Summary

1. The Context: The Stablecoin Significance

2. Enter TRON: The Dominant Stablecoin Rail

2.1. Capturing the CEX <> CEX Transfer Market

2.1. TRON’s Influence and Success in Emerging Markets

3. How TRON Wins: Execution & Economics

3.1. Competitive and Technical Advantages

3.2. Collaborations with Tether, CEXs, and PayFi Apps

3.3. Ethereum’s DeFi-Driven Use vs. TRON’s CEX-Driven Flows

3.4. Stablecoin Transaction Flows on TRON

4. Unpacking TRON’s Decentralisation

5. Strategic Positioning: Where TRON Goes Next

5.1. Expanding the Stablecoin Mix

5.2. Scaling Through BitTorrent Chain

5.3. Real-World Assets and PayFi Integration

5.4. Navigating Regulation and Market Entry

6. Final Words

Summary

TRON’s Dominance in Stablecoins: TRON has become the world’s primary settlement layer for stablecoins, hosting nearly half of all USDT and processing over $6~7 trillion in annual transactions, driven by low fees, scalability, and mobile-first accessibility.

Emerging Market Penetration: With deep roots in regions like Latin America, Africa, and Southeast Asia, TRON serves as the de facto “digital dollar rail,” supporting remittances, micro-payments, and financial inclusion through integrations with fintech apps.

Strategic Evolution: Beyond USDT, TRON is expanding through initiatives like USDD 2.0, BitTorrent Chain scaling, and real-world asset tokenisation, while navigating regulation to solidify its role as a decentralised yet efficient global settlement network.

1. The Context: The Stablecoin Significance

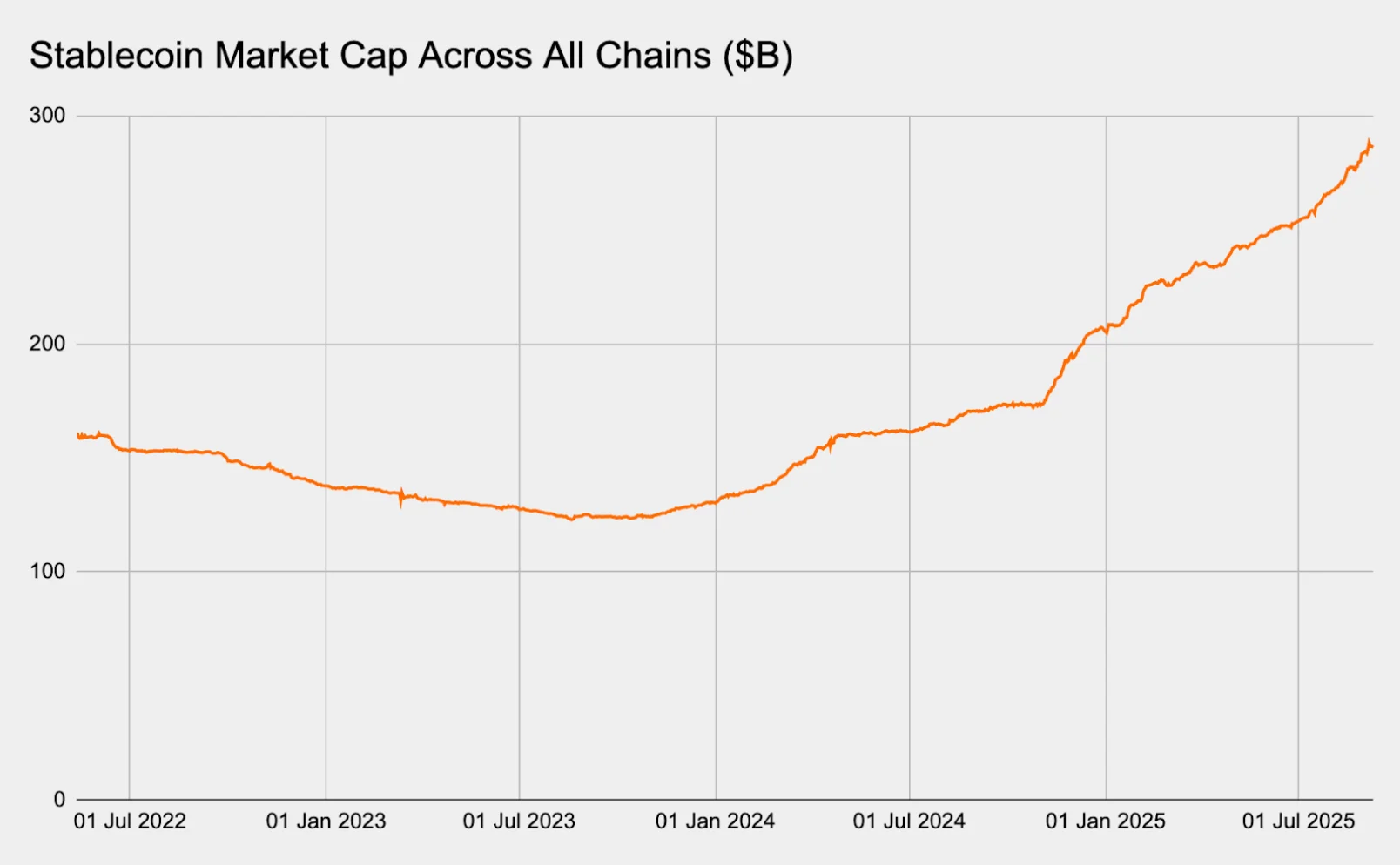

Stablecoins have emerged as the most important connective tissue between traditional finance and the crypto economy. By offering the familiarity of fiat value with the speed and programmability of blockchains, they underpin both speculative and real-world use cases. From DeFi lending protocols to cross-border remittances, stablecoins have become the unit of account and settlement rail for global crypto flows.

Figure 1: The total market cap of stablecoins has seen incredible growth since 2024

Source: DefiLlama

The origins of the stablecoin market were closely tied to Ethereum. Early entrants like USDC, USDT (initially issued on Omni, later migrating to Ethereum), and DAI found their first large-scale adoption in Ethereum’s DeFi ecosystem. Yet, Ethereum’s structural constraints such as high gas fees, slower confirmation times, and fragmentation across Layer 2 solutions, limited stablecoins’ ability to scale as a low-cost, everyday transfer medium. For many users, particularly outside developed markets, the economics of using Ethereum priced them out.

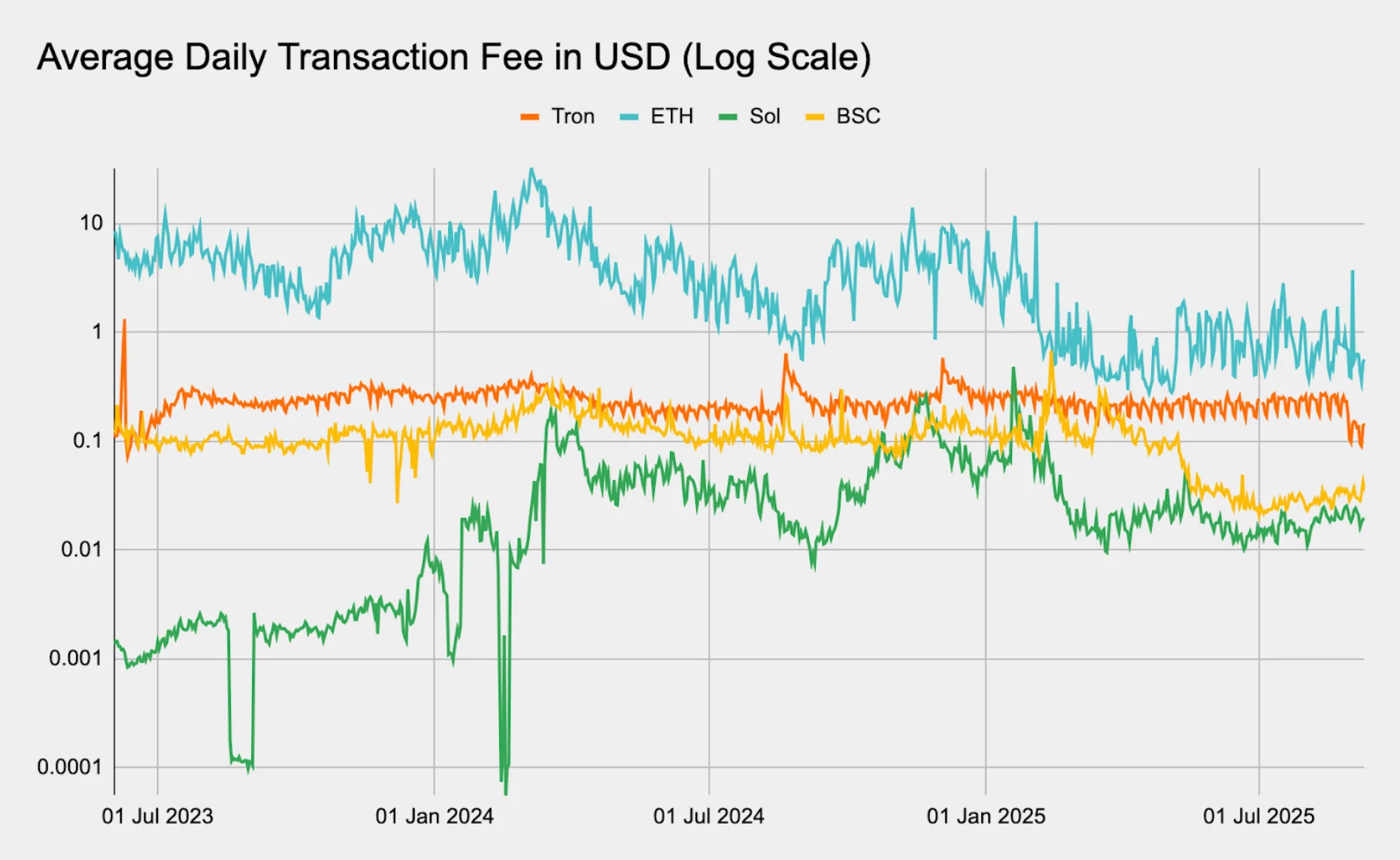

Figure 2: TRON’s average transaction fee has been remarkably stable over the years

Source: DefiLlama, Presto Research; Note: This is done by dividing daily fees by the daily transaction count to get an average fee per transaction as DefiLlama defines it i.e., this is a reasonable approximation of the average paid fee per on-chain transaction.

The gap created by Ethereum’s limitations shaped the next stage of stablecoin adoption. On one side, institutional users and advanced DeFi participants remained tethered to Ethereum, prioritising security, composability, and ecosystem depth. On the other side, retail users and emerging-market participants demanded cheap, reliable, and fast transfers. This divergence explains TRON’s rise as the primary settlement layer for USDT and highlights why stablecoins are the most direct real-world application of crypto

The impact is most visible at the user level. In developed markets, stablecoins serve as collateral in lending markets, liquidity in AMMs, and hedging instruments for traders. In emerging markets, they are a parallel payments system, enabling individuals to send remittances, hedge against local currency devaluation, and bypass capital restrictions. For this cohort, the defining factor is not composability but accessibility: the lowest possible cost to move value across borders or platforms.

2. Enter TRON: The Dominant Stablecoin Rail

2.1. Capturing the CEX <> CEX Transfer Market

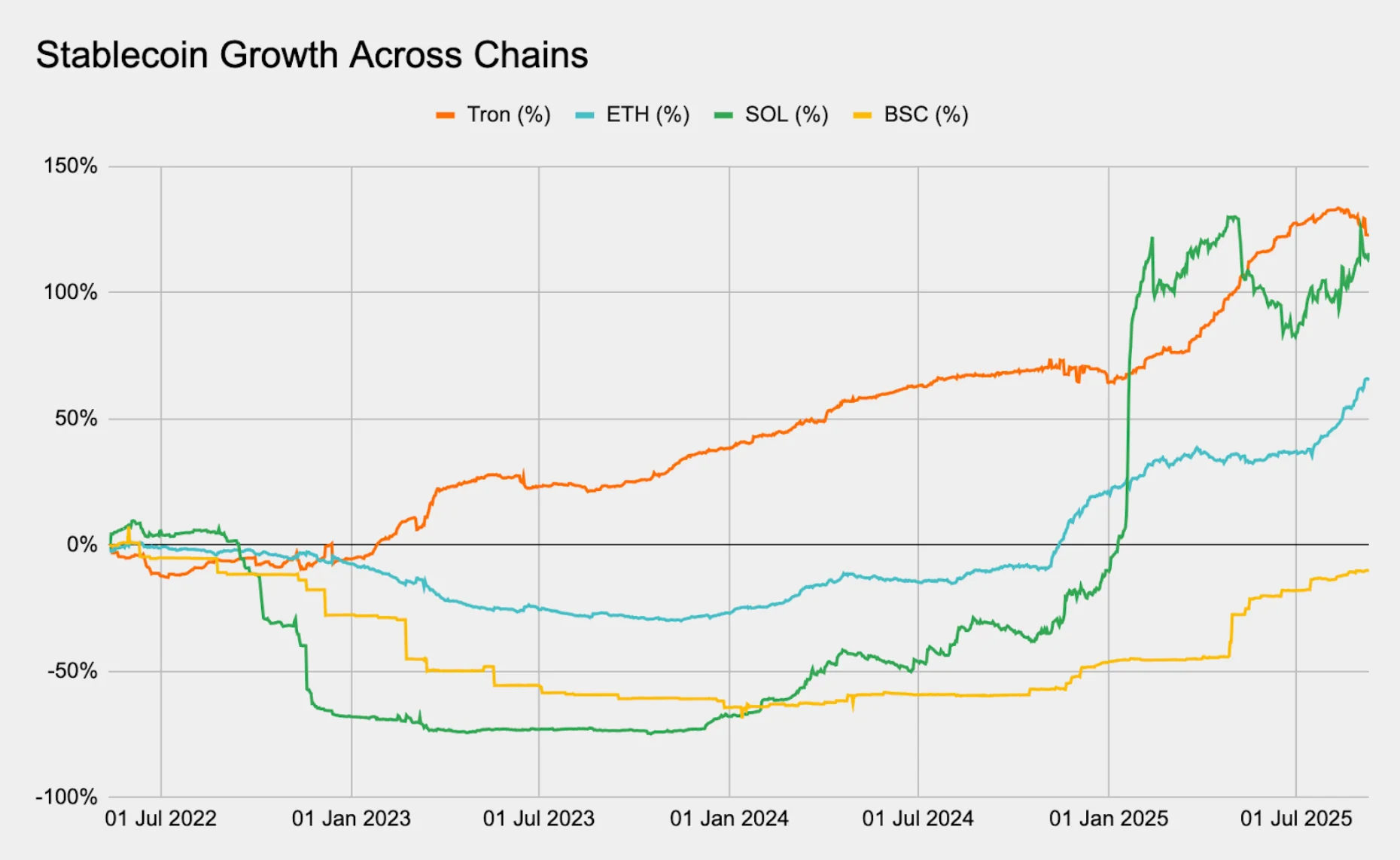

TRON launched in 2017 with limited traction compared to Ethereum. Its breakthrough came from becoming the preferred rail for Tether’s USDT issuance. By 2020, as Ethereum fees spiked during the DeFi Summer, TRON positioned itself as the low-cost alternative for stablecoin transfers. Over subsequent cycles, this positioning transformed TRON from a secondary chain into the backbone of stablecoin settlement.

TRON’s core use case emerged in centralised exchange flows. For retail and institutional users alike, stablecoins needed to move seamlessly between trading venues. Ethereum’s high costs made it inefficient for this role, whereas TRON offered the same USDT unit at near-zero transfer cost. By 2021, the majority of CEX stablecoin transfers, especially in USDT, were already conducted on TRON, creating a positive feedback loop: more CEX support led to more liquidity, which entrenched TRON further.

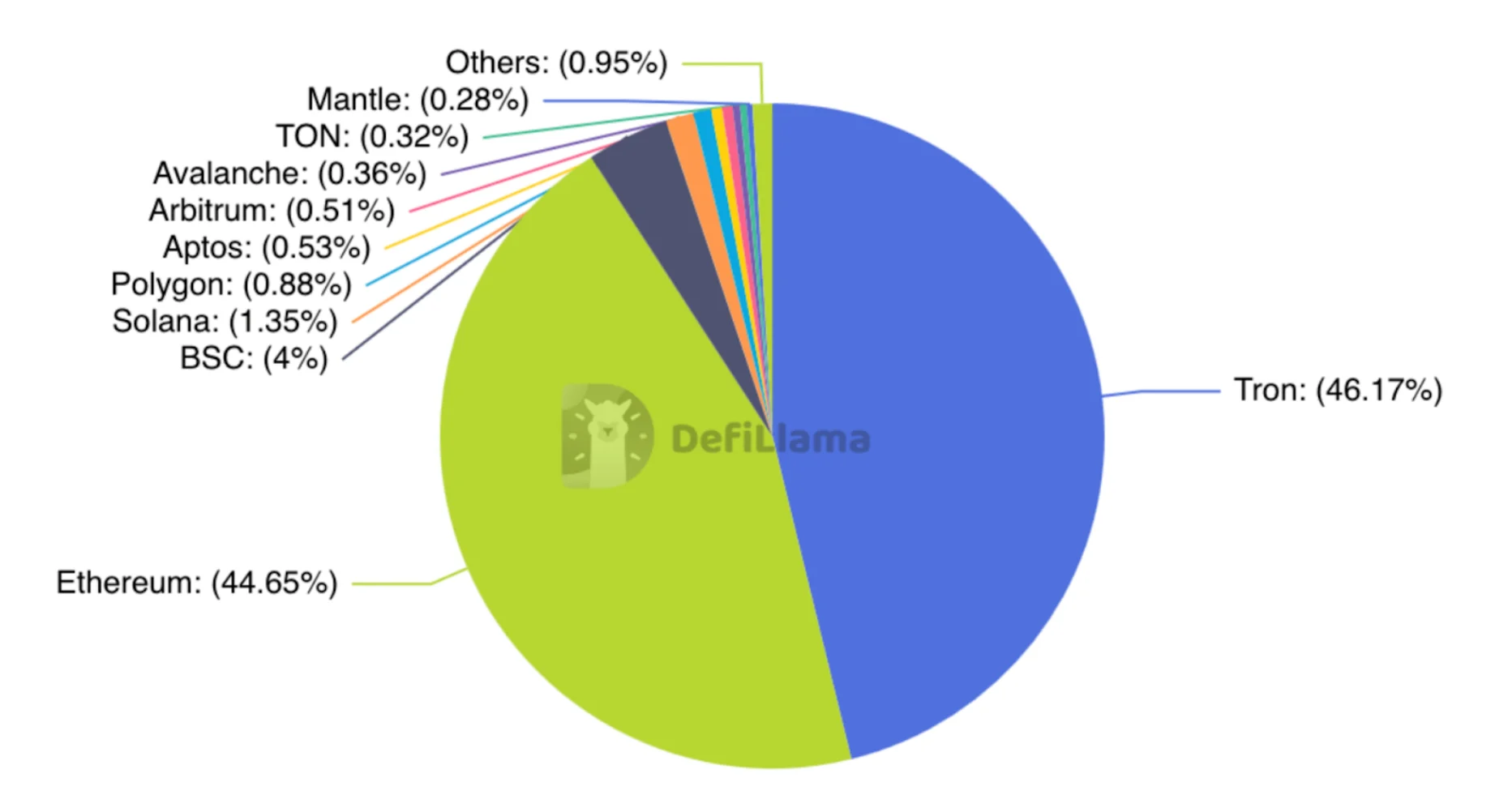

Figure 3: TRON’s dominance in the stablecoin game is undeniable

Source: DefiLlama, Presto Research

2.2. TRON’s Influence and Success in Emerging Markets

TRON has become the de facto stablecoin settlement layer in much of the emerging world. Its structural advantages of having low transaction fees combined with high throughput makes it uniquely suited for cost-sensitive users. In regions with unstable currencies, inflationary pressures, or limited banking access, TRON has effectively emerged as the “digital dollar rail” of choice.

As of September 2025, TRON hosts over 46% of global USDT supply, equivalent to $78 billion, and processes over $6~7 trillion in stablecoin transactions annually, outpacing other chains. More than 75% of all worldwide USDT transfers now run through TRON, with daily volumes exceeding $25 billion. The network supports 334 million total accounts, 11 billion cumulative transactions, and about 2.92 million daily active users, with 68% accessing via mobile wallets, a critical vector for emerging markets where smartphones are often the first gateway to financial services.

Figure 4: When looking at USDT alone, TRON’s dominance stands out further

Source: DefiLlama

TRON’s accessibility has also been reinforced by strategic fee policies. The August 2025 fee reduction of 60% spurred a surge in activity, helping TRON overtake Solana and BNB Chain in daily active addresses, reaching almost 2.5 million DAUs (Figure 5). Importantly, TRON’s grassroots retail base is visible in the 52 million addresses holding less than $1,000 in USDT, which collectively drive more than 5 million weekly small-value transactions.

Figure 5: TRON led active users by chain August

Source: DefiLlama, Presto Research’s State of Adoption: August 2025 report

Regional Penetration

The on-chain footprint maps closely to the regions highlighted by Chainalysis’ 2025 Global Crypto Adoption Index, where India (#1), Pakistan (#3), Vietnam (#4), Brazil (#5), Nigeria (#6), and Indonesia (#7) dominate. TRON is the leading stablecoin chain in 35 of 50 countries analysed.

Latin America (18% of global Tether usage): In Argentina, where inflation remains above 80%, nearly 30% of adults own crypto, with USDT on TRON used heavily for savings and remittances. Brazil, ranked #5 in adoption, conducts over 40% of USDT transfers via TRON. In Venezuela, peer-to-peer usage is entrenched, with TRON surpassing Ethereum as the main stablecoin settlement layer.

Africa: Nigeria ranks sixth globally, with TRON as the top rail for cross-border transfers. In Kenya, adoption is accelerating, with 69% of surveyed users preferring USDT on TRON for retail purchases. Across the continent, remittance corridors increasingly favour TRON rails for cost efficiency.

Asia/Southeast Asia (60% of new wallets): India, Pakistan, Vietnam, and Indonesia all rely heavily on TRON stablecoins for remittances, savings, and P2P trading. East Asia is catching up: in South Korea and Hong Kong, stablecoin settlement via TRON is gaining ground as local exchanges deepen support.

Use Cases Anchored in Stablecoin Utility

Payments & Remittances: TRON settles over 65 million USDT payments monthly, averaging 5.5 million transfers per day. Business payments grew 288% YoY, making TRON the default B2B settlement rail in parts of LATAM and APAC.

Retail & Microtransactions: With 69 million unique USDT addresses, TRON dominates small-scale payments, from e-commerce to payroll.

Financial Inclusion & DeFi Access: While TRON’s DeFi ecosystem is smaller than Ethereum’s, 62% of its 1.9 million smart contracts support lending and staking, offering a low-fee alternative in underbanked markets.

Fintech Integration: More than 50 mobile apps and fintech platforms in LATAM, Africa, and Asia now integrate TRON stablecoin rails, embedding crypto into everyday financial infrastructure.

Figure 6: TRON remains the chain of choice for payments applications in emerging markets

Source: Aeon on Twitter

TRON’s success in emerging markets is not an accident of convenience, but the result of scalable economics, regional accessibility, and mobile-first integration.

3. How TRON Wins: Execution & Economics

TRON has firmly established itself as the leading chain for stablecoins, particularly USDT. It now captures over half of global USDT supply, processes $6~7 trillion annually in stablecoin transactions, and consistently clears $24+ billion in daily USDT volume. More than 69 million wallets hold USDT on TRON, driving 9.19 million daily transactions across 334+ million accounts. Monthly stablecoin transfers exceed $600 billion, positioning TRON as the primary global settlement layer for dollar-denominated flows.

Figure 7: TRON’s stablecoin success is clear when comparing it to other L1s

Source: DefiLlama, Presto Research

3.1. Competitive and Technical Advantages

TRON’s success rests on a payments-first model optimised for accessibility. Its low fees and scalability have made it indispensable for microtransactions, P2P transfers, and cross-border remittances in cost-sensitive markets. Unlike Ethereum, whose growth has been driven by DeFi composability, TRON focuses on stablecoin liquidity and settlement utility. Nearly half of TRX supply is staked, reinforcing network security and token demand, while revenue has surged alongside usage. Beyond economics, TRON benefits from geopolitical neutrality, broad cross-chain bridge support, and integrations with mainstream fintech and wallet providers.

Performance is central to TRON’s appeal. The network offers 2000+ TPS capacity, 3-second block finality, and maintained 90% uptime even during peak congestion in Q1 2025. Its August 2025 fee restructuring reduced average transaction costs by 60%, bringing stablecoin transfers down to $0.72 from $4.28. TRON also supports gas-free USDT transfers through the gasfree service, further enhancing retail adoption. By comparison, Ethereum transactions often cost several dollars and experience variable latency, making TRON the more reliable choice for high-frequency, low-value transfers.

3.2. Collaborations with Tether, CEXs, and PayFi Apps

TRON’s trajectory is closely tied to its relationship with Tether. With $75+ billion USDT issued on TRON (almost 50% of supply), TRC-20 has overtaken ERC-20 as the dominant USDT standard. In 2025, Tether deepened its integration by enabling gas-free transfers on TRON and piloting new stablecoin products such as USD1. On the distribution side, TRON dominates CEX flows, where integrations with exchanges like Binance and HTX support $21+ billion in daily volumes. At the retail layer, PayFi apps and fintech players, including more than 30 integrations spanning payroll, remittances, and payments, make TRON rails accessible to millions.

3.3. Ethereum’s DeFi-Driven Use vs. TRON’s CEX-Driven Flows

Ethereum remains the hub for DeFi innovation, with $165 billion in stablecoins anchored by lending, DEXs, and complex financial primitives. But its flows skew toward traders and institutions, not everyday transfers. TRON, in contrast, powers the bulk of global P2P and CEX <> CEX USDT flows, dominating small-value (<$1,000) transactions and retail settlements. In H1 2025 alone, TRON processed 5.8+ billion sub-$1K transfers, often routed through CEX off-ramps or mobile wallets. While Ethereum remains the institutional settlement layer, TRON has become the retail and remittance layer.

3.4. Stablecoin Transaction Flows on TRON

Most flows on TRON are tied to remittances, inflation hedging, and business payments, which grew 288% YoY. Activity peaks during American trading hours, but the network clears transactions globally around the clock. Transfers often move from CEXs to self-custody wallets, before being dispersed via P2P channels or PayFi apps. By H1 2025, TRON had settled 1+ billion transactions worth $4.6 trillion, underlining its role as a backbone for cross-border settlement.

4. Unpacking TRON’s Decentralisation

TRON operates with a delegated proof-of-stake (DPoS) model, where 27 “Super Representatives” (SRs) are elected by token holders to produce blocks. This design enables the network to achieve low fees and fast confirmation times while keeping governance transparent through on-chain voting. The Nakamoto Coefficient for TRON is 14, meaning that at least half of the SRs would need to collude to compromise block production. While some observers highlight that a limited validator set may reduce resilience compared to larger validator pools, others note that TRON’s approach provides efficiency and clear accountability.

Figure 8: The Nakamoto Coefficient of major L1s/L2s

Chain | Nakamoto Coefficient |

Solana | 21 |

Sui | 18 |

TRON | 14 |

Near | 10 |

Polygon | 4 |

Sonic | 4 |

Bitcoin | 3 |

Ethereum | 2 |

Fantom | 2 |

Arbitrum | 1 |

Source: Chainspect (as of 10Sep25)

At the same time, TRON has taken steps in 2025 to broaden participation. The introduction of new Super Representatives, including infrastructure providers such as Nansen, Kiln, and P2P.org, has brought in institutional players to strengthen operational security and governance. Staking dynamics also matter: nearly half of TRX supply is staked, and the move to Stake 2.0 has improved flexibility, making it easier for smaller participants to allocate resources and join the network. These changes signal an intent to expand decentralisation within the limits of the DPoS model.

The network’s reliance on USDT flows is another point of contention. TRON’s dominance is inseparable from its collaboration with Tether and centralized exchanges. While this has driven adoption at scale, it also embeds opacity into on-chain activity, since most flows originate or terminate in centralised venues. By contrast, chains that are more DeFi-oriented and transparent can naturally provide regulators and analysts with clearer on-chain signals. This structural difference does not undermine TRON’s utility, but it raises the question of whether a CEX-driven ecosystem can maintain long-term credibility in the face of rising compliance pressures.

A further consideration is ecosystem diversity. Beyond stablecoins, TRON’s DeFi footprint remains limited relative to Ethereum, with a much smaller pool of applications and developers. This does not necessarily weaken its role as a settlement layer: in fact, the focus on stablecoins has allowed TRON to scale more cleanly. It does, however, reinforce the perception that TRON’s growth relies heavily on a single use case and is less resilient to shifts in market structure or regulation.

Overall, TRON’s model trades off maximal decentralisation for efficiency and accessibility. The validator structure, heavy reliance on USDT, and limited DeFi ecosystem leave it open to criticism. Yet, these same features have enabled TRON to achieve what many other blockchains could not: reliable, low-cost global settlement at scale. The degree to which this trade-off is sustainable will shape TRON’s trajectory over the next phase of stablecoin adoption.

5. Strategic Positioning: Where TRON Goes Next

5.1. Expanding the Stablecoin Mix

TRON’s leadership in USDT is undisputed, but its longer-term strategy clearly involves diversification. The launch of USDD 2.0 as a decentralised, over-collateralised stablecoin marks an effort to increase ecosystem diversity. The multi-chain rollout, beginning with Ethereum integration, introduces zero-slippage swaps and staking yields up to 12% APY, creating a parallel decentralised rail (Figure 9). At the same time, USD1, backed by World Liberty Financial, has minted $53.68 million on TRON, highlighting the chain’s role as a launchpad for politically visible and niche stablecoins. Together, these initiatives position TRON as more than a single-asset settlement layer.

Figure 9: USDD’s reach and influence in crypto is growing

Source: Justin Sun’s Twitter

5.2. Scaling Through BitTorrent Chain

Scalability remains a central part of many chains’ ambitions. The BitTorrent Chain (BTTC) serves as its L2 solution, supporting projects and users in DeFi, GameFi, and RWA experiments. Upgrades in 2025 have boosted throughput and reduced latency, while integrations with protocols such as LayerZero, deBridge, and Allbridge have enabled smoother multi-chain stablecoin transfers. Although BTTC does not yet match the visibility of Ethereum’s L2 ecosystem, it provides TRON with a native scaling strategy that extends beyond its base layer’s payments focus.

5.3. Real-World Assets and PayFi Integration

TRON’s next frontier is the tokenisation of real-world assets. Current bridges support tokenised equities, and early vault products suggest a pathway to programmable RWA integration with DeFi protocols like JustLend and SunSwap. Combined with PayFi applications from payroll to remittances, these assets could expand TRON’s role as a 24/7 settlement infrastructure. Subsidies from entities such as HTX, which now offers yield incentives on stablecoin deposits, reinforce this strategy by driving liquidity into the ecosystem.

5.4. Navigating Regulation and Market Entry

Regulatory dynamics present both challenges and opportunities. TRON has faced market pressure during episodes of global scrutiny on stablecoins, yet its response has been proactive. The introduction of USDD 2.0 reflects a shift toward decentralised models, while steps such as a $1 billion SEC shelf offering and a reverse merger with Nasdaq-listed Tron Inc., formerly known as SRM Entertainment, suggest ambitions to anchor TRON within US capital markets. In parallel, general MiCA compliance pathways in Europe and broader outreach across Asia and LATAM are intended to protect TRON’s role as a global settlement layer in an environment of rising regulatory oversight.

6. Final Words

TRON’s rise as the dominant settlement layer for stablecoins is one of the defining shifts in crypto infrastructure over the past five years. What began as an alternative to Ethereum for cost-sensitive transfers has grown into a global network that clears trillions annually, supports hundreds of millions of accounts, and anchors nearly $80 billion of USDT in circulation.

The metrics remain clear: TRON processes the majority of stablecoin transfers globally, often at a fraction of the cost of competitors. As stablecoins increasingly underpin both DeFi and PayFi use cases, TRON’s positioning makes it one of the most important and closely watched networks in crypto.