Summary

The SEC’s “Project Crypto” outlines a roadmap for mainstream crypto adoption, signaling strong policy support for crypto distribution, custody services, service flexibility, and DeFi integration.

Atkins’ July 31 speech effectively mitigates the “security risk” for activating fee switches in key DeFi protocols, positioning the fee switch as a major event-driven catalyst for DeFi tokens in the near-term.

A long position in the fee switch basket (UNI, LDO, AAVE, ENA) paired with a short position on a broad altcoin index (e.g., Binance All Composite Index perpetuals) is, in our view, the most efficient market-neutral strategy to capture fee-switch-driven upside.

1. Introduction

When Donald Trump declared on the campaign trail a year ago that he would make the U.S. “the crypto capital of the world,” the crypto industry cheered reflexively, though it wasn’t obvious what it exactly meant. Seven months into his administration, what this vision entails is clearer, particularly following SEC Chair Paul Atkins’ ‘Project Crypto’ speech three weeks ago.

This report serves two purposes. Based on the speech, we first identify the segments within the crypto industry poised to benefit from this policy tailwind. We then focus on mainstream DeFi adoption, explain why “fee switch” will be an important topic and recommend trading strategies centered on that theme – specifically, long a fee switch basket and short altcoin index.

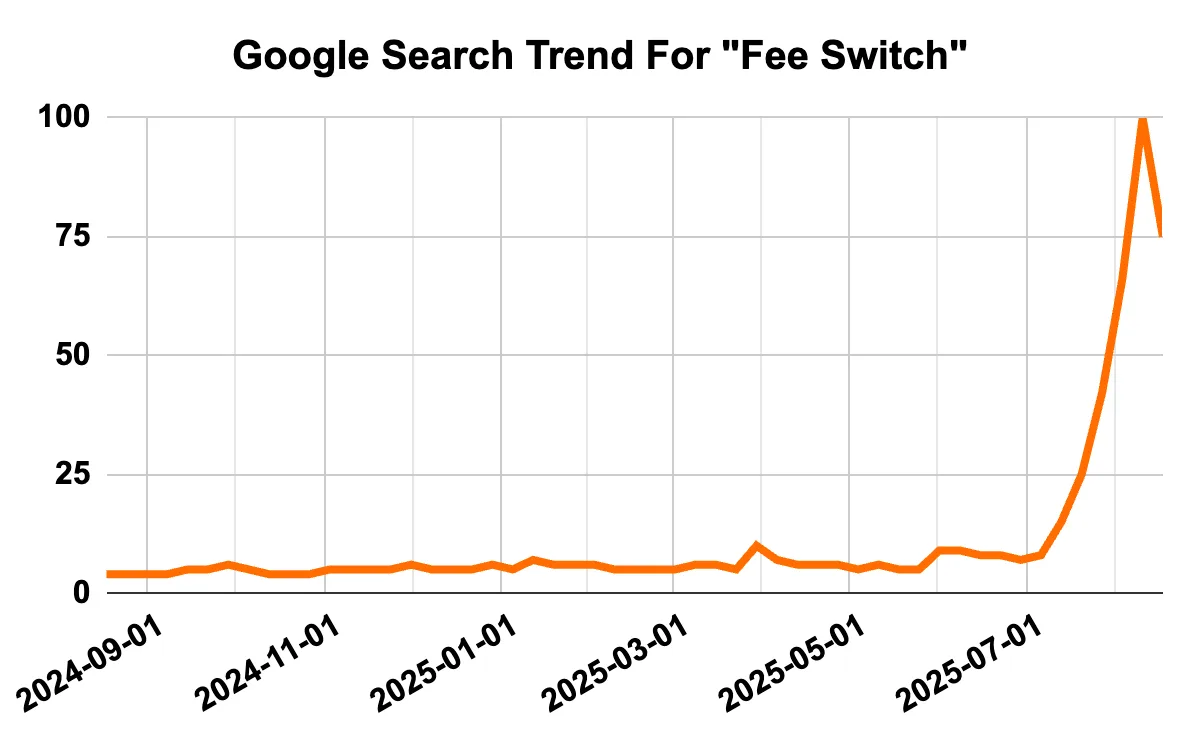

Figure 1: Trending Up

Source: Google

2. Why ‘Project Crypto’ Matters

For anyone wondering what can drive the next leg of mainstream crypto adoption after Bitcoin and stablecoin, SEC Chair Paul Atkins’ July 31st speech, “American Leadership in the Digital Finance Revolution” provides compelling answers. In his 26-minute address, he outlined his vision for how crypto should evolve and integrate with the legacy financial system. Bitwise CIO Matt Hougan even remarked, “You could build an entire venture capital firm around the chairman’s vision, creating companies to capitalize on each opportunity he lays out.”

2.1. The SEC’s Vision

Atkins’ vision can be summarized in four key points.

Crypto Distribution: Atkins aims to “bring crypto asset distributions back to America” by establishing clear guidelines for tokenization, ICOs, airdrops, and rewards. To facilitate this, he clarified that “most crypto assets are not securities” and proposed purpose-fit disclosures and safe harbors for those transactions that overlap with securities law. More on this point later.

Custody Services: Atkins believes users should have wider options on how to store their digital assets. He plans to clarify rules to support user-centric choices, including self-custody. A significant change expected is the entry of traditional custody banks into the digital asset custody business.

Service Flexibility (“Super-apps”): Atkins seeks to eliminate rules that enforce the separation of services solely to fit outdated licensing frameworks when bundling is more economically sensible. For example, he argues that non-security crypto assets should be allowed to trade on the same platforms as security crypto assets if it benefits users.

DeFi Integration: Atkins envisions DeFi playing a role in the future financial system and plans to update regulations to encourage integration. Using the term “on-chain software systems” to encompass both decentralized and more centralized services, he stated, “Decentralized finance and other forms of on-chain software systems will be part of our securities markets and not drowned out by duplicative or unnecessary regulation.”

Figure 2: Roadmap For Crypto Industry

Source: SEC

2.2. Why Most Crypto Assets Are Not Securities

“Most crypto assets are not securities” is perhaps the most profound statement from a U.S. regulator in recent memory, yet it may cause confusion given former SEC Chair Gary Gensler’s stance asserting the opposite. In truth, Atkins is simply restating what seasoned securities law experts have long understood.

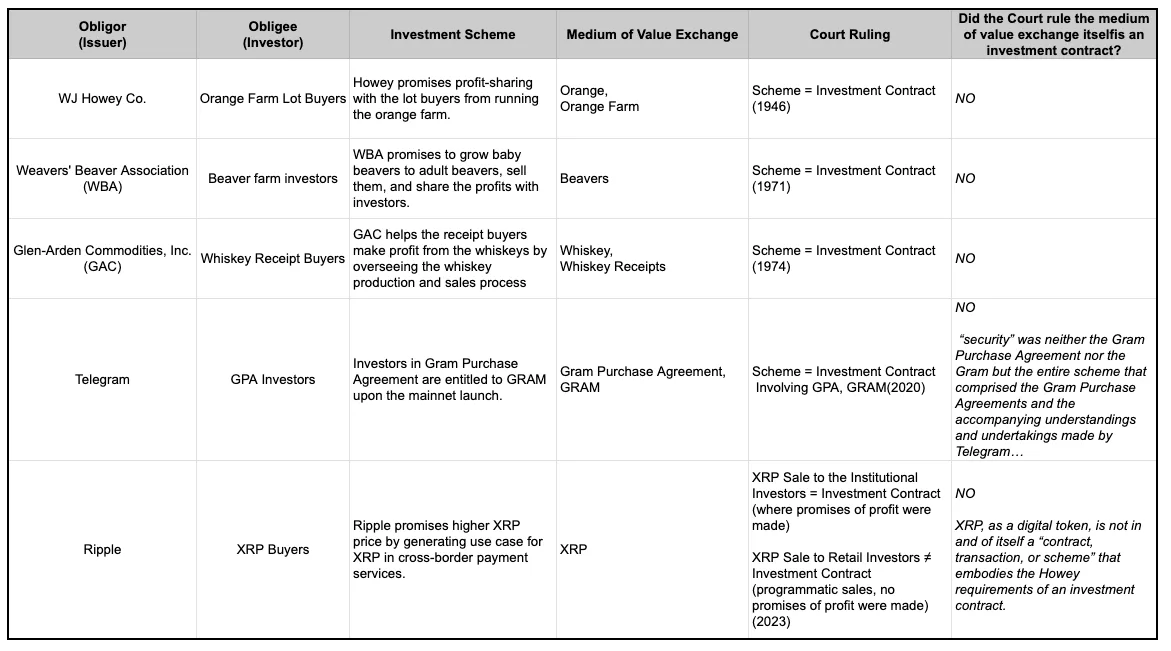

In the U.S., what constitutes a security is established under two laws: Section 2(a)(1) of the Securities Act of 1933 and Section 3(a)(10) of the Securities Exchange Act of 1934. The former defines securities by explicitly listing types of instruments (e.g., stocks, bonds), while the latter introduces the concept of an “investment contract” as a gap-filler. In other words, if an asset is not listed in Section 2(a)(1), it must be evaluated under the “Howey Test” to determine if it qualifies as an investment contract. Before even diving into what Howey Test is, however, one has to recognize that an investment contract refers to a type of transaction, not the asset itself. For a crypto asset to be considered a security, it would need to be explicitly listed in Section 2(a)(1) of the Securities Act of 1933. Written nearly a century ago, this list obviously does not include it.

This distinction is why, in SEC v. Ripple, the court ruled that Ripple violated securities law in transactions selling XRP to institutions (as those transactions constituted investment contracts) but not in programmatic sales to the general public. This ruling aligns with court decisions dating back to the 1940s (see Appendix for details). Importantly, as Atkins noted, this means that entities raising funds through crypto assets may face disclosure requirements if the transaction is deemed an investment contract.

2.3. Paradigm Shift in Finance

Of the four points, DeFi integration stands out as the most transformative. Atkins fully recognizes the promise of blockchain-based financial services and aims to create an environment where their potential can be freely unleashed. He is even prepared to amend Regulation NMS, a set of capital market rules implemented in 2005, which Atkins opposed as an SEC Commissioner for stifling innovation and competition.

In short, Atkins seeks to overhaul capital market regulations to shake the industry out of its complacency, with blockchain playing a pivotal role in this transformation. Rather than waiting for the lengthy legislative process of the CLARITY Act, he is eager to initiate these changes as soon as possible, as commented during the Wyoming Blockchain Symposium (Figure 3). With tokenized assets, DeFi, and flexible regulations fully incorporated into the existing financial system, the financial industry landscape may look drastically different than today’s.

Figure 3: A New Day at the SEC

Source: @SECPaulSAtkins, X

3. Betting on Fee Switch Trade

While Atkins’ vision to integrate DeFi into the mainstream financial system is bullish for DeFi broadly, investors seeking a concentrated bet on a clear catalyst can focus on protocols with fee switch potential.

3.1. Fee Switch Explained

A “fee switch” refers to a mechanism through which a DeFi protocol shares a portion of its revenue – typically derived from trading commissions or yield spreads – with holders of its native token. Today most DeFi tokens primarily serve governance purposes, without a clear economic tie to their underlying protocol. Activating the fee switch would distribute the protocol’s revenue to token holders, transforming these tokens into yield-generating assets.

Communities behind several DeFi protocols have debated fee switches in the past, only to ultimately vote them down or put them on hold. The reasons are twofold. First and foremost is the historically hostile regulatory environment in the U.S. The SEC’s aggressive stance on crypto under the previous administration led communities to tread carefully to avoid having their tokens labeled as securities by incorporating an income component. The second, less critical consideration is competition. If revenue distribution to token holders is funded by revenue for other stakeholders, it risks weakening the protocol’s utility and losing users. For instance, decentralized exchanges diverting rewards from liquidity providers to token holders may drive away liquidity providers, leading to reduced liquidity and higher slippage.

Figure 4: Rigorously Debated at Governance Forum

Source: Uniswap Protocol Governance

3.2. Incentivizing DeFi Integration

Atkins’ “Project Crypto” speech signals that the era of blanket crypto crackdowns is behind us. With a substantially reduced risk of arbitrary security designations and an environment conducive to mainstream DeFi adoption, communities behind top DeFi protocols are motivated to to position their platforms for maximum growth. A fee switch is one of the most obvious strategies for this.

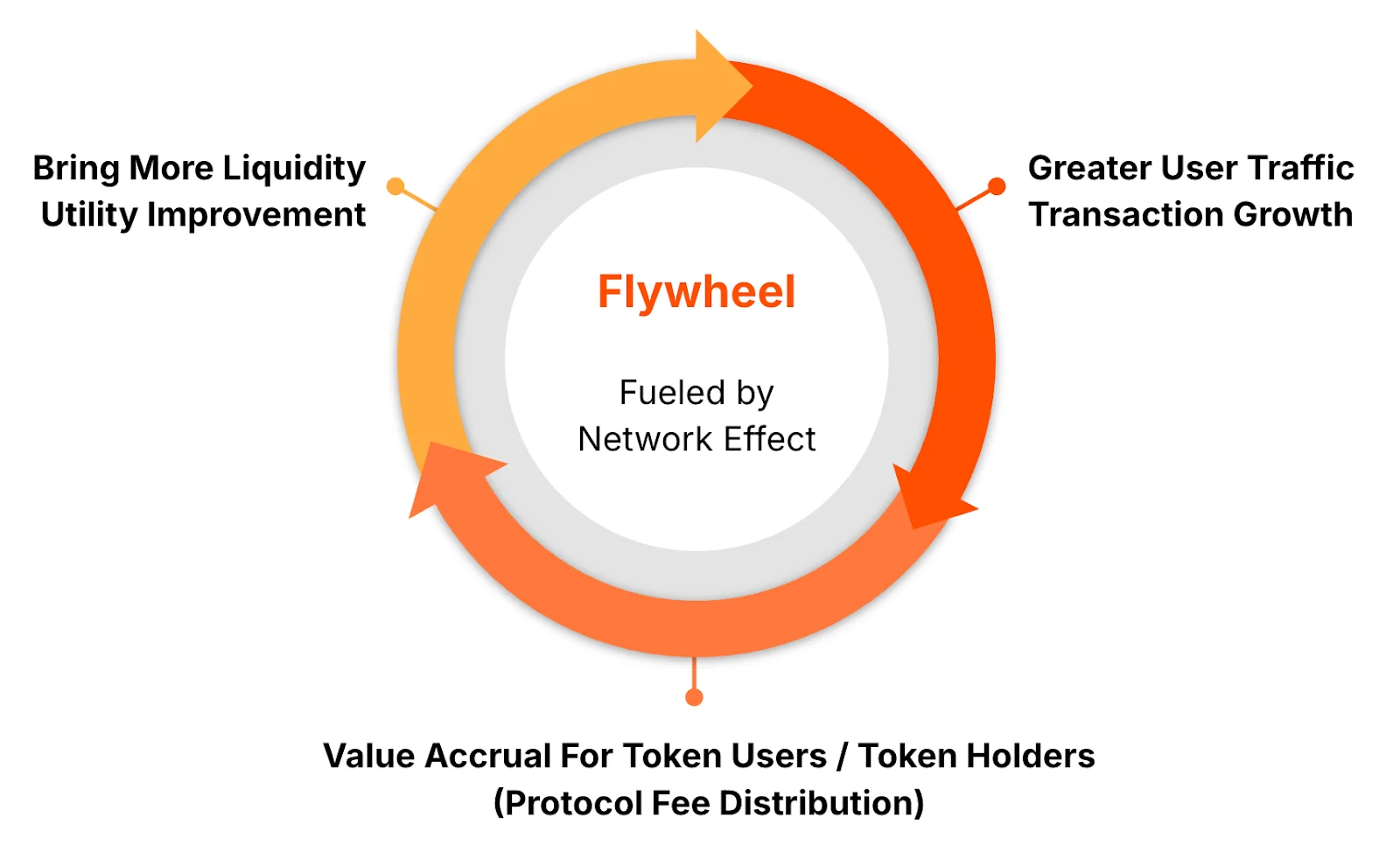

Currently, most DeFi protocol users cannot participate in the protocol’s economic upside. A fee switch changes this by introducing an incentive mechanism for financial institutions to expand its usage by integrating the service. Ownership tokens entitled to protocol revenue is a useful tool in this regard, as they can turn users into partners, creating a network effect driven by their shared incentive to ensure the protocol’s success (Figure 5).

Figure 5: What Tokens Are Made For

Source: Presto Research

3.3. Top Tokens For the Fee Switch Trade

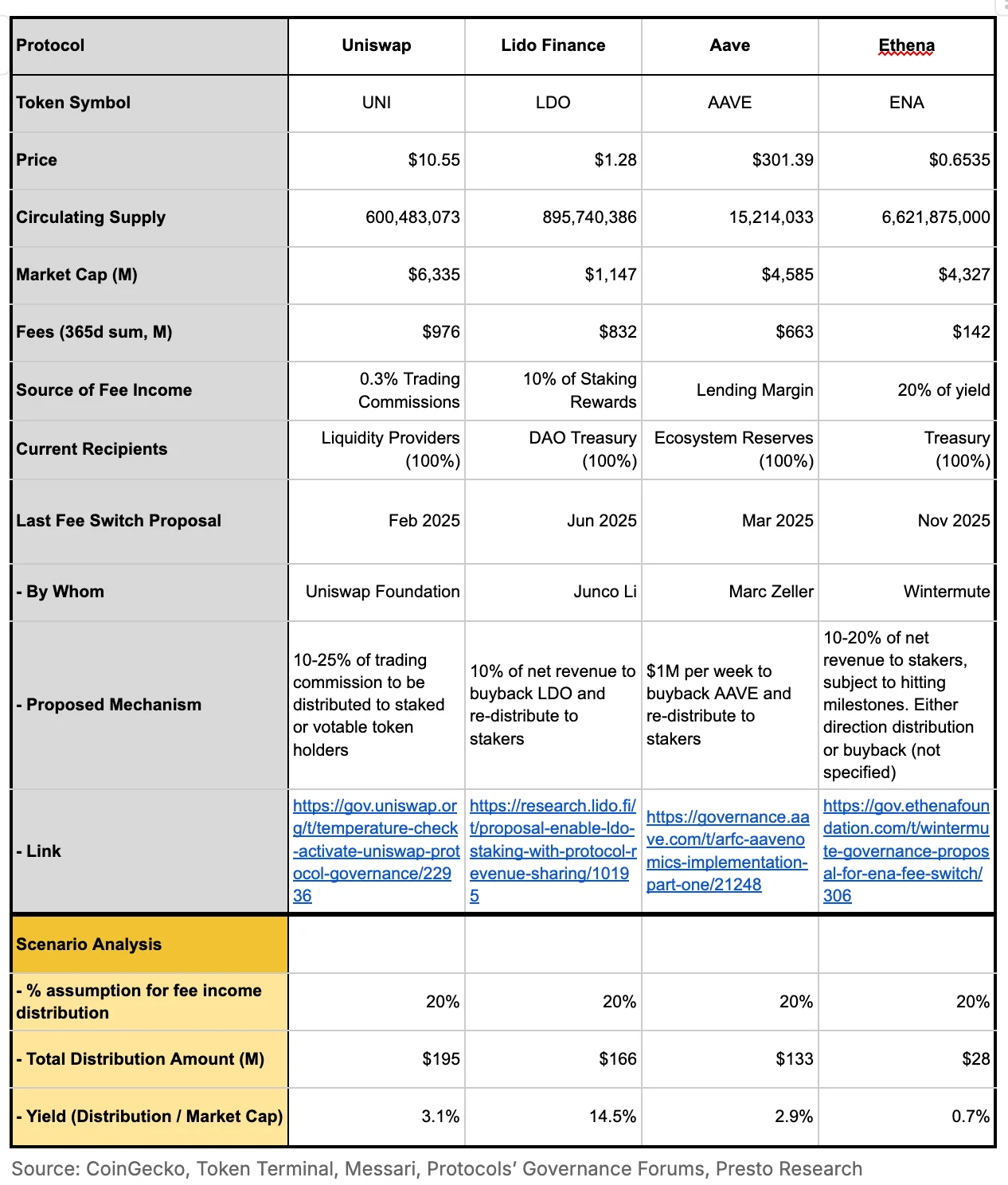

Which DeFi tokens would see the most upside when fee switches are activated? We believe the following four tokens represent the best fee switch opportunities (Figure 6). The selection is based on our assessment of the likelihood of community approval for a fee switch and its sensitivity to the event. Our assumptions are:

Larger protocols are more likely as they have capacity to accomodate institutional flow.

The leaders in their respective fields are more likely as they are less concerned about competitive pressure.

The protocols that have considered fee switches in the past are more likely as their communities are better informed.

Tokens with no revenue distribution today offer more upside than those with partial distribution (e.g. token buyback) already in place given zero-to-one effect (larger delta).

Figure 6:”The Magnificent Fee-Switch Four”

Data as of 8/21/25

Source: CoinGecko, Token Terminal, Messari, Protocols’ Governance Forums, Presto Research

3.4. A Few Words About The Table

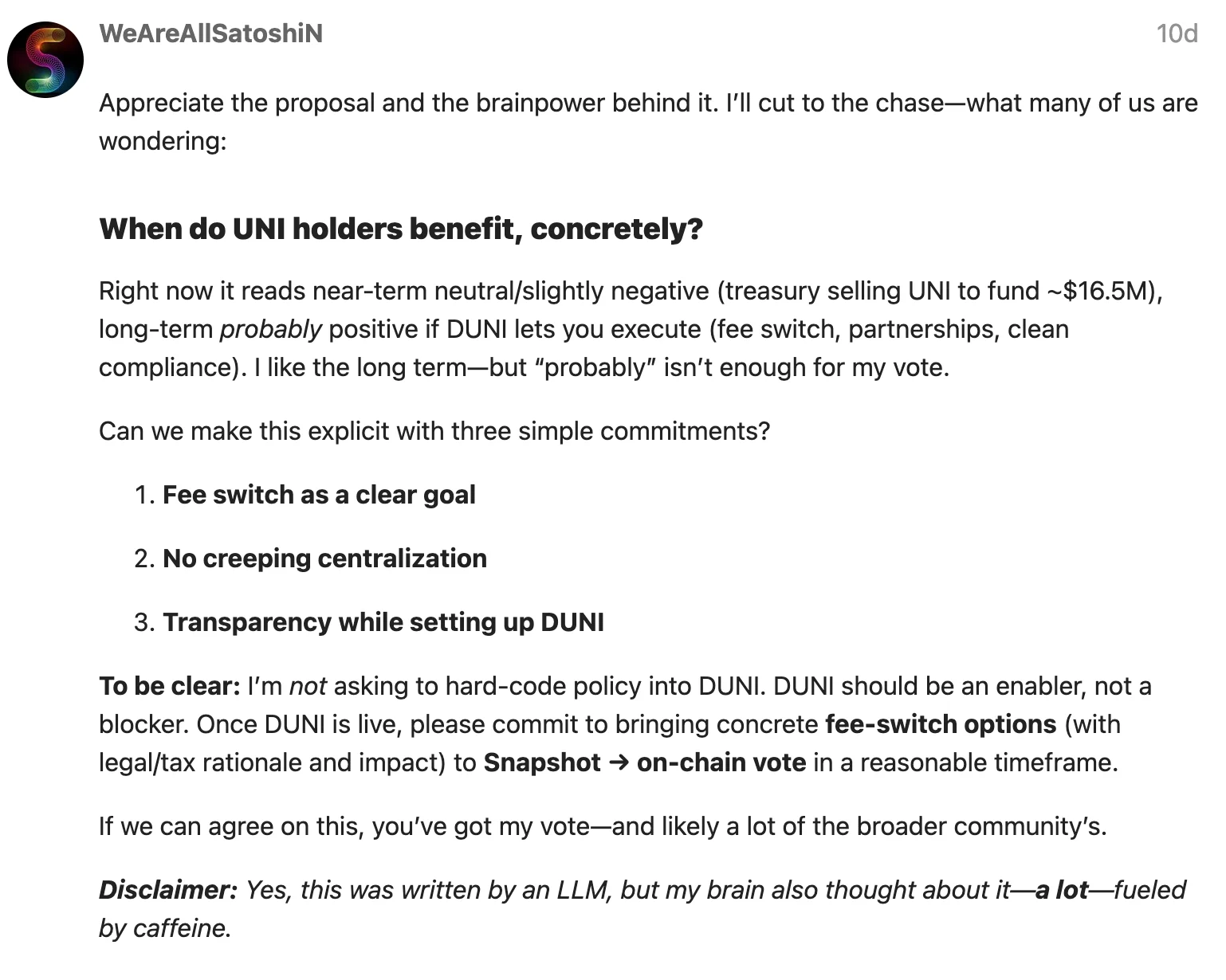

Uniswap: on Aug 12th, the Uniswap Foundation proposed the adoption of Wyoming-registered Decentralized Unincorporated Nonprofit Association (“DUNA”) as the legal structure for the Uniswap Governance Protocol. If adopted, this would allow Uniswap as a DAO to be legally recognized and compliant in the U.S., giving its members liability protections for the actions undertaken. Some view this move as a precursor to turning on the fee switch (Figure 7).

Scenario Analysis: We have assumed the protocols return 20% of the fee income, based on the proposals debated by these communities in the past. The actual implementation may not necessarily follow the so-called ‘fixed split model’ as variations can exist – e.g. dynamic adjustment model where the share of the liquidity providers can adjust depending on market conditions.

Figure 7: Paving Way for the Fee Switch?

Source: Uniswap Protocol Governance

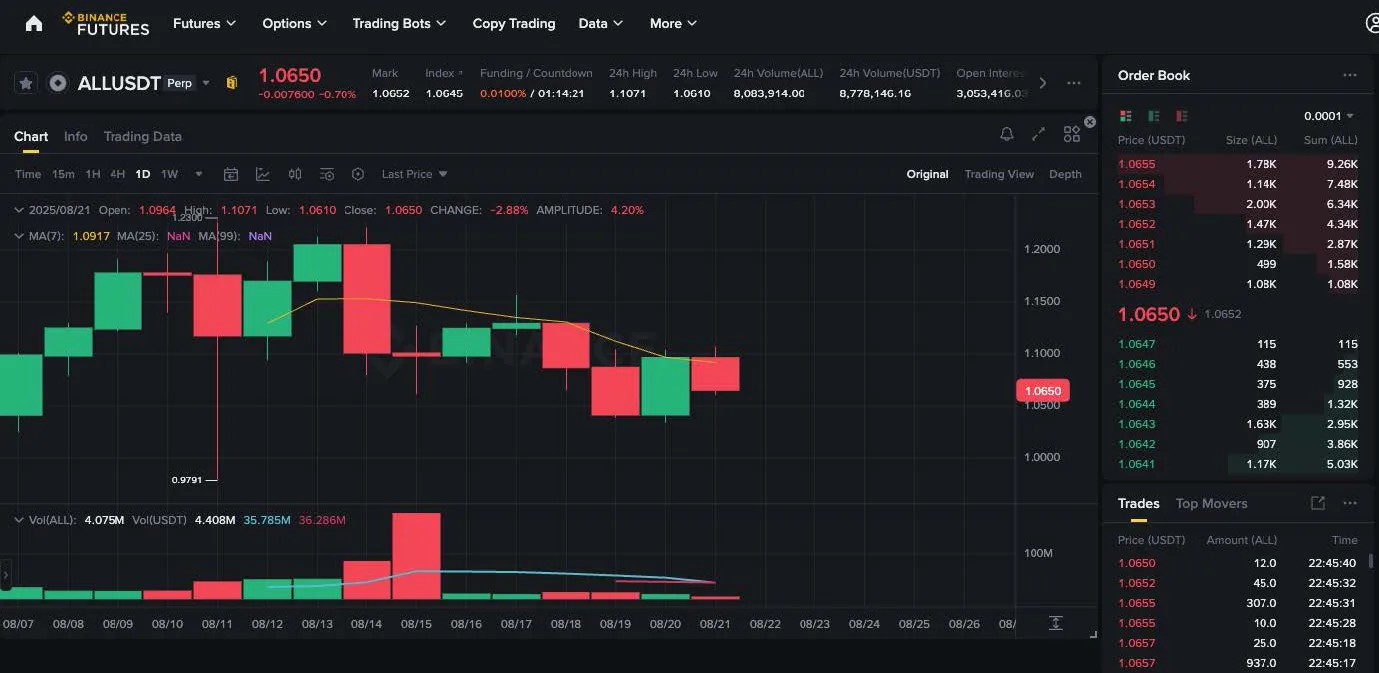

4. Optimizing Trading Strategy

Investors can tailor their trading strategy based on the analysis above. Those lacking deep insight into individual protocols are likely best served by a basket approach, which mitigates the idiosyncratic risks of specific protocols. For investors seeking purer exposure to the fee switch catalyst, pairing a long position in the basket with a short position on a broad market index (e.g., shorting Binance All Composite Index perpetual futures) can provide market-neutral exposure to the catalyst (Figure 8). Upon entering the trade, closely monitor SEC announcements regarding DeFi protocols and governance votes for the four selected protocols. Bon trading!

Figure 8: Binance All Composite Index Perps

Source: Binance

Appendix: Past Court Rulings on Investment Contracts

Source: DLx Law, Presto Research