Summary

The wealth effect and “catch-up” trade – recurring retail investor behaviors – suggest we are nearing, or already in, a third alt season, following the first two (2/27/17–1/15/18 and 1/4/21–5/9/22).

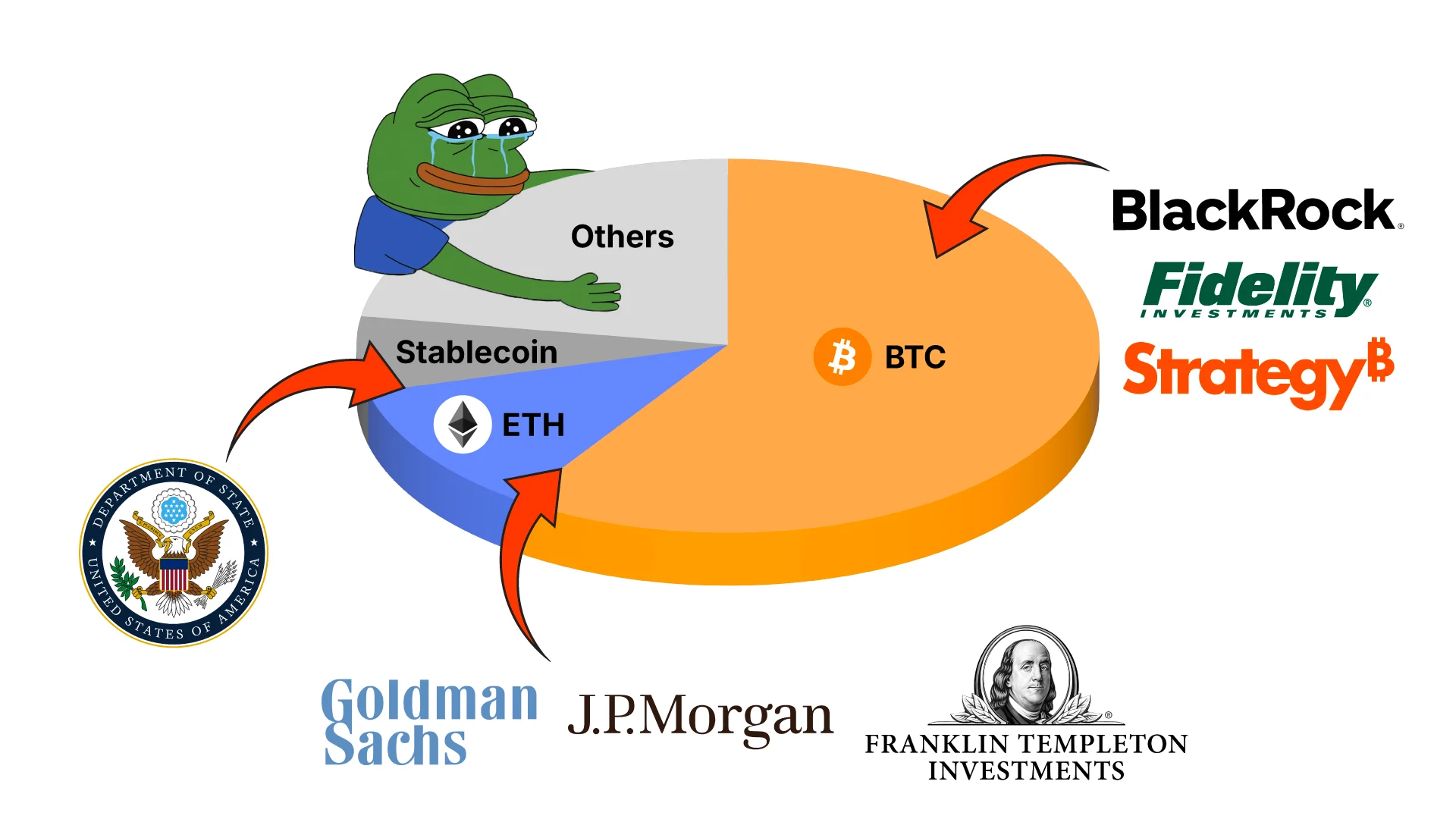

Our analysis suggests that altcoin leadership is increasingly consolidating around mature, large-cap assets with each alt season, driven by growing network effects and institutional participation.

An indiscriminate rally across the entire altcoin space, as seen in past cycles, is unlikely this time. This signals the end of the “rising tides lift all boats” era, reflecting industry maturity, with 100x altcoin opportunities reserved for truly deserving projects.

1. Introduction

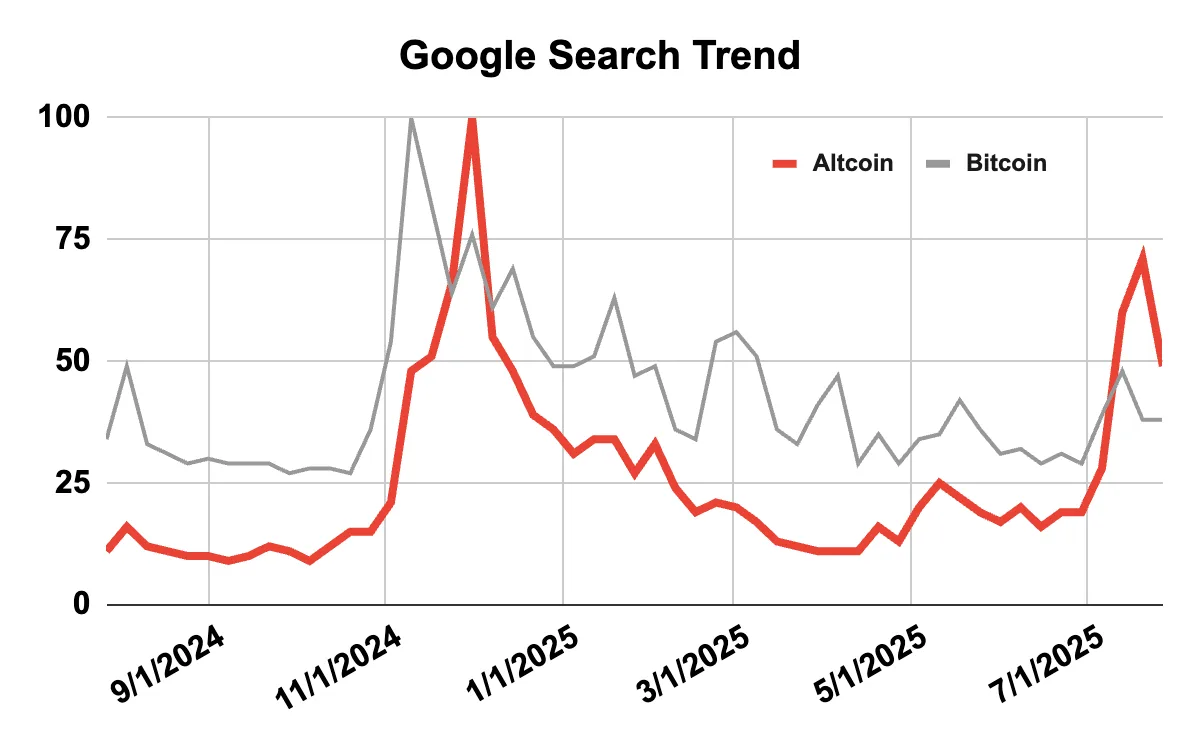

Interest in altcoins has surged recently, evidenced by a spike in Google search trends for altcoins and corresponding increases in altcoin prices. Against this backdrop, this report addresses a simple yet critical question on everyone’s mind: Will there be an alt season in this cycle, and if so, what might it look like? To answer this, we first analyze the price action of past alt seasons in detail to uncover insights and then examine the recurring behavioral factors driving the alt season phenomenon.

Figure 1: Rising Interest

Source: Google, Presto Research

2. Breaking Down Alt Seasons

Whether or not we will see an alt season, a term broadly referring to an altcoin bull market, matters for several reasons. Crypto began as a grassroots movement where retail investors played a foundational role. Today, altcoins are their primary focus and serve as the magnet that keeps them engaged. Additionally, despite the grift and bad-faith behavior prevalent in this segment, altcoins are where new ideas are tested, and innovation emerges through trial and error. The space is a laboratory for new crypto utilities. Lastly, for many crypto ventures, the revenue generated during alt seasons sustains them through the challenges of crypto winter.

Over the 16-year history of digital assets, there have been two full alt seasons, occurring during the second bull market cycle (post-2016 Bitcoin halving) and the third bull market cycle (post-2020 Bitcoin halving). A trillion-dollar question is whether we are entering a third alt season in the current cycle, following the 2024 Bitcoin halving. Our analysis is discussed below.

2.1. Analysis

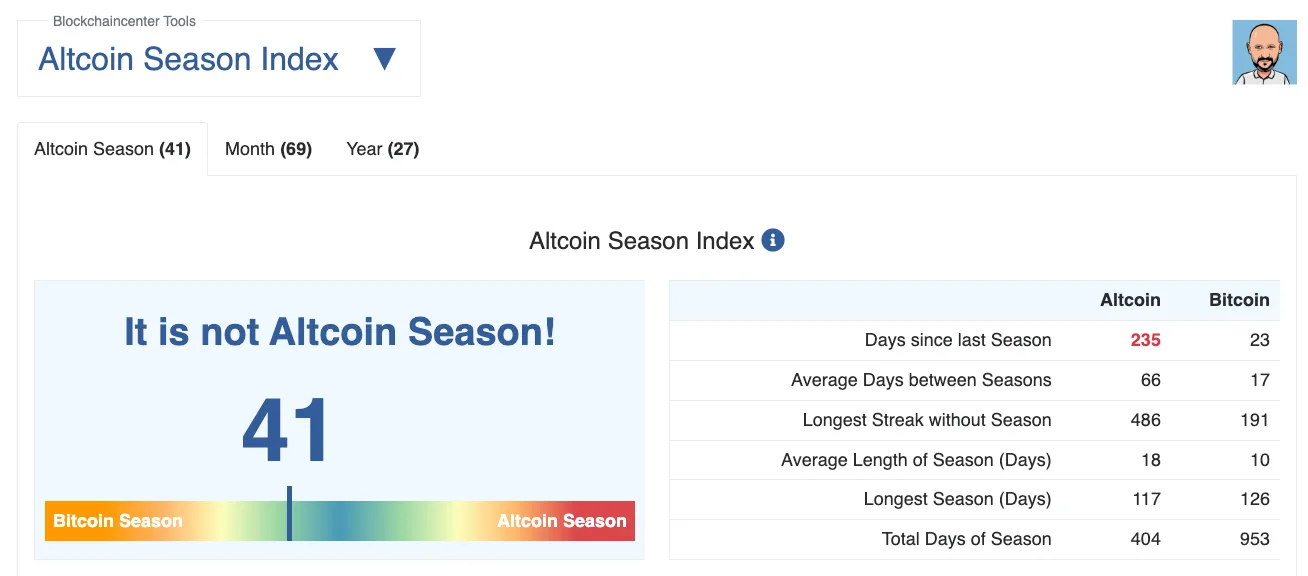

According to the Altcoin Season Index by Blockchain Center, we have not yet entered an alt season. While this index is a popular reference, its methodology is not optimal for our purposes, so we adopt an alternative approach. Our analysis examines key price action during past alt seasons, which is summarized in Figure 5. The data is compiled based on the following assumptions and categorizations.

Figure 2: Popular But Not Optimal

Source: Blockchaincenter.net

2.1.1 Altcoin Definition

We define an altcoin as any crypto assets other than Bitcoin. While there is a case for both including and excluding stablecoins in the definition, it does not significantly impact the analysis, so we retain them for simplicity. This approach aligns with our focus on the Bitcoin dominance ratio as the primary metric for identifying alt seasons, as explained next.

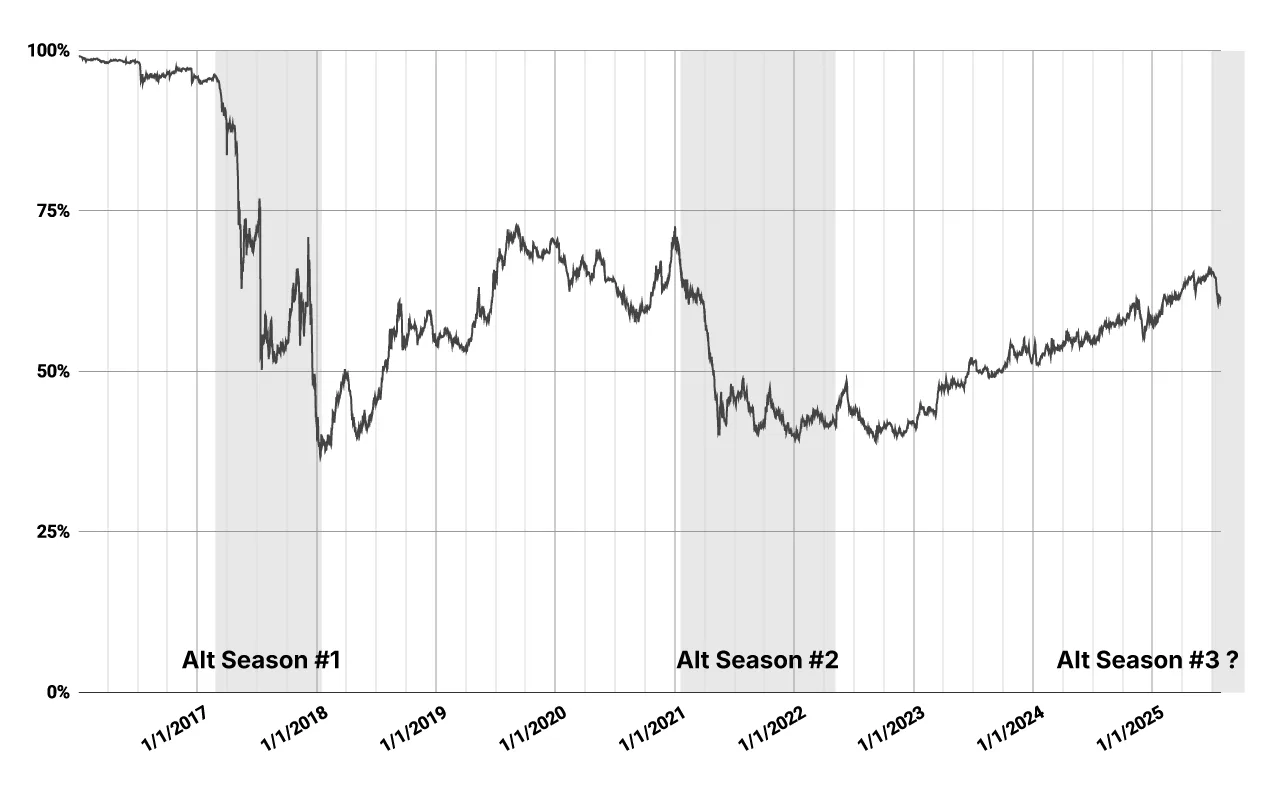

Figure 3: Alt Seasons As Defined By Bitcoin Dominance Ratio

* last data as of 7/30/25

Source: TradingView, Presto Research

2.1.2. Alt Season Definition

Bullish altcoin sentiment quintessentially characterizes alt seasons, but to define them more objectively, we reference the Bitcoin dominance ratio as a baseline (Figure 3). We define an alt season as the period between the peak and trough of the Bitcoin dominance ratio during each bull market cycle that lasts longer than 90 days. Put differently, it is a more than 90-day period when the altcoin market capitalization outpaces Bitcoin’s market capitalization.

For the second alt season, we slightly adjust this definition by moving the end date to early May, coinciding with the Terra/Luna collapse, even though the Bitcoin dominance ratio did not trough until November of that year. This adjustment reflects our view that: 1) for all practical purposes, the Terra/Luna collapse marked the start of the 2022 Crypto Winter, obliterating any remaining optimism for altcoins; and 2) the decline in the Bitcoin dominance ratio after the Terra/Luna collapse was driven not by altcoin enthusiasm but by BTC’s underperformance. As distressed crypto borrowers (e.g., Genesis, 3Arrows, BlockFi, etc.) were forced to deleverage during the May–November period that year, collateral liquidations amplified selling pressure on BTC. Consequently, we exclude the tail end of that period, which lacked bullish altcoin sentiment.

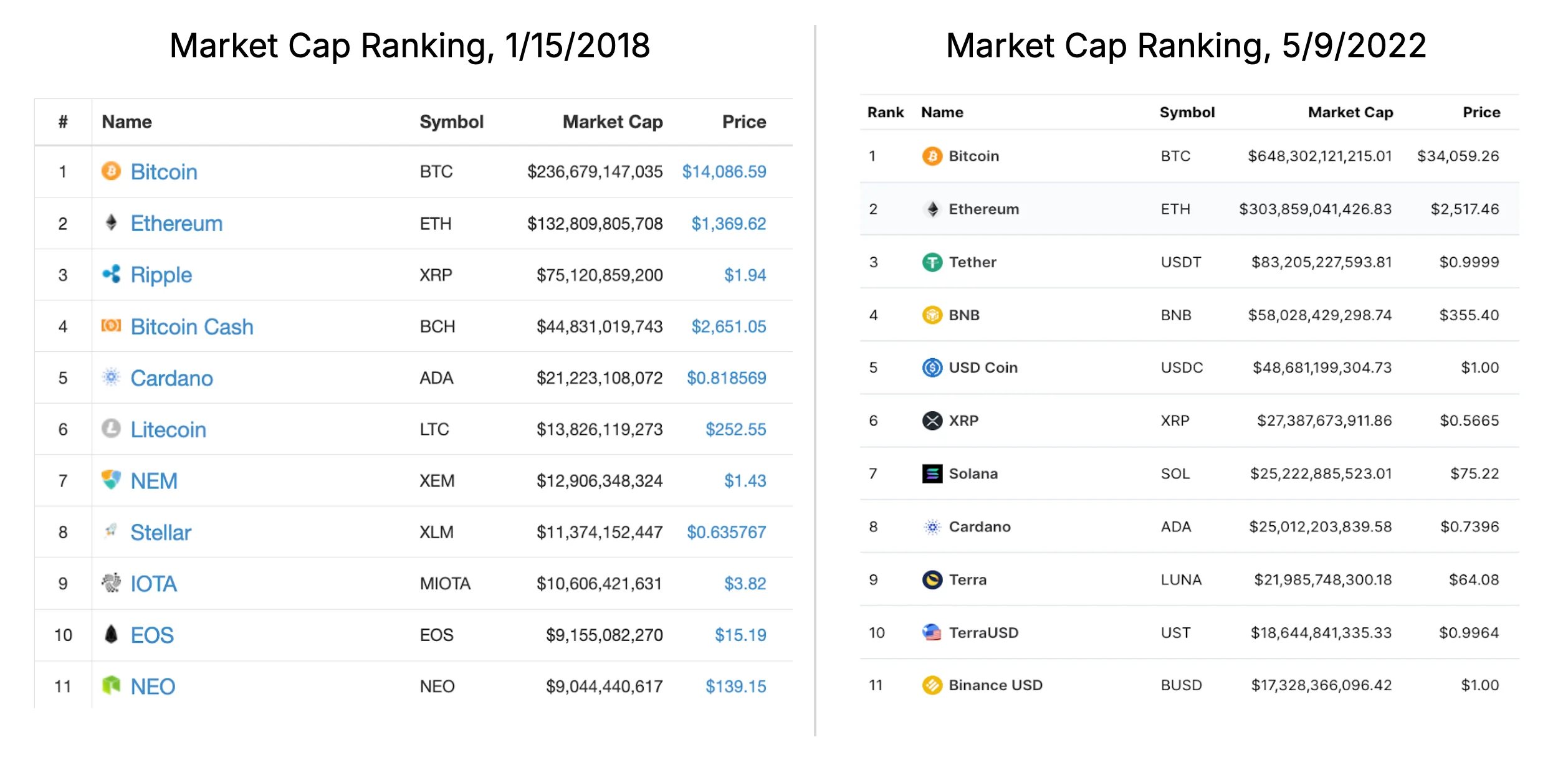

2.1.3. Segmentation

The altcoin sector comprises a diverse group of assets. To discern market leadership during each alt season, we break down altcoins into Ether and the top 10 altcoins, measuring their performance during each alt season. The top 10 altcoins are selected based on their market cap ranking on the start and last day of each alt season (Figure 4).

Figure 4: Top 10 Altcoins At The Peak of Alt Seasons

Source: WayBackMachine, Coinmarketcap, Presto Research

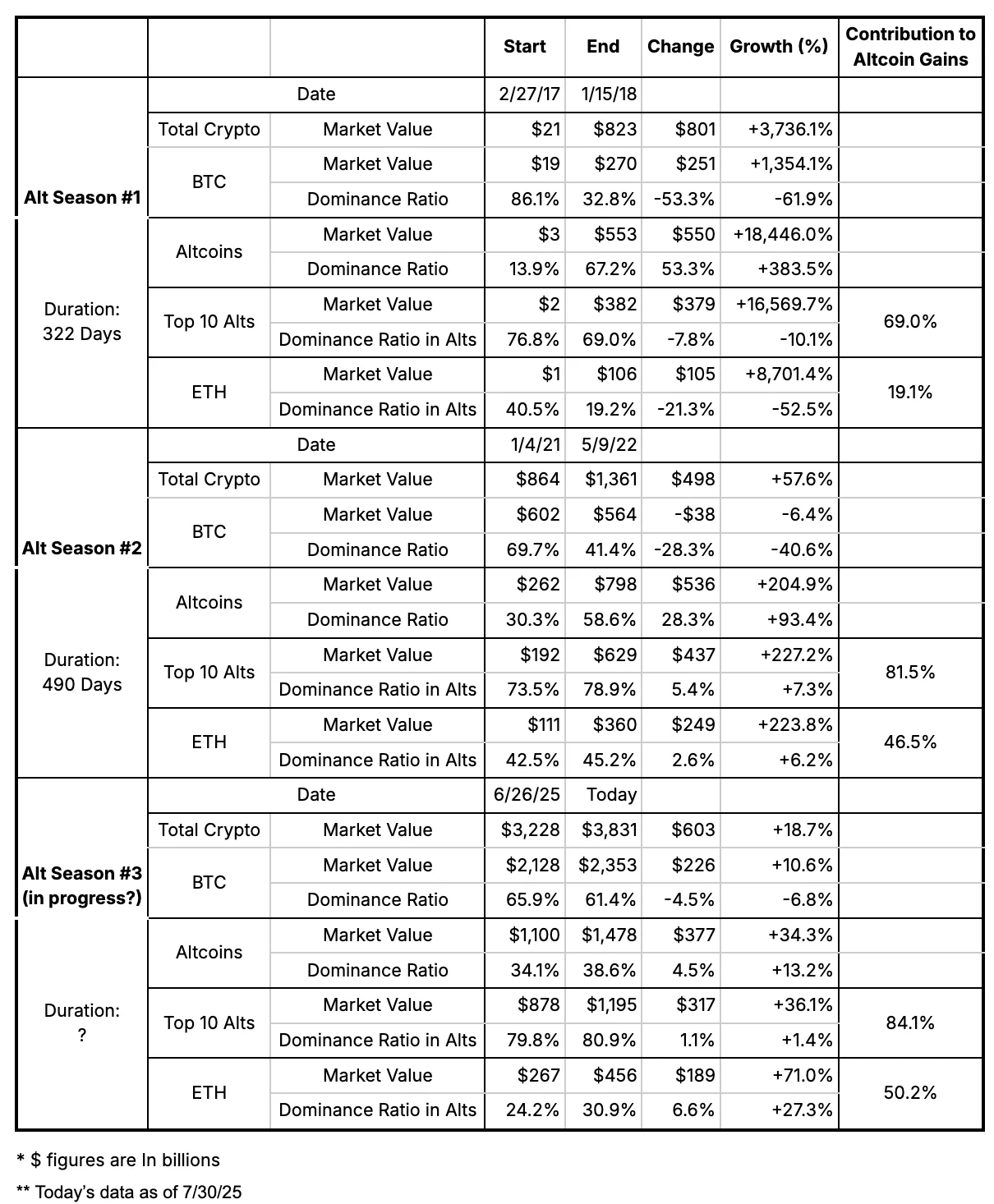

Figure 5: Comparing Alt Seasons’ Performances

Source: TradingView, Coinmarketcap, Presto Research

2.2. Key Trend: Leadership Consolidation

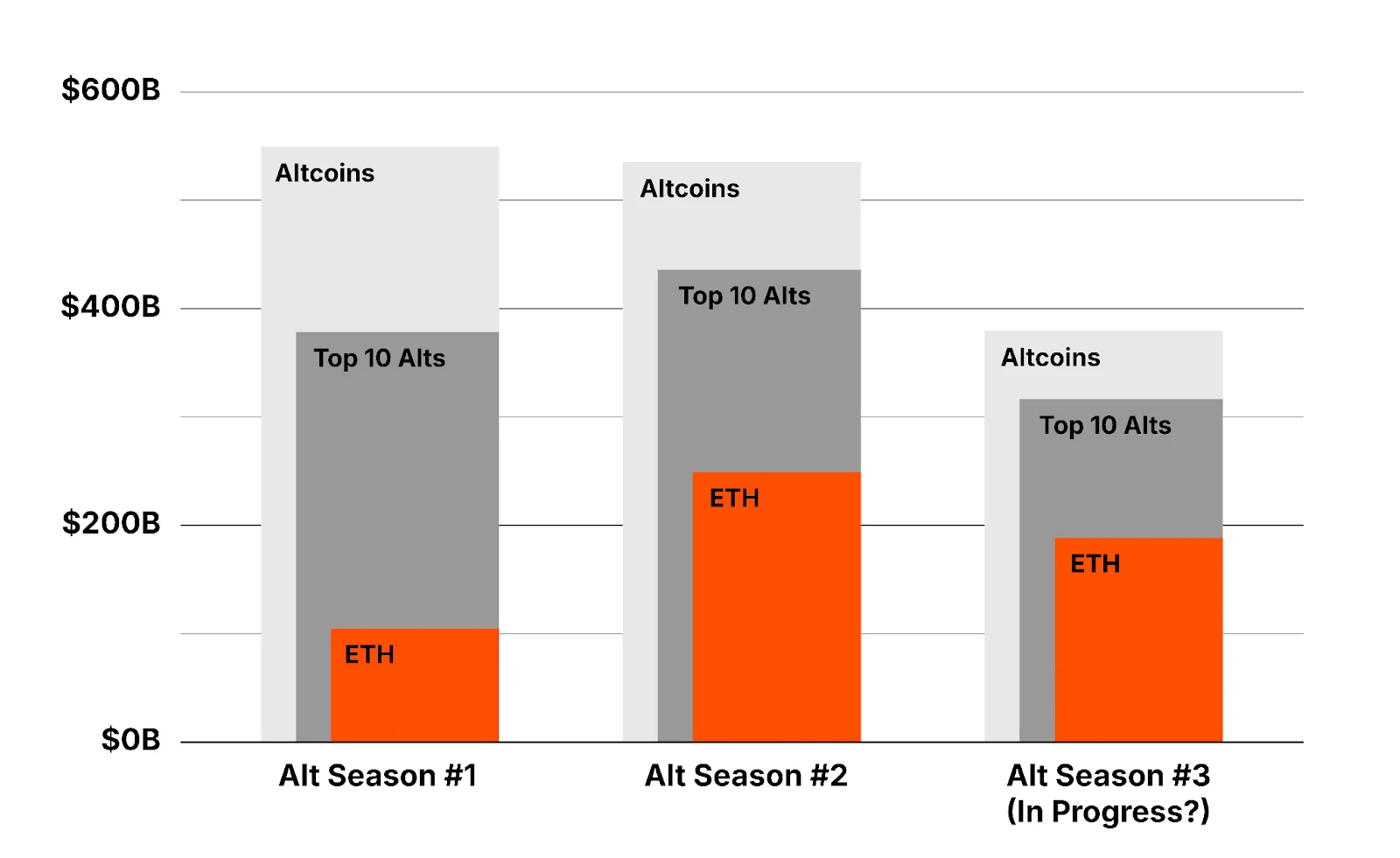

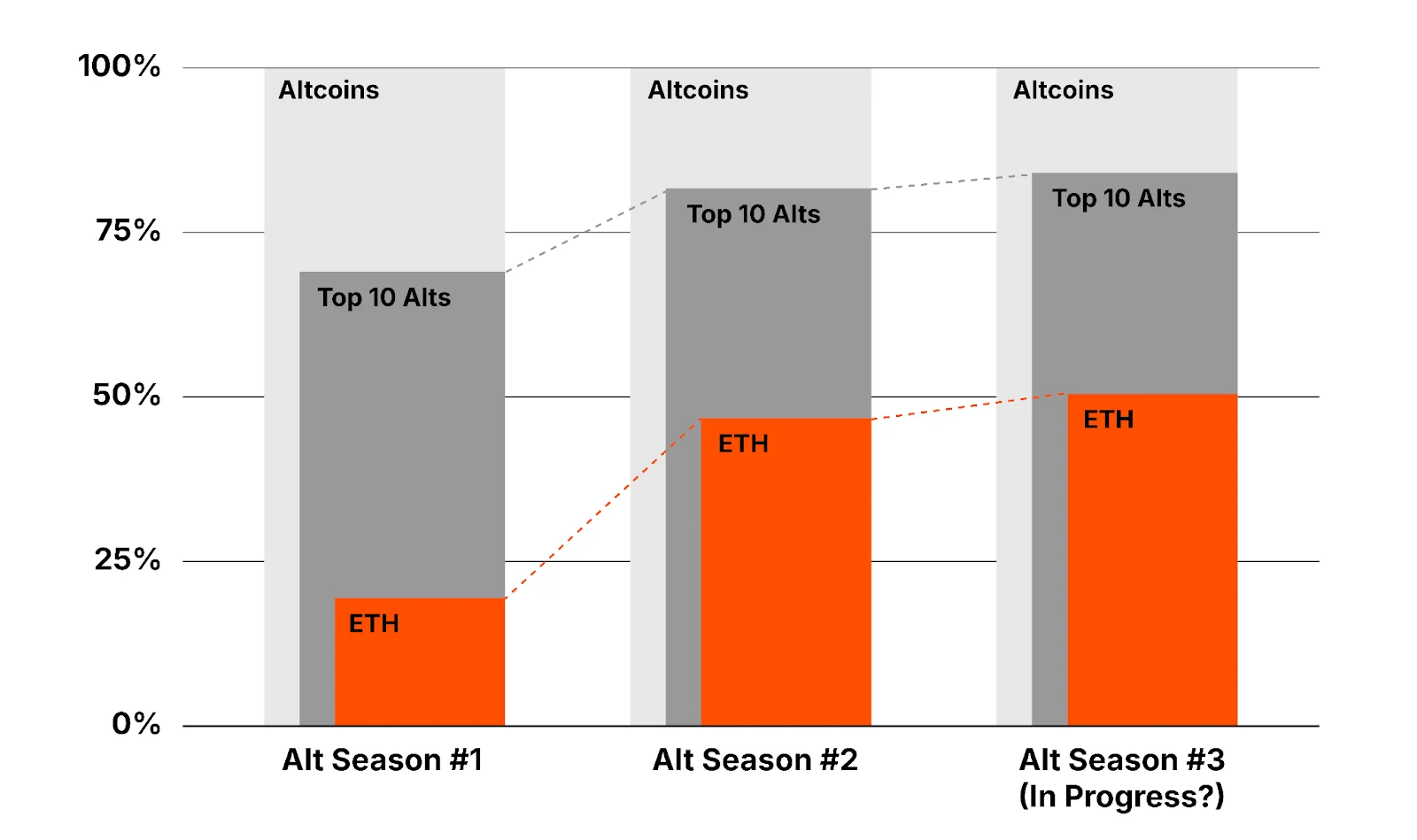

While it’s too early to tell whether the Bitcoin dominance ratio rollover since June 26 marks the start of a third alt season, recent developments around stablecoins and altcoin treasury companies paves way for the structural shift in the altcoin sentiment. If we are indeed on the cusp of another alt season, Figure 5 shed light on early signs of an intriguing trend, which is reproduced for better illustration in Figure 6 and 7 – namely, altcoin leadership consolidation.

The charts illustrate that the contributions of Ether and the top 10 altcoins to altcoins’ value gains have increased in each alt season, suggesting that mature assets play an increasingly significant role in driving alt seasons in each cycle. In a way, this should not come as a surprise; it aligns with expectations for a nascent but rapidly growing industry where value is driven by network effects. A brief history overview helps understand this trend.

During the first alt season, the altcoin value creation primarily stemmed from the ICO boom, fueled by an explosion of token creations and their price appreciation based on nothing more than whitepapers. Even Ethereum was a nascent network then, with only two years into its buildout and nothing much to show by today’s standard. In the second alt season, this trend was still there but less prominent, as the market had more time to distinguish projects shipping products from those who didn’t. In the current cycle, the technology has matured further, and successful applications are more readily identifiable (e.g. stablecoins, RWAs, DEX, prediction markets, etc.), driving greater polarization between those creating real-world utilities and those who don’t.

Figure 6: Market Value Gains During Each Alt Season (US$)

Source: TradingView, Coinmarketcap, Presto Research

Figure 7: Market Value Gains During Each Alt Season (%)

Source: TradingView, Coinmarketcap, Presto Research

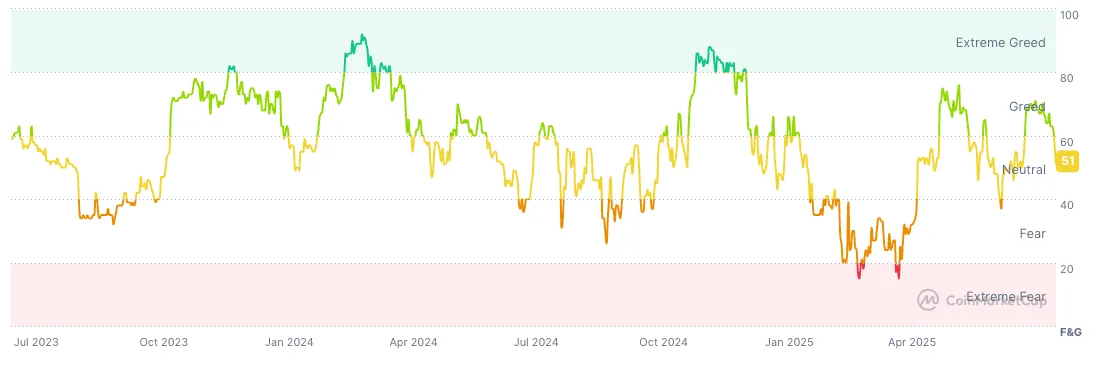

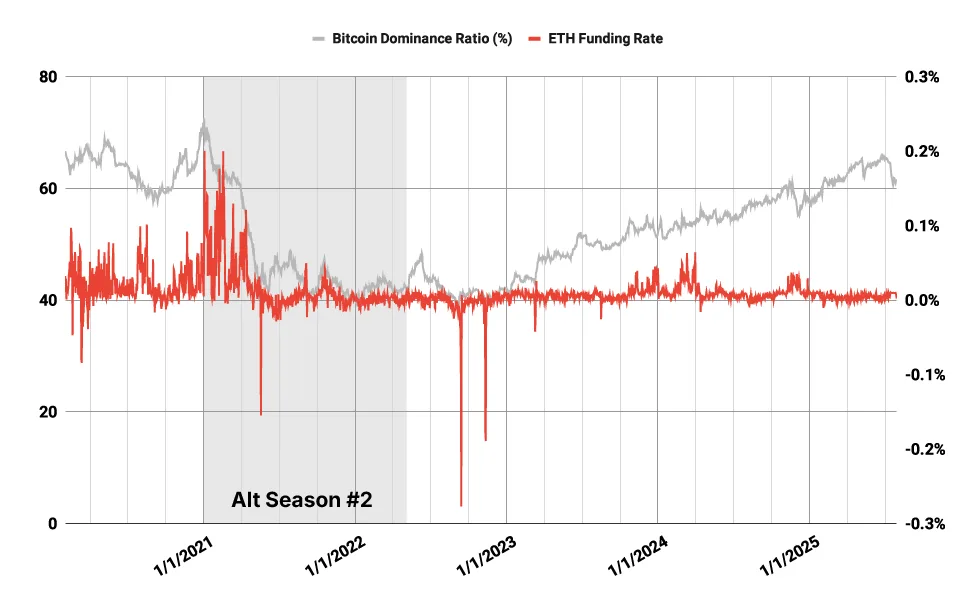

2.3. No Overheating Yet

Given that only a fraction of altcoins survive beyond a single cycle, exit strategy is an important consideration for altcoin investors. A good news is that the recent burst of altcoin interest has not translated into sentiment overheating on both relative and absolute measures.

Figure 8: CMC Crypto Fear and Greed Index

Source: Coinmarketcap

Figure 9: ETH Funding Rate Since 2nd Alt Season

*last data as of 7/30/25.

Source: TradingView, Coinmarketcap, Presto Research

3. Psychology of Alt Seasons

A phenomenon similar to alt seasons occurs in the equity market also, known as "rotational buying." For example, investors betting on a reflation trade may shift from national banks to more attractively valued regional banks as a laggard play. Similarly, a semiconductor bull might reallocate from foundries to equipment makers, betting on a capex upcycle.

That said, one key difference with crypto’s alt season is that emotions and behavioral factors play a far more significant role, consistent with the characteristics of early-stage ventures and large retail presence. This dynamic manifests differently for old and new money.

3.1. Old Money: Wealth Effect

Alt seasons can be viewed as a manifestation of wealth effect. The euphoria from Bitcoin value expansion influences BTC holders’ psychology, driving them to seek bolder opportunities further along the risk curve. This results in increased buying interest in potentially higher-return but riskier assets that are altcoins. This trend was particularly noticeable during the second alt season (1/4/21-5/9/22); BTC price action stagnated throughout the season (-6.4%), reflecting rotation away from BTC (Figure 10).

Figure 10: Altcoin Valuation Buoyed By Bitcoin Wealth Effect

Source: Glassnode

3.2. New Money: "Catch-Up Trade"

As media coverage of Bitcoin’s all-time highs attracts broad public attention during a bull market, many succumb to the “Keeping-Up-with-the-Joneses Syndrome” and seek ways to quickly catch up with early investors. These investors are naturally drawn to high risk/return assets in hopes of outperforming Bitcoin. This is especially true for new investors who are oblivious to the differences among various crypto assets.

The so-called “unit bias” best captures this dynamic. Unit bias refers to the erroneous belief that an asset is “cheap” if its per-unit price is low, giving an illusion of greater upside potential compared to assets with higher per-unit prices. For example, the thinking often goes, “BTC is already at $117,000, while XRP is only at $3, so XRP must have more upside.” Memecoin launches exploit the bias by inflating token supplies to create very low per-unit prices (e.g., PEPE currently trades at $0.00001148).

The unit bias is not unique to crypto; it exists in stock markets, too. This is why listed companies do stock splits – i.e. to make stocks appear “affordable” in the eyes of retail investors. Apple executed a 4-for-1 stock split in 2020, reducing the share price from around $500 to $125. After the split, more retail investors bought the shares, perceiving them as affordable. This increased demand temporarily boosted the stock price, despite no change in Apple's market cap or underlying fundamentals.

Figure 11: We Are Only Human

Source: quotefancy.com

4. Final Words

4.1. The Verdict

Admittedly, our analysis has limitations. Two (potentially three) alt seasons provide a limited data sample, making it challenging to draw definitive conclusions. Even if we are indeed at the start of a third alt season, altcoin leadership may shift away from Ethereum and the top 10 altcoins to smaller assets as the season progresses, potentially undermining our assertion that altcoin leadership is consolidating around more mature assets.

That said, our analysis – contextualized by behavioral factors, network effects, and broader crypto adoption – suggests we are nearing a third alt season, as defined by a declining Bitcoin dominance ratio. However, it will likely differ from past alt seasons due to evolving technology and market dynamics. Accelerating network effects and growing institutional participation indicate that altcoin leadership will be more concentrated than in previous alt seasons. Consequently, the third alt season may “feel different” and out of sync with traditional definitions, such as “75% of the top 50 coins outperforming Bitcoin.”

4.2. Rising Tides Won’t Lift All Boat (or Your Bag)

The implication is that a broad, indiscriminate rally across the entire altcoin space, as seen in past cycles, is unlikely in this cycle. While a $50 million market-cap token rocketing to a $5 billion valuation may still occur sporadically, such events will be exceptions rather than the norm. Well-capitalized institutional participation, combined with a crypto-native investor base increasingly proactive in calling out rug-pulls and unsubstantiated hype, will limit 100x opportunities to the very few truly deserving cases.

This potentially signals the end of the era where rising tides lifted all boats. And that’s good for the industry. The perception that “crypto is easy money” has attracted subpar players and questionable market practices along with them, but these will gradually be weeded out in a more mature marketplace. Slowly but surely, the industry is moving in the right direction.