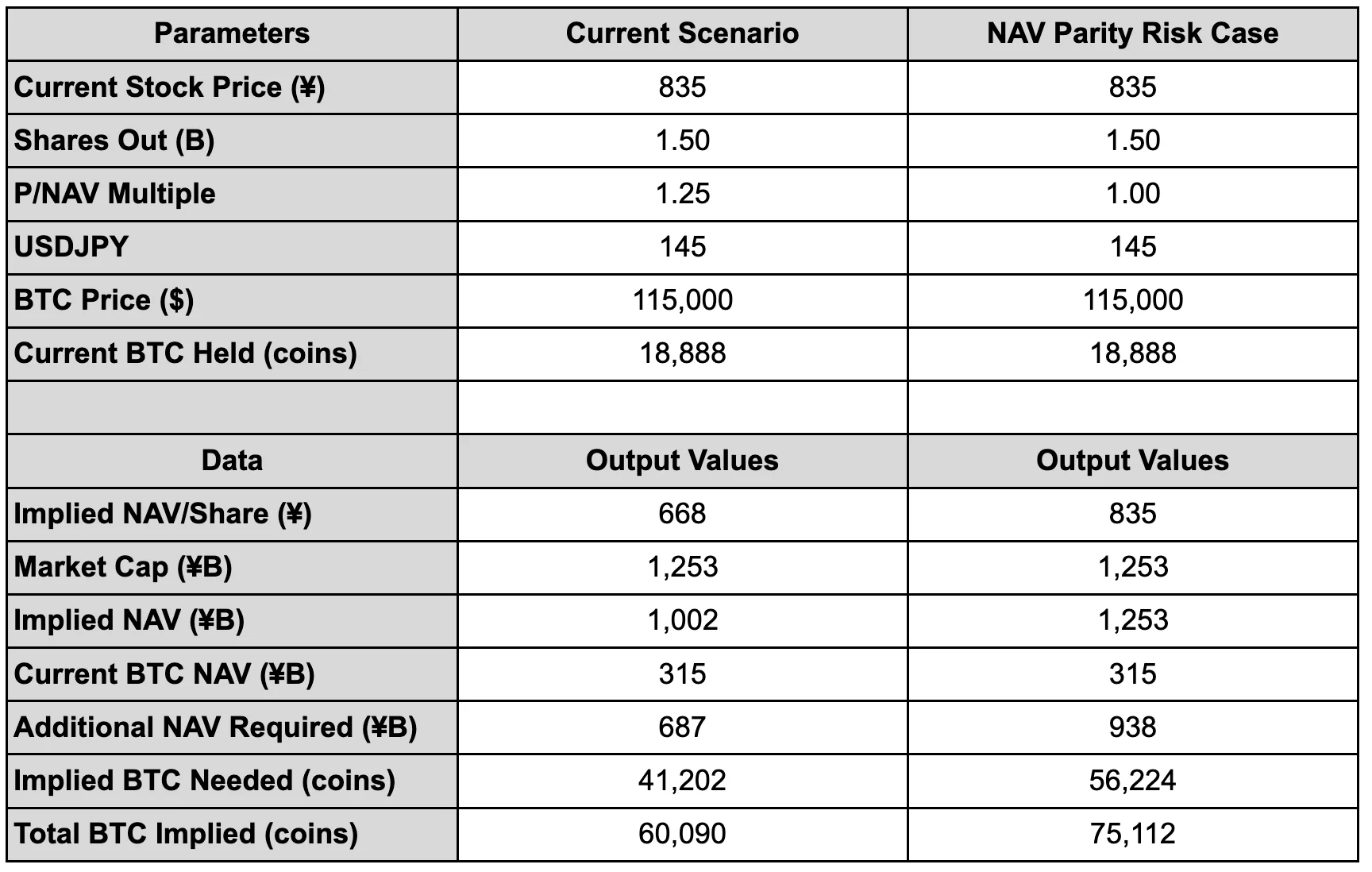

Scenario and Sensitivity Models

Figure 13 attempts a different approach by gauging what the share price already discounts and to size the premium risk. At ¥835 with a 1.25x P/NAV, USDJPY 145 and BTC $115k (current figures, roughly), the sheet implies NAV/share ¥668 and total NAV ~¥1.00tn. With ~¥315bn of BTC already on the balance sheet, the price is underwriting ~¥687bn of extra NAV, or ~41,200 coins, for ~60,100 BTC in total. In other words, today’s premium assumes a step-up of roughly 3.2x from 18,888 BTC.

Another interesting use for this sort of analysis is to set the multiple to 1.00x, to test parity. To justify ¥835, NAV/share must be ¥835, which requires ~¥1.253tn of NAV. That implies ~¥938bn of incremental NAV, or ~56,200 coins, taking the total to ~75,100 BTC. The same price becomes a much higher holdings hurdle once the premium compresses.

This tells us that the market price already bakes in meaningful further accumulation to about 60k BTC. If the premium fades to parity, the bar rises to ~75k BTC. The valuation therefore rests on two levers staying intact: continued conversion of capital into coins, and preservation of a non-trivial premium to NAV. The gap to management’s 210k BTC ambition remains wide under either read.

Figure 13: Simple 2y scenario model

Source: Presto Research

Alternative Lenses

Closed-end fund lens: Premiums of 2x NAV look unsustainable long-term; most funds revert to NAV parity.

Tax-arbitrage lens: At least until 2027, Japan’s tax regime sustains demand. From this perspective, the premium is structural and shares could be fairly valued.

Growth-option lens: If the 555 Million Plan executes and holdings compound, forward NAV could rise fast enough that today’s premium looks justified.

Equity-market lens: With >120k shareholders and liquidity rivalling blue chips, Metaplanet trades as a narrative asset. In this lens, valuation is more behavioural than fundamental.

Different lenses suggest different valuations. Once the numerous assumptions are added - and considering, as Gurevich argues, that traditional finance may not be equipped to value a Bitcoin treasury company - these models merely provide a framework through which investors can attempt to triangulate what the share price already discounts, what execution path in coins and capital it assumes, and how much premium compression the thesis can withstand. Ultimately, valuation is less about balance-sheet maths than about the durability of Japan’s arbitrage. If that edge holds, the premium persists; if it fades, mean reversion may be brutal.

6. Market Positioning & Influence

6.1 P&L, Balance Sheet, and Cash Flow

Metaplanet has become the clearest example of how Japan’s household savings shift is intersecting with crypto. The expansion of New NISA in 2024, which removed lifetime limits and lifted annual growth quotas to ¥3.6mm per account, created a zero-tax wrapper for equities. By mid-2025, over 25mm Japanese adults held NISA accounts, including 7.4mm under 40, with flows into equities tripling year-on-year.

Metaplanet stock is NISA-eligible, meaning retail investors can access Bitcoin exposure inside a tax shelter, avoiding the 20% capital gains tax on equities and the punitive 55% tax on crypto classified as miscellaneous income. The company quickly rose to the top of SBI Securities’ and Rakuten’s weekly NISA purchase rankings, even surpassing blue-chip names. Retail platforms and ITmedia described the surge as a “狂乱” (frenzy), with Metaplanet branded as a “脱法的ビットコインETF” (a de facto legal Bitcoin ETF).

For younger investors, this is uniquely attractive. Gen Z and millennials in Japan face suppressed wages, rising inflation, and low-return savings instruments. The slogan “Bitcoin + zero tax + leverage = Japan’s ultimate Bitcoin proxy” circulated widely, boosting the name “メタプラ” (short-form name for Metaplanet used online) amongst young investors. Community dynamics reinforce the draw: grassroots groups like “Metaplanet Madness” on Twitter and “Metaplanet Dojo” on Discord, youth-friendly executives like Dylan LeClair, and meme-infused numerology (“8888 BTC”, “555 Plan”). Reportedly, there are a considerable number of NISA accounts with only one stock in their portfolios: Metaplanet stock. This ecosystem positions Metaplanet not only as an investment but also as a cultural community.

Retail participation has exploded accordingly. As explored in §2.2, shareholders grew 1,075% since in the year-and-a-half Metaplanet pivoted, with more than 60,000 retail NISA users forming the backbone of the base. Trading volumes often exceeded ¥200bn in a day, briefly topping Toyota and Nintendo. The retail-led surge has created a dual identity: Metaplanet as a savings vehicle for youth and as a speculative engine amplifying volatility.

6.2 Institutional vs Retail Dynamics

Retail dominates ownership but institutions are increasingly present. By mid-2025, retail accounted for ~87% of the register, while institutions represented ~13%. Large foreign holders such as Fidelity’s National Financial Services (12.9% stake) and Capital Group (11m shares) have entered. The inclusion of Metaplanet in the MSCI Japan Index, as well as its inclusion into the FTSE Japan Index for the September 2025 review, have further validated its standing.

Institutions engage in two distinct ways. As holders, they provide ballast and mandate-driven exposure. As traders, they amplify volatility: Bloomberg reported short interest exceeding 20% of free float, signalling heavy hedge fund activity. This duality gives Metaplanet both credibility and fragility. Retail flows fuel rallies and short squeezes, while institutional shorting enforces discipline.

The result is a stock very much caught between two identities, driven by investor types on the opposite ends of the spectrum. For some retail investors, Metaplanet is a generational savings vehicle wrapped in national identity. For institutions, it is both an arbitrageable proxy and a high-beta trading instrument. The interaction of these two camps explains why the stock has simultaneously become Japan’s most-bought NISA name and its most shorted equity.

Metaplanet’s influence is anchored in its retail appeal via NISA, amplified by cultural branding, and complicated by institutional participation. It sits at the intersection of tax policy, youth disillusionment, and global crypto narratives. That mix has made it not just a treasury company, but a social and market phenomenon in Japan.

Final Word

Metaplanet is a proof of concept for Japan’s single-map approach to crypto. A centralised FSA–JVCEA framework, disclosure-first pivots through TDnet, prescriptive custody rules, and NISA-fuelled distribution have allowed a listed company to operate as a high-velocity Bitcoin vault and to finance accumulation in public markets. Scarcity on the TSE and a retail-heavy base have sustained a premium to NAV that would likely be arbitraged away in the US, where ETF competition, an Investment Company Act overhang, and fragmented supervision raise friction. In short, Japan enables what the US cannot, at least for now.

The opportunity is real but bounded. The model depends on clean licensed rails, continued access to serial equity and short-tenor bonds, and a non-trivial premium to NAV. It also depends on policy staying supportive, or at least predictable. If custody incidents, tax changes, parity-seeking ETFs, or US-style disclosure frictions creep in, the arbitrage narrows and the premium compresses. The investment lens is therefore two-part: coins and capital on one side, premium durability on the other.

Japan’s edge is structural rather than cyclical, but it must be maintained. If the regime holds its clarity and discipline, Metaplanet can remain the flagship expression of that edge and a benchmark for Asia. If the edge fades, mean reversion will be swift. Either way, the company has already signalled something larger than itself: that jurisdictional design matters, and that capital markets will reward the places that make new financial architectures executable.