Contents

(1) Macro Backdrop

(2) Crypto Market Moves

(3) Crypto Fund Performance

(4) Positioning and Flows

(5) Takeaways

1. Macro Backdrop

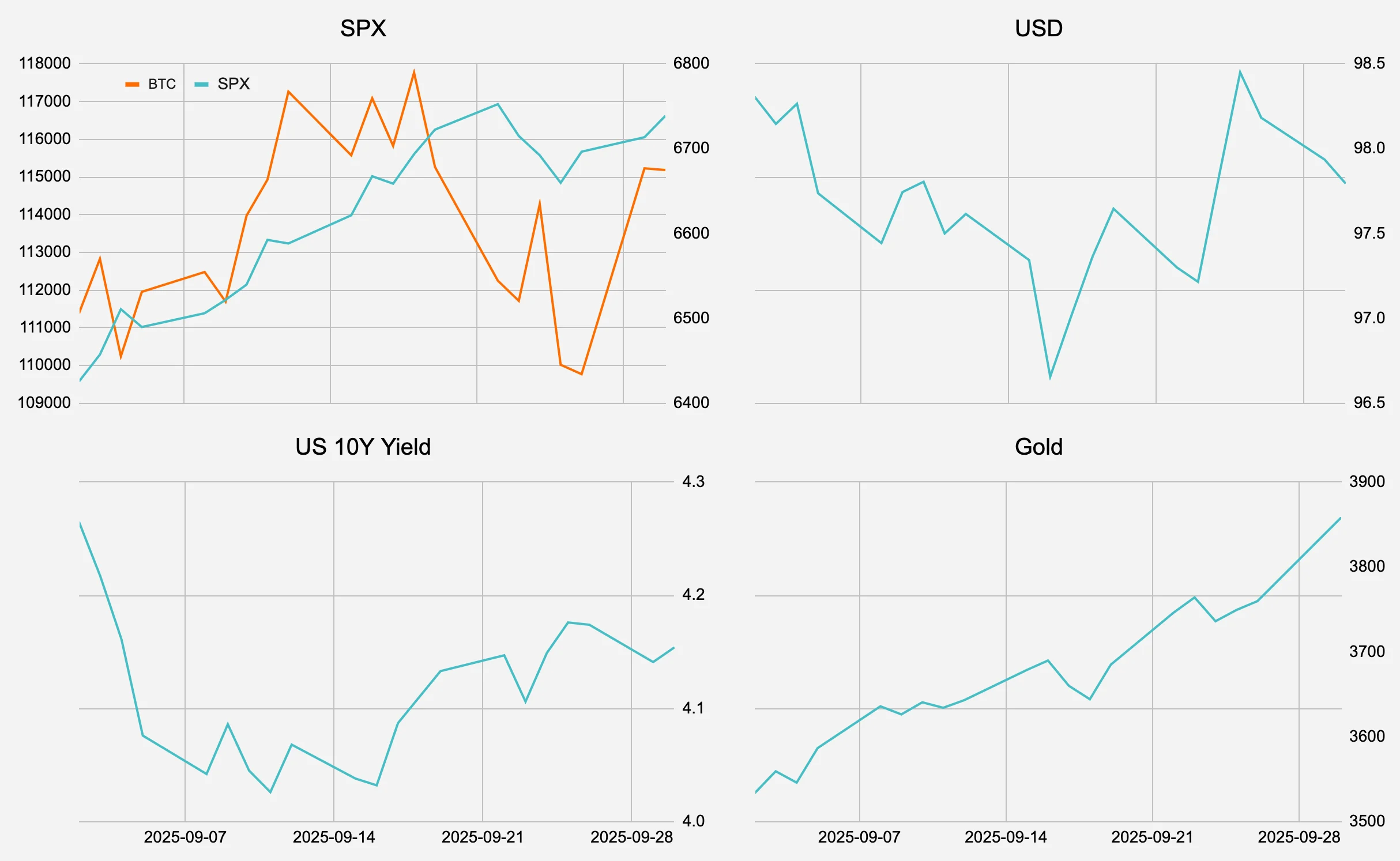

Markets entered September on a fragile footing. UK fiscal stress pushed 30-year Gilts to levels last seen in 1998, while US yields climbed early in the month amid renewed trade friction and softening labour data. President Trump announced fresh tariffs on Brazil, India, and heavy trucks, alongside threats of 100% levies on China and India routed through the EU. Political noise added to volatility: France’s prime minister lost a confidence vote, NATO jets intercepted Russian drones over Poland, and President Xi pressed Washington for Taiwan concessions.

Into mid-month, payrolls again disappointed, and the Federal Reserve delivered a 25 bp rate cut as expected, with the updated dot plot signalling two additional cuts before year-end. The Bank of England paused, the Bank of Japan held steady, and central banks from Norway to the Riksbank shifted decisively toward easing. By late September, Powell and Miran’s dovish tone had anchored global risk sentiment. Equities and credit firmed, gold traded at record highs, and investors braced for a potential US government shutdown on October 1.

Figure 1: September price action

Source: Presto Research

2. Crypto Market Moves

Crypto traded choppy through the month. Bitcoin ranged between $107k and $117k, closing near $114k, while Ethereum faded from $4,600 mid-month to around $4,100 into quarter-end. Solana briefly reached the $250s before retracing. The month’s narrative was driven by structural catalysts: MicroStrategy lifted holdings to 636k BTC, US lawmakers floated a proposal for a strategic Bitcoin reserve, and the first US Dogecoin ETF (DOJE) launched.

Attention turned quickly toward Solana ETF filings, with major issuers expected to submit in October. CME confirmed plans to list Solana and XRP options, and the CFTC proposed tokenised collateral for futures, marking another step toward institutional integration. Policy momentum built on Powell’s dovish signalling and the White House Crypto Council’s backing of a market structure bill before year-end.

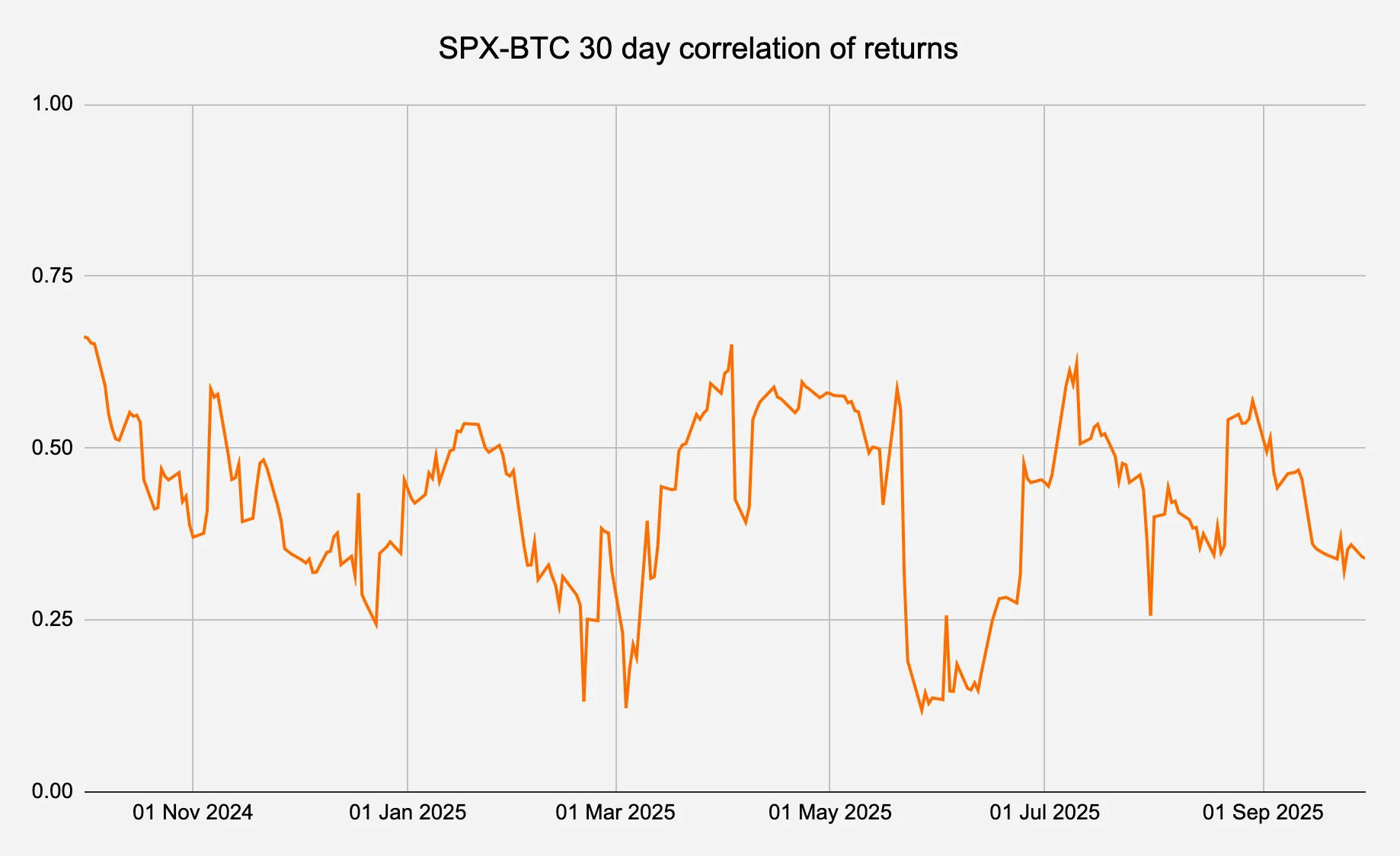

Figure 2: Correlations softened as equities continued their march upwards

Source: Presto Research

Derivatives remained active. BTC implied volatility trended lower into mid-month before rebounding, with 1M IV bottoming near 32v and closing closer to 36–37v, still well below 6M and 1Y tenors. ETH skew flipped between calls and puts as flows oscillated from upside call buying early in the month to defensive put positioning into expiry. The September expiry cleared roughly $17bn in BTC and $5bn in ETH open interest, with max pain levels near $110k and $3.8k respectively. Basis stayed firm around 7–8% annualised, while traders pressed OTM BTC puts around $100k and lifted BTC calls into Q4. Solana options also gained traction, with 244-strike sales mid-month and 235/240 call spreads sold into October.

By month-end, crypto had absorbed a heavy flow of ETF speculation, legislative headlines, and a major expiry reset. Spot markets remain consolidative, volatility has reset lower, and positioning looks cleaner heading into Q4 against a backdrop of Fed easing and persistent macro risk.

Given crypto’s comparative weakness to traditional risk assets, correlations dropped from above 0.50 to the low 0.30s by month-end (Figure 2).

3. Crypto Fund Performance

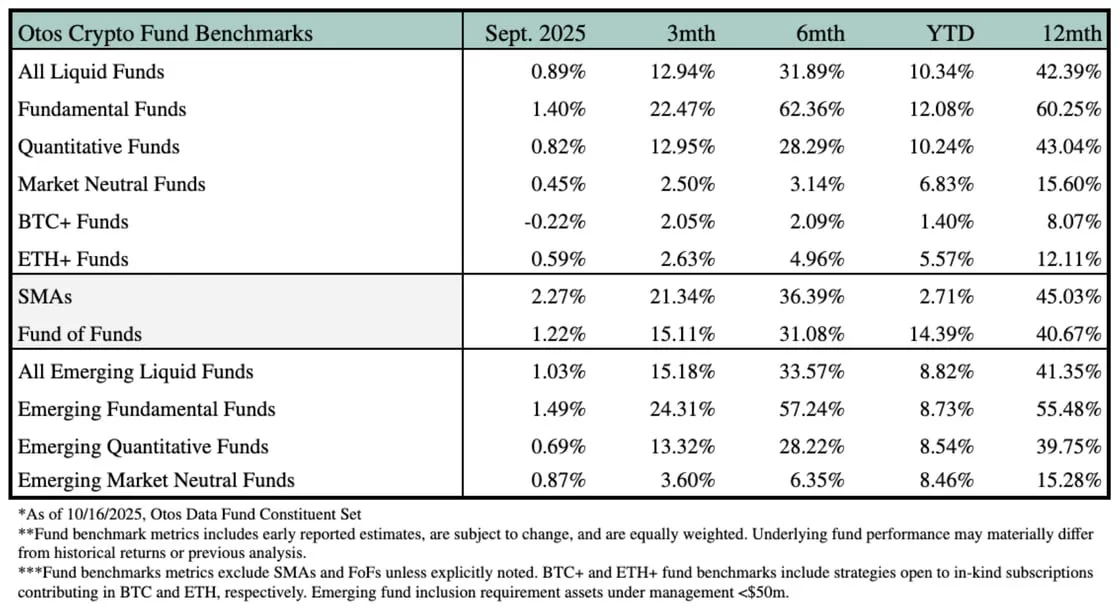

Figure 3: Fundamental funds led the way once again

Source: Otos Data

Otos benchmark data for September show that crypto hedge funds managed to outperform underlying spot markets once again despite compressed volatility and choppy price action: the liquid fund benchmark returned an average +0.89% in September, bringing the YTD to +10.34%.

Fundamentals: +1.40%, YTD +12.08%.

Quantitative: +0.82%, YTD +10.24%.

Market Neutral: +0.45%, YTD +6.83%.

BTC+/ETH+: -0.22%, 0.59% respectively, YTD +1.40%, +5.57%.

SMAs returned +2.27%, while Fund of Funds delivered a +1.22%, extending its YTD performance to +14.39%. Among smaller managers (<$50mm AUM), Emerging Fundamental Funds led the way once again with +1.49% (+8.73% YTD).

4. Positioning and Flows

Manager sentiment shifted sharply in late September. The confluence of Trump’s tariff shock, Bitcoin’s flash crash, and a record-breaking rally in gold reframed market attention away from AI and data-centre themes toward the underlying fragility of credit and liquidity. The “debasement” meme resurfaced across financial and social media, signalling renewed anxiety over fiat erosion and a rotation back into hard assets.

The divergence in performance highlights key behavioural dynamics through the lens of Financial Narrative Reliability (FNR). At the principal layer, the flash crash tested conviction, forcing managers and allocators to re-evaluate explanatory frameworks and risk models. Those with adaptive structures or disciplined hedging re-established coherence fastest, reaffirming the strategic value of process-driven execution. At the market narration layer, the crash acted as a collective reset: dominant narratives around institutional confidence and macro inevitability gave way to renewed scrutiny and recalibration.

5. Takeaways

September reflected a global market recalibration. Central banks turned decisively dovish as geopolitical risk intensified, while crypto absorbed a burst of ETF headlines, policy momentum, and an options expiry reset. The volatility spike and subsequent flash crash forced narrative introspection across both investors and managers, reinforcing the importance of adaptive frameworks and capital discipline.

As Q4 begins, the macro backdrop of easing policy, fiscal stress, and renewed hard-asset narratives sets the tone for a volatile but constructive environment. Within crypto, cleaner positioning and improving institutional structure provide a firmer base for upcoming catalysts from Solana ETF decisions to renewed flows into active strategies.