Summary

Layer3 ($L3) stands out as one of the few crypto protocols generating genuine, recurring revenue — $16.6M in 2024 with projections exceeding $20M ARR for 2025. Layer3 has built a sustainable business model where protocols pay for user acquisition, not token subsidies.

As the dominant quest-to-earn platform, Layer3 has facilitated over 120 million quest completions, 500 million on-chain actions, and $285M in rewards distribution. With 500+ protocol clients across 40+ chains and 3.2 million users, Layer3 has become the de facto growth layer for crypto projects seeking verifiable user engagement.

Trading at ~$20M market cap against $20M+ ARR, Layer3 offers compelling fundamental value. Ongoing revenue-funded buybacks, and planned product spinouts, the token presents upside heading into Q4 2025.

1. Introduction

In crypto, traction has become currency. Protocols compete fiercely to demonstrate user activity, transaction volumes, and ecosystem vitality—metrics that drive exchange listings, venture funding, and market perception. Yet despite billions allocated to token incentives, Web3 lacks coherent growth infrastructure. There is no "Google Ads" for wallet behavior, no unified attribution system for verified on-chain actions, no scalable marketplace connecting projects with users.

Layer3 fills this void. It functions as a growth-as-a-service platform, operating a two-sided marketplace where protocols design incentive campaigns ("quests"), users complete verifiable on-chain tasks for rewards, and Layer3 orchestrates the entire process—from campaign management to fraud detection to data analytics. Over time, this position has made Layer3 the default growth layer for Web3, powering user acquisition for major ecosystems like Arbitrum, Base, Optimism, and hundreds of protocols.

Unlike the vast majority of crypto projects that depend on speculative emissions or narrative momentum, Layer3 generates meaningful recurring revenue from real clients paying for measurable outcomes. In 2024, the company achieved $16.6M in revenue—a 10× year-over-year increase—while maintaining profitability with a lean team. This rare combination of strong fundamentals, scalable business model, and strategic positioning within crypto's attention economy makes $L3 a compelling investment thesis, particularly as the protocol prepares for strategic product launches and value-return mechanisms in late 2025.

2. What is Layer3?

Layer3 is an omnichain identity and distribution protocol that rewards users for on-chain activity while helping protocols acquire and retain users. At its core, Layer3 operates a two-sided marketplace connecting supply (protocols needing growth) with demand (users seeking engagement rewards).

For Protocols: Layer3 enables projects to design and manage growth campaigns—from simple single-step activations ("bridge to Base") to complex multi-stage missions ("trade, stake, and participate in governance on Arbitrum"). The platform handles campaign orchestration, multi-chain attribution, sybil detection, and provides detailed analytics on user behavior and conversion metrics.

For Users: Participants complete quests through Layer3's interface, earning rewards in the form of tokens, NFTs, points, or other digital assets. Each completion generates a CUBE—an ERC-721 NFT credential that attests to verified on-chain actions, creating a portable reputation layer across Web3.

The Business Model: Layer3 generates revenue through service fees while reward budgets are funded by protocol clients themselves. This asset-light, client-funded model eliminates the need for inflationary token emissions, providing operational leverage and long-term sustainability. The platform's technology stack covers campaign orchestration, multi-chain verification, fraud detection, and behavioral analytics—effectively functioning as Web3's marketing operating system.

Figure 1: Arbitrum Campaign on Layer3 Website

Source: Layer3 Website

Beyond campaigns, Layer3's infrastructure now powers airdrop distribution, on-chain user targeting, and audience segmentation across 40+ blockchain ecosystems. As more protocols use the platform, Layer3's behavioral dataset grows larger and more defensible, creating powerful network effects.

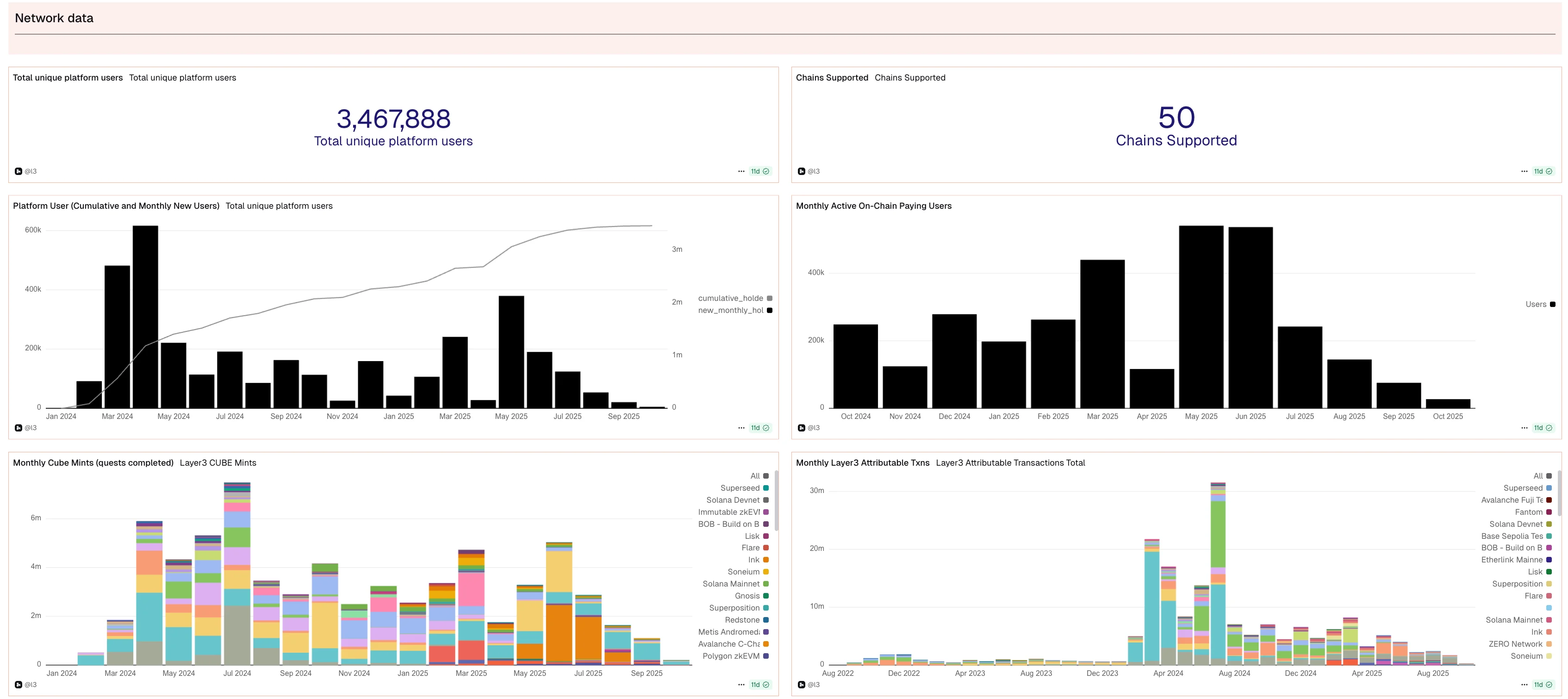

Figure 2: Key Statistics (as of October 2025)

Metric | Value |

Total Quest Completions | 120M+ |

On-Chain Actions Verified | 500M+ |

CUBE NFTs Minted | 20.4M |

Unique Users | 3.2M |

Wallet Connections | 8.2M |

Total Rewards Distributed | $285M+ |

Native $L3 Distributed | ~$4M |

Monthly Active Users | ~300K |

Figure 3: Layer3 Network Data: Users and Transactions

Source: Dune

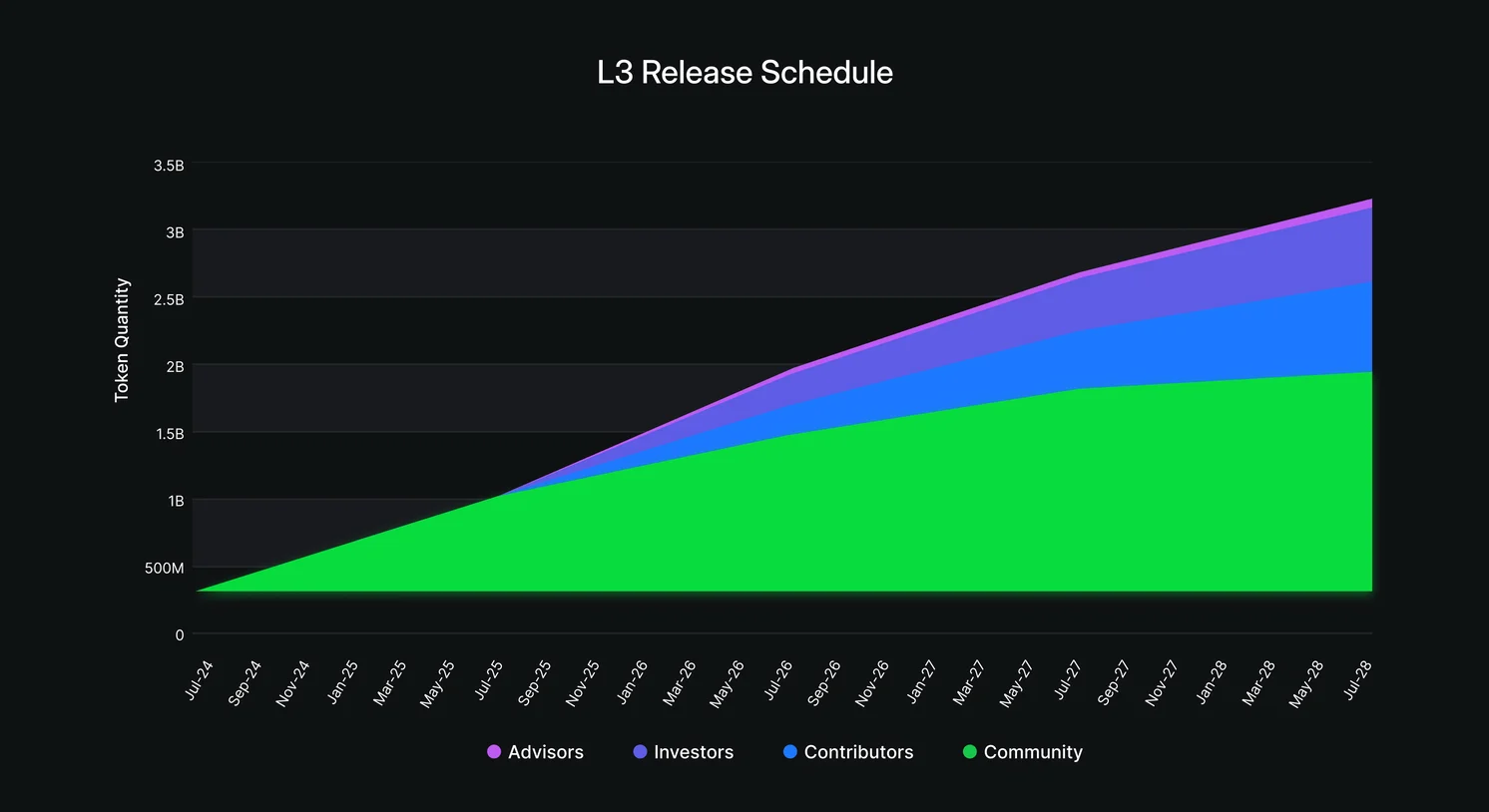

2.1. Tokenomics of Layer3

Supply Structure:

Total Supply: 3.33B $L3 (fixed)

Circulating: ~820M (24.6%) via CMC

Token Distribution:

Community: 51% (1.7B) — quarterly emissions tied to proof-of-contribution

Core Contributors: 25.3% (843M) — 1-year cliff + 4-year linear vesting

Investors: 23.2% (773M) — 1-year cliff + 3-year linear vesting

Advisors: 0.5% (17M) — same vesting structure

Utility Mechanisms:Layered Staking (3 Tiers):

Layer 1: Stake for yields + governance rights

Layer 2: Unlock reward boosts (25%-100% based on stake size)

Layer 3: Activity multipliers (1.5×-2× on quest completions)

Deflationary Mechanics:

100% of ETH fees → automatic $L3 buybacks via DEX

Platform spending in $L3 → tokens burned

2024 buybacks: ~$1M+ tracked on-chain (via Dune)

Builder Requirements:

Protocols must stake/burn $L3 to post quests

Creates ongoing buy pressure as platform scales

Figure 4: $L3 Tokenomics

Source: Layer3

3. Thesis: Layer3 as a Revenue Engine for Web3 Growth

While most Web3 platforms rely on speculative TVL metrics or token emissions to demonstrate value, Layer3 earns tangible revenue from verifiable demand: protocols paying for user growth. The investment thesis rests on three core pillars that together create a self-reinforcing flywheel of value creation.

3.1. Airdrops Are Here to Stay

The quest-to-earn model has proven resilient across market cycles, driven by a fundamental structural need: protocols require demonstrable user activity, and Layer3 provides the most efficient infrastructure to generate it.

Airdrops remain the dominant form of user acquisition in Web3. From Arbitrum to zkSync, Celestia to Berachain, every major protocol continues to rely on token-based incentives to drive awareness, bootstrap network effects, and create the activity metrics that justify valuations and exchange listings.

Evidence of Persistent Demand:

- Arbitrum: Layer3 users claimed over 20% of total airdrop tokens distributed

- zkSync: Nearly 30% of airdrop participants came through Layer3 campaigns

- Mantle: Attention Index peaked at 352 with over 33,000 verified participants in a single campaign

- Recent Activity (Q3 2025): BNB Chain saw 92% signal growth driven by Layer3 activations; Berachain's "March of the Beras" campaign achieved 8.5M participants and $25B TVL boost

Why This Demand is Structural, Not Temporary

The airdrop economy has become self-reinforcing. Protocols view user activity data as a key signal for:

- Exchange listings (CEXs require proof of genuine demand)

- VC interest (activity metrics justify valuations and funding rounds)

- Market perception (transaction volumes drive narrative and social proof)

As long as on-chain traffic metrics remain a determinant of perceived traction—and there's no evidence this is changing—the infrastructure that measures and monetizes that traffic will retain fundamental importance.

The Quality vs. Quantity Debate

Critics argue that quest-based growth generates "mercenary users" who farm airdrops without genuine engagement. This misses a critical nuance: many protocols explicitly optimize for scale metrics over user quality. As Layer3 co-founder Brandon Kumar noted in the Presto Research podcast, some projects don't want bot filtering—they optimize for wallet counts, transaction volumes, and social engagement that drive listings and funding narratives.

Layer3's architecture accommodates both strategies. Campaigns can be configured for high-signal attribution (deep user verification, multi-step engagement) or for broad viral reach (simple tasks, maximum participation). This flexibility makes Layer3 a neutral platform layer serving the full spectrum of protocol growth needs—from quality-driven projects like Arbitrum to scale-optimized testnets like Pharos (2M participants in 6 weeks).

By serving both ends of the market, Layer3 ensures persistent demand regardless of which growth philosophy dominates any given cycle.

3.2. Creates Revenue—Real, Recurring, and Scaling Fast

Layer3 distinguishes itself through genuine business fundamentals in an industry dominated by speculative metrics. The protocol generates revenue from actual clients paying for measurable services, not from token emissions or artificial TVL inflation.

Figure 5: Business Model Breakdown

Period | Metric | Value |

2024 | Annual Revenue | $16.6M |

2024 | YoY Growth | 10× |

2025 | Projected ARR | $20M+ |

Unlike DeFi protocols that pay users to simulate activity, Layer3 operates a client-funded marketplace:

1. Protocols allocate budget from token treasuries to fund quest rewards

2. Layer3 charges service fees for platform access, campaign management, analytics, and fraud detection

3. Users receive rewards funded by protocols, not Layer3's treasury

4. Layer3 captures margin on coordination and verification services

Layer3 has distributed $285M+ in total rewards while spending only ~$4M in native $L3 tokens—meaning 98.6% of reward value comes from client budgets, not the protocol treasury. This demonstrates genuine market demand for the service independent of token price.

For perspective, Layer3 now ranks among the top revenue-generating crypto applications alongside centralized exchanges and custodians—a rare achievement for a decentralized protocol. While competitors report larger user numbers, Layer3's focus on monetization over vanity metrics has created superior unit economics.

With 500+ protocol clients, Layer3's average revenue per client is ~$40K annually, though major L1/L2 partnerships (Arbitrum, Base, Optimism) likely command significantly higher fees for comprehensive campaign management and analytics.

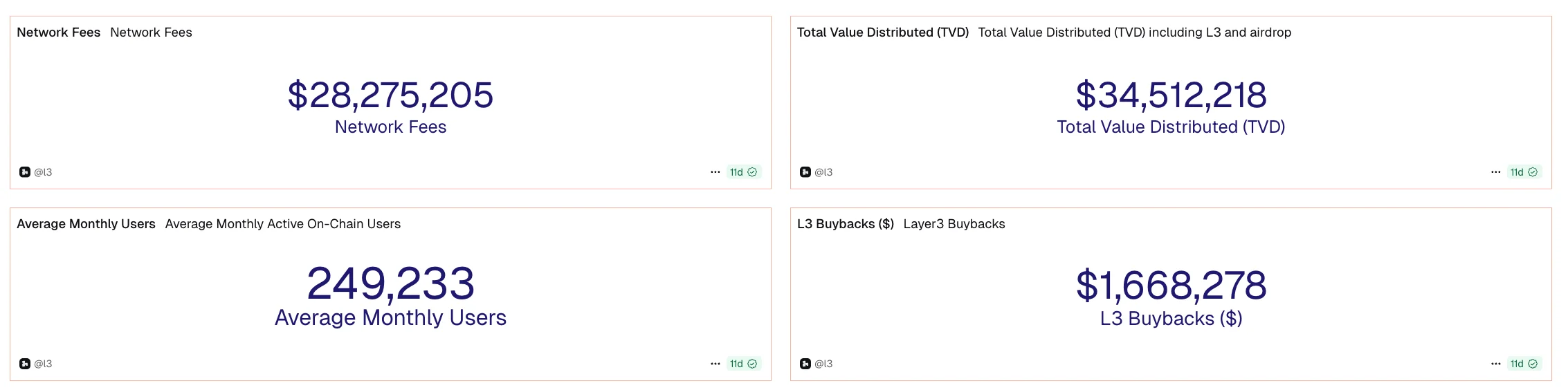

Figure 6: Over $1.6M in Total $L3 Buybacks

Source: Layer3

3.3. Optionality to Buyback and Value Return

Recurring cash flow provides Layer3 with capabilities that most protocols lack: the ability to return value to token holders through multiple mechanisms while simultaneously funding ecosystem growth and product expansion.

Revenue-Funded Buyback Program

Layer3 operates an ongoing buyback mechanism converting protocol revenue into direct token demand:

Mechanics:

100% of ETH-denominated fees (from credential mints, incentive deployments, and non-$L3 transactions) are automatically converted into $L3 buybacks via DEX pools across Ethereum, Base, Optimism, and other supported chains

Broader revenue (subscriptions, data sales) flows to Foundation treasury for discretionary use, including additional buybacks, staking incentives, and ecosystem grants

Historical Execution:

2024: Several million dollars in buybacks completed (~$1.6M tracked on Dune Analytics)

Implied Take Rate: ~5-10% of total reward distribution ($285M) suggests Layer3 captures fees to fund operations and buybacks

No Fixed Schedule: Buybacks are Foundation-discretionary but tied to revenue growth—$20M+ ARR provides substantial capacity

Strategic Product Optionality

Beyond buybacks, Layer3's revenue enables an IAC-style portfolio approach: develop multiple products under one umbrella, then potentially spin them out as independent protocols with token allocations to $L3 holders.

Figure 7: Products Under Development

Product | Status | Metrics | Value Proposition |

Trading Platform | Beta/Active | $200M+ volume reported | DeFi aggregation and swaps |

Prediction Markets | Active | $500K revenue (Q1 2025) | Event-based betting and forecasting |

Token Launch Tools | Development | TBA | Quest-to-earn launchpads for new projects |

Layer3 Intel | Active | Powers 3M+ transactions | AI agent infrastructure for incentive coordination |

With $20M+ ARR providing 5-10% ($1-2M) for buybacks annually, 98.6% of rewards client-funded, and new products creating optionality, Layer3 has built a cash-generating machine rare in crypto—one that can self-fund growth while returning value to holders without relying on speculative token emissions.

4. Valuation: The Disconnect in Plain Sight

Current Metrics:

Market Cap: ~$20M

ARR: $20M+

P/S Ratio: ~1×

Circulating Supply: 820M $L3 (~24.6% of total)

Figure 8: Comparable Analysis

Category | Typical P/S Multiple |

High-Growth SaaS | 5-10× |

Profitable Crypto Infrastructure | 3-5× |

Conservative Case | 3× |

Figure 9: Competitive Landscape Among Crypto Companies

Platform | User Base | Revenue Status | Key Differentiator |

Layer3 | 3.2M users, 300K MAU | $20M+ ARR, profitable | On-chain verification, multi-chain |

Galxe | 26-34M users | Undisclosed | Enterprise scale, broad reach |

Zealy | 700K MAU | Grant-funded | Community tasks, analytics |

Guild.xyz | ~500K-1M | Grant-funded | Token-gated access |

5. Risks & Considerations

5.1. Discretionary Value Accrual—Token Linkage Remains Uncodified

Layer3 generates real revenue, but how that value flows to $L3 holders is not guaranteed on-chain. Unlike protocols with explicit fee-sharing mechanisms (e.g., Hyperliquid), Layer3's value capture relies on voluntary Foundation decisions. While it uses ETH fees generated from credential mints and token incentives to buyback $L3 from DEX pools, the broader revenue buyback remains discretionary.

If revenue growth slows, or if the Foundation prioritizes ecosystem reinvestment over tokenholder returns, there's no automatic mechanism enforcing value distribution. Investors must therefore trust management stewardship rather than relying on coded guarantees.

What Would Strengthen This:

Codified Buyback Policy: E.g., "50% of quarterly net revenue allocated to $L3 buybacks"

Fee-Sharing Mechanism: Direct revenue distribution to stakers (dividend-style)

Formal Treasury Framework: Transparent capital allocation strategy approved by governance

Until such mechanisms exist, $L3 valuation depends partially on faith in management alignment rather than purely on mathematical protocol economics.

5.2. Sustainability of Quest-to-Earn Model

The fundamental question: Is quest-based growth a durable category, or a temporary meta?

Bear Case—Airdrop Fatigue and Regulatory Pressure:

User Burnout: Airdrop farmers may experience diminishing returns as more protocols compete for attention; quality of engagement could decline

Regulatory Risk: Token incentivization and airdrop farming could face scrutiny as potentially unregistered securities offerings or coordinated promotions

Shift to Organic Growth: Protocols might pivot toward reputation-based systems, referral programs, or paid acquisition rather than quest incentives

Data Obsolescence: If activity metrics lose credibility as growth signals, Layer3's dataset becomes less valuable

Bull Case—Structural Demand Persists:

Metrics Drive Narratives: For 3-5 years minimum, protocols will need demonstrable user activity for exchange listings, funding rounds, and market perception—Layer3 provides the most efficient infrastructure

Network Effects Compound: Layer3's 500M+ action dataset becomes increasingly difficult to replicate; switching costs rise for protocols already integrated

Regulatory Clarity: SEC is likely to loosen its stance on airdrops to US-based users in near future, as per the Atkins’ speech

Product Diversification: Expansion into trading, AI agents, and prediction markets reduces dependency on single quest model

Evolution Not Extinction: Quest-to-earn may mature into sophisticated user acquisition rather than disappear—Layer3's data moat positions it to lead that evolution

Most Likely Scenario: Core quest revenue may plateau as the market matures, but Layer3's infrastructure advantages and product expansion provide buffers. The platform's ability to adapt (from NFT quests to L2 airdrops to AI coordination) suggests it can evolve with changing growth paradigms.

5.3. Execution Risk on New Product Verticals

Layer3's expansion into trading, prediction markets, token launches, and AI infrastructure presents multiple execution challenges including Competitive Market Risk, Resource Constraints, and Product-Market Fit Uncertainty.

6. Conclusion

As crypto transitions from speculation to sustainability, Layer3 represents one of the few verifiable businesses with real product-market fit and recurring revenue. With $16.6M in 2024 revenue, a $20M+ ARR, 500+ protocol clients, and 120M completed quests, Layer3 has achieved profitability at scale while most of Web3 remains pre-revenue.

Protocols will keep paying for measurable user activity—because growth metrics still drive listings, valuations, and funding. By monetizing this attention layer, Layer3 captures that structural demand directly. The upcoming Q4 2025 spinouts and revenue-funded buybacks add tangible catalysts for tokenholder value.

--------

Disclaimer: Presto has not received any grants, funding, or financial incentives from Layer3 or its affiliated entities. The views expressed in this report are based on independent research and analysis conducted by the author. This report is not intended as investment advice and does not represent the official position of Layer3 or any related parties. All opinions are our own and reflect our current views as of the date of publication.